|

|

Rapaport TradeWire February 9, 2017

Feb 9, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

February 9, 2017

|

|

|

Diamond demand stable as reduced supply of polished and higher rough costs support price levels. Over $1B of new higher-priced rough entered the market in January without any increase in polished demand. Oversupply of expensive polished expected. Chinese New Year good for gold, but gem-set jewelry sales stagnate. Chow Tai Fook holiday sales +4% in China, -11% in Hong Kong & Macau. U.S. retailers hoping to tap pent-up diamond jewelry demand over Valentine’s Day. Indian jewelers starting to restock for ongoing wedding season after demonetization froze orders. ALROSA Jan. sales +60% to $365M. Tiffany & Co. CEO Frederic Cumenal resigns after disappointing Christmas. |

|

| Diamonds |

1,272,940 |

| Value |

$7,619,110,474 |

| Carats |

1,337,727 |

| Average Discount |

-30.52% |

www.rapnet.com

|

|

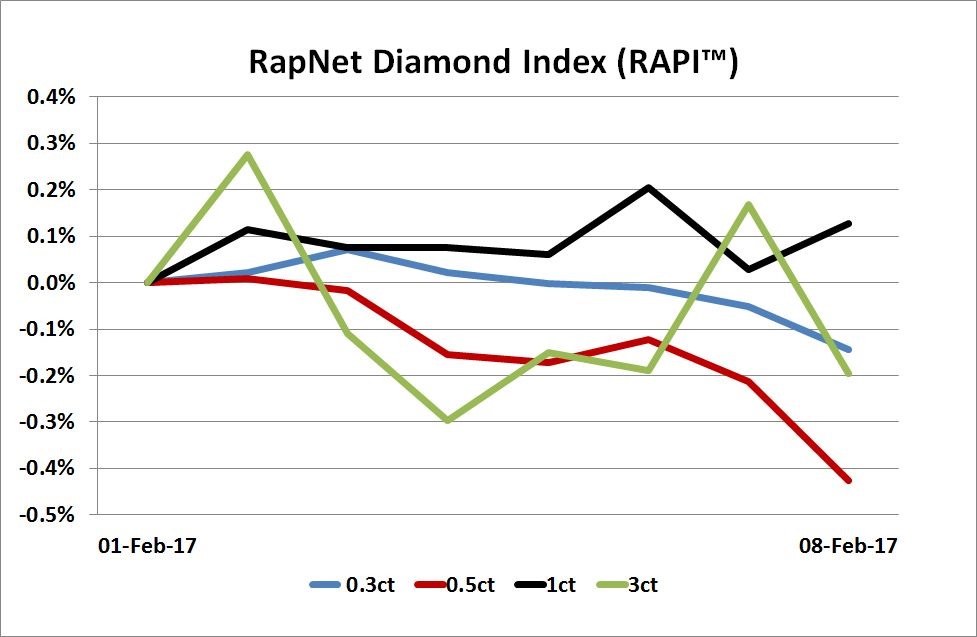

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

The diamond-cutting sector in India is obviously coping with the problems caused by the currency reform in the country somewhat faster than expected.

The diamond-cutting sector in India is obviously coping with the problems caused by the currency reform in the country somewhat faster than expected.

ALROSA vice-president Yury Okoemov

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Slight improvement in NY trading. Dealers managing

with lower inventory as retailers start to replenish holiday stock…

Belgium: Cautious trading after quiet Antwerp fair. Buyers

testing the market by offering deeper discounts but no urgency to buy goods…

Israel:

Polished trading quieter than expected for this

time of year. Hopes that high-profile foreign delegations will raise trading

levels at Israel International Diamond Week (Feb. 13-16)…

India: Sentiment improving as impact of demonetization

begins to fade. Jewelry retailers starting to buy again after two-month lull as

wedding season demand improves…

Hong

Kong: Wholesale market quiet as dealers slowly return

from Chinese New Year vacation. Chinese tourist arrivals steady during the

festival but Hong Kong attracting price-sensitive visitors from lower-tier

cities…

Click here for deeper analysis |

|

|

|

INSIGHTS

|

|

|

|

| |

Can Lady Gaga Save Tiffany & Co?

