|

|

Rapaport TradeWire March 16, 2017

Mar 16, 2017 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

March 16, 2017

|

|

|

Positive sentiment spreads to trading centers

after Hong Kong show demonstrates good dealer demand for dossiers. Selective

buyers creating opportunities for suppliers with the best goods. Large volume

of new polished expected to fill shortages of better-quality RapSpec A2+

diamonds. Big-stone market improving ahead of Basel show. Rough market stable.

ALROSA 2016 revenue +41% to $5.5B, profit quadruples to $2.3B. Grib Diamonds

2016 sales +82% to $336M. Gem Diamonds 2016 revenue -24% to $190M, loss of

$144M vs. profit of $77M the previous year. U.S. Jan. polished imports flat at

$1.8B, polished exports -1% at $1.3B.

|

|

| Diamonds |

1,236,139 |

| Value |

$7,603,902,582 |

| Carats |

1,345,085 |

| Average Discount |

-30.30% |

www.rapnet.com

|

|

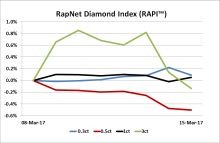

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

At present, the industry is certainly facing some challenges, but we believe those challenges, as in the past, are short-term in nature.

At present, the industry is certainly facing some challenges, but we believe those challenges, as in the past, are short-term in nature.

Mark Light, chief executive officer of Signet Jewelers.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Positive sentiment with

steady demand and buyers looking for deals, particularly on GIA-dossiers…

Belgium: Steady activity raises

the mood in Antwerp. Buyers filling specific orders and careful not to build up

excessive inventory…

Israel:

Trading continues to

improve. Selective buyers looking for larger volumes in a narrower range of

categories…

India: Dealers more optimistic

than before the Hong Kong show. U.S. demand steady and Chinese demand continues

to improve. SIs moving well…

Hong

Kong: Positive mood continues

as dealers follow up on leads from the Hong Kong show. Suppliers selling larger

volumes of lower-priced goods…

Click here for deeper analysis |

|

|

|

MARTIN RAPAPORT

|

|

|

|

| |

Martin Rapaport to Give Special Presentation at IDC

Martin Rapaport will give a special presentation at the

International Diamond Conference in Mumbai on March 20th, 2017. His

speech will discuss significant changes in U.S. tax policy that may have a

severe impact on the diamond and jewelry industry. Following the conference, Martin will be making an official statement on the matter.

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Bringing Diamonds to a New Generation

Jean-Marc Lieberherr, CEO of the Diamond Producers Association

(DPA), outlines some of the challenges and goals facing the organization as it

works to change the industry’s narrative to raise consumers’ desire for

diamonds.

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

U.S. Polished Imports Steady in January

U.S. polished-diamond imports were flat at $1.77 billion in

January, according to government data, maintaining the country’s role of

supporting industry demand through its stability. A slide in volume was balanced

by an 8% rise in the imports’ average price to $2,099 per carat. Polished

exports, meanwhile, slipped 1% year on year to $1.25 billion, raising net

polished imports 1% to $517 million. Rough imports nearly quadrupled, reaching

$120 million, while rough exports more than tripled to $56 million.

U.S. polished-diamond imports were flat at $1.77 billion in

January, according to government data, maintaining the country’s role of

supporting industry demand through its stability. A slide in volume was balanced

by an 8% rise in the imports’ average price to $2,099 per carat. Polished

exports, meanwhile, slipped 1% year on year to $1.25 billion, raising net

polished imports 1% to $517 million. Rough imports nearly quadrupled, reaching

$120 million, while rough exports more than tripled to $56 million.

|

| |

Trade Leaders to Gather at Mumbai Conference

India’s Gem & Jewellery Export Promotion Council (GJEPC) will

host industry figures from across the world next week at a conference to mark

the organization’s 50th anniversary. Entitled “Mines to Market 2017,” the

two-day conference on March 19 to 20 will feature talks by ministers from

mining countries, representatives of diamond producers, and heads of retail and

luxury brands, the GJEPC announced.

India’s Gem & Jewellery Export Promotion Council (GJEPC) will

host industry figures from across the world next week at a conference to mark

the organization’s 50th anniversary. Entitled “Mines to Market 2017,” the

two-day conference on March 19 to 20 will feature talks by ministers from

mining countries, representatives of diamond producers, and heads of retail and

luxury brands, the GJEPC announced.

|

| |

Sarine Brings Surat Business Under One Roof

Sarine Technologies has united all its Surat-based operations in

one building in the Indian diamond-manufacturing city. The new six-story

facility, Sarin House, spans 5,100 square meters and hosts about 400 staff

members, the Israel-based supplier of diamond-processing technology said. The

building will house customer care and support, along with services such as

Quazer laser processing, the Galaxy inclusion-mapping system, and the Sarine

Profile sales tool.

