|

|

Rapaport TradeWire February 2, 2017

Feb 2, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

February 2, 2017

|

|

|

Polished trading slow with Far East dealers on holiday during the Chinese New Year. Manufacturing profit margins squeezed with high rough prices and soft polished demand as 1 ct. RAPI -0.9% in Jan. U.S. 2016 jewelry sales +5% to $71.4B but consolidation continues as JBT reports 1,669 jewelry businesses closed in 2016. Signet makes key personnel changes to strengthen digital offering after lackluster holiday season. LVMH 2016 jewelry sales +5% to $3.7B. ALROSA 2016 production -2% to 37.4M cts., sales +34% to 40.1M cts. Belgium 2016 polished exports -10% to $11.8B, rough imports +9% to $12.1B. Rio Tinto to close U.S. office. Brendan Bell to step down as Dominion CEO. |

|

| Diamonds |

1,273,522 |

| Value |

$7,655,960,304 |

| Carats |

1,352,757 |

| Average Discount |

-30.35% |

www.rapnet.com

|

|

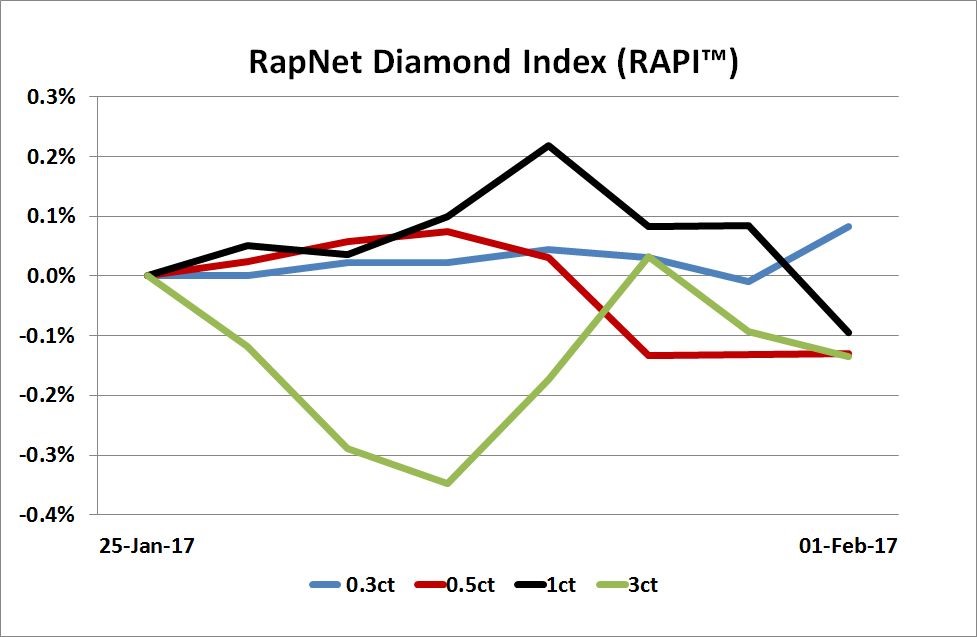

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The [Tiffany] brand is definitive and iconic, yet continues to push and evolve with the times.

The [Tiffany] brand is definitive and iconic, yet continues to push and evolve with the times.

Lady Gaga after collaborating with Tiffany & Co. for the jeweler's new campaign

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Polished

market stable but quieter than expected for this time of year. Dealers

surprised by strong rough market while polished and retail sectors sluggish…

Belgium: Cautious

polished trading during Antwerp Fair. Steady orders for specific goods with

very little inventory buying…

Israel:

Polished

trading quiet. Growing concerns about low profitability amid continued strength

in the rough market. Steady demand for 0.30 to 2.99 ct., F-I, SI2-I1, RapSpec

A3+ diamonds…

India: Trading

subdued with limited transactions as foreign buyers push for deeper discounts.

Very few large orders in place from retailers building up inventory…

Hong

Kong: Dealer

market on vacation with retailers focusing on Chinese New Year season. Busy

shopping period calms as consumers spend holiday week with family or traveling…

Click here for deeper analysis |

|

|

| RAPAPORT STATEMENT

|

|

|

|

| |

Polished Prices Slide Despite Buoyant Rough Market

Diamond

manufacturing profits were squeezed in January amid strong rough demand while

polished prices softened. The RapNet Diamond Index (RAPI™) for

1-carat diamonds fell 0.9% during the month and was down 6.8% from a year ago.

Manufacturers raised polished production as they expect trading to improve

after the holiday season. However, the high level of rough sales was not

supported by activity in the polished and retail sectors, with jewelers

reporting disappointing December sales.