Tiffany & Co. appears to be shaking things up. It’s replacing

its CEO, has brought in designer Reed Krakoff as its chief artistic officer and

ran a Super Bowl ad for the first time featuring Lady Gaga. Gaga brings her own

femininity and twist to the Tiffany story, while her strong opinions suggest

the jeweler recognizes it’s missing out on a generation of consumers. But will

Gaga, and her 65 million Twitter followers, spark company growth and inspire

some much needed creativity in the industry’s marketing?

Click here to continue reading |

|

|

|

INDUSTRY

|

|

|

|

| |

DPA to Scrutinize Synthetic Detection Machines

The Diamond Producers Association (DPA) plans to audit synthetics detectors to help the industry navigate its way around the broad choice of machines available on the market. The group is laying the groundwork for an independent laboratory that will test diamond-screening devices currently sold in the market and publish its results to the trade. The marketing body aims to gather a committee of representatives from major industry organizations by the end of March to assess the scope of the program.

The Diamond Producers Association (DPA) plans to audit synthetics detectors to help the industry navigate its way around the broad choice of machines available on the market. The group is laying the groundwork for an independent laboratory that will test diamond-screening devices currently sold in the market and publish its results to the trade. The marketing body aims to gather a committee of representatives from major industry organizations by the end of March to assess the scope of the program. |

| |

India’s Jewelry Market Shows Signs of Recovery

Traffic at this week’s Signature India International

Jewellery Show was light, but buyers were placing orders again. The upswing in demand was as a result of Indian jewelry

retailers needing goods for the rest of the wedding season, as they haven’t bought

for two to three months since the government’s demonetization program froze

activity in November. Exhibitors said sales were still 20% below last year’s

levels, but were happy to be doing business again. Gold sales were better than

studded jewelry, while there was very little loose-diamond trading.

Traffic at this week’s Signature India International

Jewellery Show was light, but buyers were placing orders again. The upswing in demand was as a result of Indian jewelry

retailers needing goods for the rest of the wedding season, as they haven’t bought

for two to three months since the government’s demonetization program froze

activity in November. Exhibitors said sales were still 20% below last year’s

levels, but were happy to be doing business again. Gold sales were better than

studded jewelry, while there was very little loose-diamond trading.

|

| |

ALROSA Gains as Indian Demand Stabilizes

ALROSA reported a 60% jump in diamond sales to $365.4 million in January as manufacturing in India showed signs of a turnaround. Revenue from rough diamonds stood at $358.2 million, while polished sales were pegged at $7.3 million. India’s diamond trade had slowed in the last two months of 2016 as the government invalidated INR 500 and INR 1,000 notes, snapping liquidity. However, diamond cutters in India are coming to terms with the new reality faster than expected, ALROSA explained.

ALROSA reported a 60% jump in diamond sales to $365.4 million in January as manufacturing in India showed signs of a turnaround. Revenue from rough diamonds stood at $358.2 million, while polished sales were pegged at $7.3 million. India’s diamond trade had slowed in the last two months of 2016 as the government invalidated INR 500 and INR 1,000 notes, snapping liquidity. However, diamond cutters in India are coming to terms with the new reality faster than expected, ALROSA explained. |

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Tiffany CEO Cumenal in Shock Departure

Tiffany & Co.’s chief executive officer Frederic Cumenal stepped down with immediate effect, the company announced on Sunday. Chairman and former CEO Michael Kowalski has taken over the role in the interim. Tiffany’s board has been disappointed by recent financial results, Kowalski noted, with holiday sales in the Americas falling 4%, partly due to protests outside New York’s Trump Tower that restricted access to the flagship Fifth Avenue store. Cumenal (pictured) had been CEO since April 2015.

Tiffany & Co.’s chief executive officer Frederic Cumenal stepped down with immediate effect, the company announced on Sunday. Chairman and former CEO Michael Kowalski has taken over the role in the interim. Tiffany’s board has been disappointed by recent financial results, Kowalski noted, with holiday sales in the Americas falling 4%, partly due to protests outside New York’s Trump Tower that restricted access to the flagship Fifth Avenue store. Cumenal (pictured) had been CEO since April 2015.