Sarine Technologies has united all its Surat-based operations in

one building in the Indian diamond-manufacturing city. The new six-story

facility, Sarin House, spans 5,100 square meters and hosts about 400 staff

members, the Israel-based supplier of diamond-processing technology said. The

building will house customer care and support, along with services such as

Quazer laser processing, the Galaxy inclusion-mapping system, and the Sarine

Profile sales tool.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Chow Tai Fook Taps into Tokyo Tourism

Chow Tai Fook will open its first branded store in Japan, as the

weakening yen has increased Tokyo’s appeal to Chinese tourists. The Hong

Kong-based jeweler will launch an outlet inside Laox WATCH, a specialty

timepiece shop in Central Tokyo’s Shinjuku neighborhood. Chow Tai Fook said it was

seeking to tap into growing leisure

spending by Chinese tourists in Japan. The number of Chinese visitors to

the country jumped 28% to 6.4 million in 2016, according to the Japan National

Tourism Organization.

Chow Tai Fook will open its first branded store in Japan, as the

weakening yen has increased Tokyo’s appeal to Chinese tourists. The Hong

Kong-based jeweler will launch an outlet inside Laox WATCH, a specialty

timepiece shop in Central Tokyo’s Shinjuku neighborhood. Chow Tai Fook said it was

seeking to tap into growing leisure

spending by Chinese tourists in Japan. The number of Chinese visitors to

the country jumped 28% to 6.4 million in 2016, according to the Japan National

Tourism Organization.

|

| |

Christie’s to Auction Famed Jonker Diamond

Harry Winston’s famous Jonker No. 5 diamond will be among the top

lots offered at Christie’s Magnificent Jewels auction in Hong Kong this May.

The rectangular-cut, 25.27-carat, D-color, VVS2-clarity diamond is expected to

sell for $2.2 million to $3.6 million, or up to $142,461 per carat, the company

said. The stone is one of 13 polished diamonds cut from the famous 726-carat

Jonker rough, which digger Jacob Jonker discovered at South Africa’s

Elandsfontein mine in 1934.

Harry Winston’s famous Jonker No. 5 diamond will be among the top

lots offered at Christie’s Magnificent Jewels auction in Hong Kong this May.

The rectangular-cut, 25.27-carat, D-color, VVS2-clarity diamond is expected to

sell for $2.2 million to $3.6 million, or up to $142,461 per carat, the company

said. The stone is one of 13 polished diamonds cut from the famous 726-carat

Jonker rough, which digger Jacob Jonker discovered at South Africa’s

Elandsfontein mine in 1934.

|

| |

Complex Patek Philippe Watch Up for Auction

Sotheby’s will auction what it claims is Patek Philippe’s most

complicated watch. The Calibre 89 pocket watch, which took Patek Philippe

almost 10 years to build, is estimated at $6.4 million to $9.9 million, the

auction house said. Unveiled in 1989 to mark the iconic Swiss watchmaker’s

150th anniversary, the yellow-gold timepiece has 33 complications, or features

other than the time display. It will lead Sotheby’s Important Watches auction

in Geneva on May 14.

Sotheby’s will auction what it claims is Patek Philippe’s most

complicated watch. The Calibre 89 pocket watch, which took Patek Philippe

almost 10 years to build, is estimated at $6.4 million to $9.9 million, the

auction house said. Unveiled in 1989 to mark the iconic Swiss watchmaker’s

150th anniversary, the yellow-gold timepiece has 33 complications, or features

other than the time display. It will lead Sotheby’s Important Watches auction

in Geneva on May 14.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Profit Spikes amid Diamond Market Recovery

ALROSA’s profit quadrupled to $2.3 billion (RUB 133.47 billion) in

2016 from $554.2 million the previous year, as rough diamond demand improved

and the Russian ruble recovered against the dollar. Revenue grew 41% to $5.46

billion. Foreign exchange gains of $553 million boosted the bottom line,

following a 2015 loss from the weak ruble. ALROSA’s board this week approved

the appointment of Sergey Ivanov for a three-year term as president and CEO.

ALROSA’s profit quadrupled to $2.3 billion (RUB 133.47 billion) in

2016 from $554.2 million the previous year, as rough diamond demand improved

and the Russian ruble recovered against the dollar. Revenue grew 41% to $5.46

billion. Foreign exchange gains of $553 million boosted the bottom line,

following a 2015 loss from the weak ruble. ALROSA’s board this week approved

the appointment of Sergey Ivanov for a three-year term as president and CEO.

|

| |

Grib Diamond Sales Surge Ahead of Takeover

Lukoil’s diamond revenue nearly doubled to $335.8 million (RUB 20

billion) last year, ahead of the oil producer’s sale of the Grib mine. Sales of

rough stones stood at $184.7 million in 2015, having risen from $16.8 million in

2014, the miner said. The company announced the $1.45 billion sale of the mine

to Russian investment group Otkritie Holding last year, with the deal currently

subject to government approvals.