Purchase the full Rapaport Monthly Report – February 2017

|

|

|

|

INDUSTRY

|

|

|

|

| |

U.S. Jewelry Market Shrinks in 2016

The

number of jewelry businesses operating in the U.S. fell 6% to 26,725 last year, according to the Jewelers Board of

Trade. Some 1,518 businesses simply discontinued, unrelated to financial failure or

merger, an increase of 63% from the previous year. Consolidation from

mergers or takeovers increased 3.5% to 118, while bankruptcies fell 15% to 33. The number of jewelry retailers leaving the industry grew 43%

to 1,269.

The

number of jewelry businesses operating in the U.S. fell 6% to 26,725 last year, according to the Jewelers Board of

Trade. Some 1,518 businesses simply discontinued, unrelated to financial failure or

merger, an increase of 63% from the previous year. Consolidation from

mergers or takeovers increased 3.5% to 118, while bankruptcies fell 15% to 33. The number of jewelry retailers leaving the industry grew 43%

to 1,269.

|

| |

Prices of Blue Diamonds Reach All-Time High

The

Fancy Color Diamond Index climbed 0.4% in 2016 due to continued strength in

demand for blues and pinks, the Fancy Color Research Foundation reported.

Prices of blue diamonds jumped 5.5% to an all-time high due to low supply. Prices of pink diamonds increased

1.4%, while yellow-diamond prices fell 4%.

The

Fancy Color Diamond Index climbed 0.4% in 2016 due to continued strength in

demand for blues and pinks, the Fancy Color Research Foundation reported.

Prices of blue diamonds jumped 5.5% to an all-time high due to low supply. Prices of pink diamonds increased

1.4%, while yellow-diamond prices fell 4%.

|

| |

Global Weakness Hits Antwerp Diamond Trade

Belgium’s

polished diamond trade fell last year due to the economic slowdown in India

and China, the Antwerp World Diamond Centre (AWDC) said. Polished exports slid

10% to $11.8 billion, while imports fell by the same margin to $11.39 billion.

Belgium’s rough trade performed better, with imports growing 8.6% to $12.09

billion and exports up 11% to $12.73 billion last year.

Belgium’s

polished diamond trade fell last year due to the economic slowdown in India

and China, the Antwerp World Diamond Centre (AWDC) said. Polished exports slid

10% to $11.8 billion, while imports fell by the same margin to $11.39 billion.

Belgium’s rough trade performed better, with imports growing 8.6% to $12.09

billion and exports up 11% to $12.73 billion last year.

|

| |

Rio Tinto to Close New York Marketing Base

Rio

Tinto Diamonds will shut its North American sales and marketing office in the

first quarter as part of a cost-cutting exercise. The New York representative

base was set up a decade ago to serve as a gateway to the U.S. retail sector.

The miner will continue to collaborate with its ‘Select Diamantaire’ clients on

marketing initiatives in the country. Brandee Dallow (pictured), who headed the

New York operation, will leave Rio Tinto when the office closes.

Rio

Tinto Diamonds will shut its North American sales and marketing office in the

first quarter as part of a cost-cutting exercise. The New York representative

base was set up a decade ago to serve as a gateway to the U.S. retail sector.

The miner will continue to collaborate with its ‘Select Diamantaire’ clients on

marketing initiatives in the country. Brandee Dallow (pictured), who headed the

New York operation, will leave Rio Tinto when the office closes.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

U.S. Jewelry Sales Rise Amid Higher Prices

U.S.

jewelry sales increased 4.8% to $71.4 billion in 2016, government data showed. Sales

at specialist jewelry stores climbed 3% to $25.3 billion in the first 11

months, according to separate data, which lags by a month. Sales grew as

prices rose with the consumer price index (CPI) for jewelry jumping 6.2% during

the year. Watch sales increased 5.3% to $9.5 billion with the CPI for watches

advancing 5.2%.

U.S.

jewelry sales increased 4.8% to $71.4 billion in 2016, government data showed. Sales

at specialist jewelry stores climbed 3% to $25.3 billion in the first 11

months, according to separate data, which lags by a month. Sales grew as

prices rose with the consumer price index (CPI) for jewelry jumping 6.2% during

the year. Watch sales increased 5.3% to $9.5 billion with the CPI for watches

advancing 5.2%.

Image: Newscast

|

| |

LVMH Growth Highlights High-End Resilience

LVMH

Moët Hennessy Louis Vuitton reported jewelry and watch sales increased 9% to $1.05

billion (EUR 982 million) in the fourth quarter and by 5% to $3.71 billion for

the full year. The group, which includes Bulgari, Chaumet, Tag Heuer, Hublot

and De Beers Diamond Jewellers, said it shrugged off political and economic

uncertainty with growth driven by improvements in China, South Korea and the

Middle East.