Image: Martin Crook

|

| |

Chow Tai Fook’s Holiday Sales Jump in China

Chow Tai Fook said sales from the mainland outperformed

those in Hong Kong during the Chinese New Year holiday period. Retail revenue

from mainland China showed a 4% jump for January 14 to February 3, which covers

the two-week run-up to the festival and the first seven days of the New Year.

By contrast, sales in Hong Kong and Macau fell 11%.

Chow Tai Fook said sales from the mainland outperformed

those in Hong Kong during the Chinese New Year holiday period. Retail revenue

from mainland China showed a 4% jump for January 14 to February 3, which covers

the two-week run-up to the festival and the first seven days of the New Year.

By contrast, sales in Hong Kong and Macau fell 11%.

|

| |

Pandora Sales Rise as Store Network Grows

Pandora’s revenue grew 21% to $2.9 billion (DKK 20.28 billion) last year as the jeweler expanded its network of branded stores. The number of Pandora-branded retail locations, known as concept stores, increased by 336 to 2,138 in 2016, the company reported. These types of stores recorded a 37% jump in sales. Revenue from multi-branded stores fell 7% as the number of locations slumped by 1,829 to 3,966. Group profit jumped 64% to $861.9 million.

Pandora’s revenue grew 21% to $2.9 billion (DKK 20.28 billion) last year as the jeweler expanded its network of branded stores. The number of Pandora-branded retail locations, known as concept stores, increased by 336 to 2,138 in 2016, the company reported. These types of stores recorded a 37% jump in sales. Revenue from multi-branded stores fell 7% as the number of locations slumped by 1,829 to 3,966. Group profit jumped 64% to $861.9 million. |

|

|

|

MINING

|

|

|

|

| |

Rio Tinto Diamond Sales Lag Behind Market

Rio Tinto’s diamond revenue slid 12% to $613 million last

year, even as global rough demand strengthened. Net income dived 41% to

$47 million. The decline is at odds with the increase in sales seen at

other comparable miners, including De Beers and ALROSA. Overall rough demand

recovered in 2016 from a cyclical downturn in the previous year, but varied

significantly across product segments, Rio Tinto said.

Rio Tinto’s diamond revenue slid 12% to $613 million last

year, even as global rough demand strengthened. Net income dived 41% to

$47 million. The decline is at odds with the increase in sales seen at

other comparable miners, including De Beers and ALROSA. Overall rough demand

recovered in 2016 from a cyclical downturn in the previous year, but varied

significantly across product segments, Rio Tinto said.

|

| |

Rio Tinto Gifts India Mine to Government

Rio Tinto took an unusual decision to hand over the Bunder diamond mining project in India as a gift to a regional government, after walking away from the program last year. The government of Madhya Pradesh, where the project is located, will take ownership of Bunder’s assets and infrastructure in accordance with an order signed last month. In August, the company announced it wouldn’t be continuing with the project because of an internal cost-cutting exercise.

Rio Tinto took an unusual decision to hand over the Bunder diamond mining project in India as a gift to a regional government, after walking away from the program last year. The government of Madhya Pradesh, where the project is located, will take ownership of Bunder’s assets and infrastructure in accordance with an order signed last month. In August, the company announced it wouldn’t be continuing with the project because of an internal cost-cutting exercise.

Image: Copyright © 2017 Rio Tinto

|

| |

Letšeng Sales Fall as Large-Diamond Output Drops

Gem Diamonds said sales from its high-value Letšeng mine

fell 22% to $184.6 million last year as the company extracted fewer large rough

diamonds than expected. The average selling price dropped 26% to $1,695 per

carat. Production of rough diamonds weighing 100 carats or more at Letšeng

has crept up every year from three stones in 2012 to a peak of 11 in 2015,

before falling to four last year.

