|

|

Diamond Trade Hopeful for Polished Price Rebound

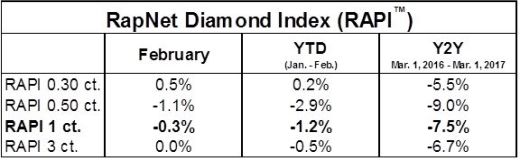

RapNet Diamond Index (RAPI™) for 1ct. Continues to Soften

Mar 1, 2017 4:18 AM

By Rapaport

|

|

|

RAPAPORT... PRESS

RELEASE, March 1, 2017, New York… Diamond trading this February was slower than

in previous years, with buyers pushing for deeper discounts and suppliers expecting

firmer prices at the Hong Kong show. Sentiment improved, as dealers anticipate U.S.

and Chinese jewelers will start replacing inventory sold during the holiday

seasons.

The RapNet

Diamond Index (RAPI™) for 1-carat polished diamonds declined 0.3% in

February and was down 1.2% from the beginning of the year.

©

Copyright 2017, Rapaport USA Inc.

The

Rapaport Monthly Report – March 2017 notes that polished inventories are rising

as major manufacturers return to full polished production following strong rough

buying in January and February. Rough demand was steady, with De Beers February

sight valued at $545 million, following a large $720 million January sale. Profit

margins tightened in 2017 as rough prices firmed and polished prices softened.

The effect

of India’s demonetization policy has stabilized. Smaller diamond and jewelry

companies must improve transparency and shift to electronic payments. Higher governance

and compliance standards in all industry centers will enable greater bank

financing and improve profitability.

Greater

investment in marketing will raise consumer demand and ensure long-term

profitability. Larger marketing budgets are required to strengthen the status

of natural diamonds as an emotional store of value, following disappointing

sales during the Christmas and Chinese New Year seasons.

Hopes are

high for the Hong Kong show, as jewelers are expected to return to the market. Rough

sales are projected to slow as a large volume of new polished supply hits the

market in the second quarter. Suppliers hope polished prices will increase, enabling

a return to profits. Excess supply may put a strain on midstream inventory if

the expected rise in polished demand doesn’t materialize.

The

Rapaport Monthly Report is available at store.rapaport.com/monthly-report.

Rapaport

Media Contacts: media@diamonds.net

U.S.:

Sherri Hendricks +1-702-893-9400

International:

Gabriella Laster +1-718-521-4976

Mumbai: Priyanka

Vaidya +91-97699-38102

About

the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price

in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25

quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered

for sale on RapNet – Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.2

million diamonds valued at approximately $8 billion. Additional information is

available at www.diamonds.net.

About

the Rapaport Group: The Rapaport Group is an international network of companies

providing added-value services that support the development of ethical, transparent,

competitive and efficient diamond and jewelry markets. Established in 1976, the

Group has more than 16,300 clients in over 120 countries. Group activities

include Rapaport Information Services, providing the Rapaport Price List,

research, analysis and news; RapNet – the world's largest diamond trading

network; Rapaport Laboratory Services, providing GIA and Rapaport gemological

services in India, Belgium and Israel; and Rapaport Trading and Auction

Services, specializing in recycled diamonds and jewelry. Additional information

is available at www.diamonds.net.

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|