LVMH

Moët Hennessy Louis Vuitton reported jewelry and watch sales increased 9% to $1.05

billion (EUR 982 million) in the fourth quarter and by 5% to $3.71 billion for

the full year. The group, which includes Bulgari, Chaumet, Tag Heuer, Hublot

and De Beers Diamond Jewellers, said it shrugged off political and economic

uncertainty with growth driven by improvements in China, South Korea and the

Middle East. |

| |

Pandora Enters Burgeoning Indian Jewelry Market

Pandora

is opening its first stores in India to capitalize on expected growth in the

country. The Danish jeweler, known for its charm bracelets and silver

jewelry, is planning about 50 concept stores in the next three years, in

addition to shop-in-shops, with five concept stores projected for 2017. The

jeweler selected Pan India Charms & Jewellery as its official

distributor in the country.

Pandora

is opening its first stores in India to capitalize on expected growth in the

country. The Danish jeweler, known for its charm bracelets and silver

jewelry, is planning about 50 concept stores in the next three years, in

addition to shop-in-shops, with five concept stores projected for 2017. The

jeweler selected Pan India Charms & Jewellery as its official

distributor in the country.

Image: Jorge Royan |

| |

Signet Shakes Up Senior Management

Signet

Jewelers announced several strategic and operational appointments following

disappointing holiday sales. Bryan Morgan, VP of supply-chain

management and repair, was promoted to COO to replace Ed Hrabak who is

retiring. Sebastian Hobbs, currently U.K. managing director, was named

president and chief customer officer, a new position created to improve the

consumer experience. Brian Tilzer,

chief digital officer at CVS Health, was appointed to Signet’s board.

Signet

Jewelers announced several strategic and operational appointments following

disappointing holiday sales. Bryan Morgan, VP of supply-chain

management and repair, was promoted to COO to replace Ed Hrabak who is

retiring. Sebastian Hobbs, currently U.K. managing director, was named

president and chief customer officer, a new position created to improve the

consumer experience. Brian Tilzer,

chief digital officer at CVS Health, was appointed to Signet’s board. |

|

|

|

MINING

|

|

|

|

| |

ALROSA Caps 2016 Output to Reduce Stocks

ALROSA’s

diamond production fell 2% to 37.4 million carats in 2016 as the miner focused

on reducing excessive inventory from the previous year. Sales volume increased

34% to 40.1 million carats while the value of sales exceeded $4.3 billion.

ALROSA said it reduced output at its alluvial deposits to align with the weak diamond

market environment in 2015. Fourth-quarter production increased 10% to 9.5

million carats driven by its underground operations, while the company is

planning to raise output 6% this year.

ALROSA’s

diamond production fell 2% to 37.4 million carats in 2016 as the miner focused

on reducing excessive inventory from the previous year. Sales volume increased

34% to 40.1 million carats while the value of sales exceeded $4.3 billion.

ALROSA said it reduced output at its alluvial deposits to align with the weak diamond

market environment in 2015. Fourth-quarter production increased 10% to 9.5

million carats driven by its underground operations, while the company is

planning to raise output 6% this year.

|

| |

First Gahcho Kué Diamond Sale Disappoints

Mountain

Province failed to sell a quarter of the goods offered at its inaugural sale

of rough diamonds from the Gahcho Kué mine. The company withdrew mostly brown

and lower-quality supply from the tender due to insufficient bids as tight

liquidity limited Indian buyers. The January sale took place in Antwerp and

fetched $6.3 million from 49,420 carats. Production at Gahcho Kué, a

joint venture with De Beers, launched in September, with output reaching 862,000 carats in 2016.

Mountain

Province failed to sell a quarter of the goods offered at its inaugural sale

of rough diamonds from the Gahcho Kué mine. The company withdrew mostly brown

and lower-quality supply from the tender due to insufficient bids as tight

liquidity limited Indian buyers. The January sale took place in Antwerp and

fetched $6.3 million from 49,420 carats. Production at Gahcho Kué, a

joint venture with De Beers, launched in September, with output reaching 862,000 carats in 2016.

|

| |

Lucapa Buys Lesotho Diamond Mine

Lucapa

Diamond Company acquired a 70% stake in the Mothae mine in Lesotho for $9

million. The company expects the resource will complement its high-value Lulo mine

in Angola since it also contains large,

premium-value and type-IIa diamonds. The miner received a 10-year mining

lease and a right to extend by another decade from the Lesotho government,

which owns the remaining 30% of the mine. Mothae was previously owned by Lucara Diamond Corporation.