Gem Diamonds said sales from its high-value Letšeng mine

fell 22% to $184.6 million last year as the company extracted fewer large rough

diamonds than expected. The average selling price dropped 26% to $1,695 per

carat. Production of rough diamonds weighing 100 carats or more at Letšeng

has crept up every year from three stones in 2012 to a peak of 11 in 2015,

before falling to four last year.

|

|

|

|

GENERAL

|

|

|

|

| |

Gold Price Hike Dampens Jewelry Demand

A jump in gold prices and sluggishness in India and China negatively impacted global jewelry demand last year, according to the World Gold Council. Global demand fell 15% to 2,041.6 tonnes in 2016, a seven-year low. Indian demand for gold jewelry fell 22%, partly because the price of the metal jumped 8%, the council explained. A nationwide jewelers’ strike in the first quarter also contributed to the weakness, as did the government’s demonetization policy in November.

A jump in gold prices and sluggishness in India and China negatively impacted global jewelry demand last year, according to the World Gold Council. Global demand fell 15% to 2,041.6 tonnes in 2016, a seven-year low. Indian demand for gold jewelry fell 22%, partly because the price of the metal jumped 8%, the council explained. A nationwide jewelers’ strike in the first quarter also contributed to the weakness, as did the government’s demonetization policy in November. |

| |

Gahcho Kué Hits Big League with 68ct. Diamond

Mountain Province Diamonds recovered the largest

gem-quality stone yet from its Gahcho Kué mine in Canada. At 67.87 carats, the

octahedron-shaped rough diamond was extracted during the ramp-up of the mine,

which was launched in September last year. The mine is on track to achieve

commercial production, meaning 70% of capacity, during the first quarter, with

the second sale of diamonds scheduled to take place in Antwerp from February 20

to March 1.

Mountain Province Diamonds recovered the largest

gem-quality stone yet from its Gahcho Kué mine in Canada. At 67.87 carats, the

octahedron-shaped rough diamond was extracted during the ramp-up of the mine,

which was launched in September last year. The mine is on track to achieve

commercial production, meaning 70% of capacity, during the first quarter, with

the second sale of diamonds scheduled to take place in Antwerp from February 20

to March 1.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

European luxury stocks declined, with Swatch Group (-4.9%) falling the most as the timepiece retailer reported a drop in full-year sales and profit. Jewelry retailer Vaibhav (+43%) led mixed Indian shares after reporting promising quarterly profit figures. Hong Kong industry stocks also varied, with Chow Tai Fook (-3.2%) heading the declines after releasing disappointing Hong Kong sales over the Chinese New Year even as mainland revenue was positive. Mining stocks generally weakened, with Gem Diamonds (-3%) reporting lower sales and fewer large-diamond recoveries.

View the detailed industry stock report

| |

Feb 9, 2017 (12:19 GMT) |

Feb 2, 2017 (12:25 GMT) |

Chng. |

|

| $1 = Euro |

0.94 |

0.93 |

0.01 |

|

| $1 = Rupee |

66.85 |

67.32 |

-0.47 |

|

| $1 = Israel Shekel |

3.75 |

3.76 |

-0.01 |

|

| $1 = Rand |

13.41 |

13.40 |

0.01 |

|

| $1 = Canadian Dollar |

1.31 |

1.30 |

0.01 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,239.28 |

$1,221.30 |

$17.98 |

1.5% |

| Platinum |

$1,021.00 |

$1,006.55 |

$14.45 |

1.4% |

| Silver |

$17.76 |

$17.67 |

$0.09 |

0.5% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

28,329.70 |

28,226.61 |

103.09 |

0.4% |

| Dow Jones |

20,054.34 |

19,890.94 |

163.40 |

0.8% |

| FTSE |

7,209.11 |

7,147.91 |

61.20 |

0.9% |

| Hang Seng |

23,525.14 |

23,184.52 |

340.62 |

1.5% |

| S&P 500 |

2,294.67 |

2,279.55 |

15.12 |

0.7% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Sentiment improving as impact of demonetization

begins to fade. Jewelry retailers starting to buy again after two-month lull as

wedding season demand improves. Gold jewelry performing better than diamonds.

Diamond buyers cautious with trading expected to rise for Hong Kong show (Feb.

28). Manufacturing levels stable with smaller factories still cautious amid limited

liquidity.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|