Lucapa

Diamond Company acquired a 70% stake in the Mothae mine in Lesotho for $9

million. The company expects the resource will complement its high-value Lulo mine

in Angola since it also contains large,

premium-value and type-IIa diamonds. The miner received a 10-year mining

lease and a right to extend by another decade from the Lesotho government,

which owns the remaining 30% of the mine. Mothae was previously owned by Lucara Diamond Corporation.

|

| |

First Liqhobong Rough Sale Set for February

Firestone

Diamonds will hold its maiden sale of rough diamonds from the Liqhobong mine in

Antwerp from February 6 to 10, with results expected the following week. The

company plans to host another sale toward the end of March and two sales per

quarter thereafter. Production at the Lesotho-located mine was launched in

October with more than 20 special stones above 10.8 carats and several fancy

yellow diamonds among the mix.

Firestone

Diamonds will hold its maiden sale of rough diamonds from the Liqhobong mine in

Antwerp from February 6 to 10, with results expected the following week. The

company plans to host another sale toward the end of March and two sales per

quarter thereafter. Production at the Lesotho-located mine was launched in

October with more than 20 special stones above 10.8 carats and several fancy

yellow diamonds among the mix.

|

|

|

|

GENERAL

|

|

|

|

| |

Dominion CEO Quits Before Company's Move to Calgary

Dominion

Diamond Corporation’s chief executive Brendan Bell will stand down when the miner

moves its headquarters from Yellowknife to Calgary. A process is underway to find

a replacement, with Bell (pictured) committing to the role until June 30. Bell said the

move was necessary to reduce operating costs, but he could not continue as CEO

for personal reasons. Bell joined Dominion in July 2013, effectively serving

as CEO since November 2014.

Dominion

Diamond Corporation’s chief executive Brendan Bell will stand down when the miner

moves its headquarters from Yellowknife to Calgary. A process is underway to find

a replacement, with Bell (pictured) committing to the role until June 30. Bell said the

move was necessary to reduce operating costs, but he could not continue as CEO

for personal reasons. Bell joined Dominion in July 2013, effectively serving

as CEO since November 2014. |

| |

RJC Unveils New Self-Assessment Guide

The

Responsible Jewellery Council introduced an updated self-assessment workbook in

a revised format designed to help members understand its code of practice. The

group, which monitors sourcing practices in the jewelry market, explained the

new publication tailors self-assessment questions toward the activities of its

members and includes instructions to help companies plug compliance gaps ahead

of an audit.

The

Responsible Jewellery Council introduced an updated self-assessment workbook in

a revised format designed to help members understand its code of practice. The

group, which monitors sourcing practices in the jewelry market, explained the

new publication tailors self-assessment questions toward the activities of its

members and includes instructions to help companies plug compliance gaps ahead

of an audit.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Signet (-7.2%) led the declines in U.S. retail stocks after it announced a shake-up of its senior management team. European luxury shares were also down, headed by Richemont (-2.2%), after the Cartier owner also revealed several leadership changes. Chow Tai Fook (+5.9%) led resurgent Far East stocks, while Indian jewelry shares improved.

View the detailed industry stock report

| |

Feb 2, 2017 (12:25 GMT) |

Jan 26, 2017 (13:30 GMT) |

Chng. |

|

| $1 = Euro |

0.93 |

0.93 |

-0.01 |

|

| $1 = Rupee |

67.32 |

68.16 |

-0.84 |

|

| $1 = Israel Shekel |

3.76 |

3.79 |

-0.03 |

|

| $1 = Rand |

13.40 |

13.35 |

0.05 |

|

| $1 = Canadian Dollar |

1.30 |

1.31 |

-0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,221.30 |

$1,190.47 |

$30.83 |

2.6% |

| Platinum |

$1,006.55 |

$975.65 |

$30.90 |

3.2% |

| Silver |

$17.67 |

$16.87 |

$0.80 |

4.7% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

28,226.61 |

27,708.14 |

518.47 |

1.9% |

| Dow Jones |

19,890.94 |

20,068.51 |

-177.57 |

-0.9% |

| FTSE |

7,147.91 |

7,178.49 |

-30.58 |

-0.4% |

| Hang Seng |

23,184.52 |

23,374.17 |

-189.65 |

-0.8% |

| S&P 500 |

2,279.55 |

2,298.37 |

-18.82 |

-0.8% |

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Trading

subdued with limited transactions as foreign buyers push for deeper discounts.

Very few large orders in place from retailers building up inventory. Suppliers

waiting for Hong Kong International Jewellery Show (Feb. 28) to assess Far East

demand and sustainable polished price levels. Steady rough trading after large

De Beers and ALROSA sales. Manufacturers raising production in anticipation

that polished trading will improve in February and March.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|