Lukoil’s diamond revenue nearly doubled to $335.8 million (RUB 20

billion) last year, ahead of the oil producer’s sale of the Grib mine. Sales of

rough stones stood at $184.7 million in 2015, having risen from $16.8 million in

2014, the miner said. The company announced the $1.45 billion sale of the mine

to Russian investment group Otkritie Holding last year, with the deal currently

subject to government approvals.

|

| |

Gem Diamonds Scraps Bonuses after Weak 2016

Gem Diamonds’ senior managers missed out on their performance-based

pay as the miner slid to a loss of $144 million in 2016. The decision not to

award Clifford Elphick, Michael Michael and Glenn Turner – respectively the

company’s chief executive officer, chief financial officer and legal chief –

their bonuses for the year came after revenue fell 24% to $189.8 million in

2016. The company noted a decline in the number of large diamonds extracted

from its Letšeng mine in Lesotho.

Gem Diamonds’ senior managers missed out on their performance-based

pay as the miner slid to a loss of $144 million in 2016. The decision not to

award Clifford Elphick, Michael Michael and Glenn Turner – respectively the

company’s chief executive officer, chief financial officer and legal chief –

their bonuses for the year came after revenue fell 24% to $189.8 million in

2016. The company noted a decline in the number of large diamonds extracted

from its Letšeng mine in Lesotho.

|

| |

Merlin Magics Up Green Diamonds in Australia

Merlin Diamonds has recovered five green diamonds at its Australian

mining operations, following the discovery of a rare blue diamond in December.

The largest of the green diamonds weighs 1.4 carats, and another is 0.21

carats. Independent experts are inspecting other green diamonds from the Merlin

mine besides these five, the company said. The diamonds surfaced at the mine’s

Kaye pit, part of the operations that the company acquired from Rio Tinto in

2004.

Merlin Diamonds has recovered five green diamonds at its Australian

mining operations, following the discovery of a rare blue diamond in December.

The largest of the green diamonds weighs 1.4 carats, and another is 0.21

carats. Independent experts are inspecting other green diamonds from the Merlin

mine besides these five, the company said. The diamonds surfaced at the mine’s

Kaye pit, part of the operations that the company acquired from Rio Tinto in

2004.

|

|

|

|

GENERAL

|

|

|

|

| |

Barbara Wheat to Lead Asian Gem Institute

The Asian Institute of Gemological Sciences (AIGS) has appointed

Barbara Wheat as president. Wheat will be based at the AIGS headquarters in

Bangkok, Thailand, starting in late March. She will leave her current role as

executive vice president of the Natural Color Diamond Association (NCDIA), but

plans to open a Thailand chapter of the organization.

The Asian Institute of Gemological Sciences (AIGS) has appointed

Barbara Wheat as president. Wheat will be based at the AIGS headquarters in

Bangkok, Thailand, starting in late March. She will leave her current role as

executive vice president of the Natural Color Diamond Association (NCDIA), but

plans to open a Thailand chapter of the organization.

|

| |

JA Unveils CASE Award Winners

Jewelers of America (JA) announced the winners of its 27th annual

CASE Awards for jewelry design. Among them were Christian Caine Design of West

Virginia, which came first in the new People’s Choice category; The Gem Vault

in New Jersey, for two separate white-gold-and-gem pieces; Louisiana’s Aucoin

Hart Jewelers, for a pair of diamond, sapphire and pearl earrings; and Virginia’s

White & Ivory, for a ring featuring a Black Australian doublet opal, a

sapphire and diamonds.

Jewelers of America (JA) announced the winners of its 27th annual

CASE Awards for jewelry design. Among them were Christian Caine Design of West

Virginia, which came first in the new People’s Choice category; The Gem Vault

in New Jersey, for two separate white-gold-and-gem pieces; Louisiana’s Aucoin

Hart Jewelers, for a pair of diamond, sapphire and pearl earrings; and Virginia’s

White & Ivory, for a ring featuring a Black Australian doublet opal, a

sapphire and diamonds.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Diamond and jewelry stocks were mixed this week, with the

larger conglomerates leading the gains. Shares in Anglo American jumped (+12%) on

news that Indian billionaire Anil Agarwal may buy up to 13% in the De Beers

parent. Signet Jewelers rose (+6.1%) despite disappointing earnings as

management calmed concerns about sexual harassment charges. U.S. department stores were among the bigger

losers for the week with Macy’s declining (-4.6%) on reports of activist investor

Starboard selling its stake in the retail chain.

View the detailed industry stock report

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Polished market stable as dealers returned from positive

Hong Kong show. Dealers optimistic about the U.S. and hopeful the Chinese

market is starting to improve. Good demand for GIA dossiers, especially SIs. A

lot of imperfect goods (milky or black-spotted) on the market. Steady rough

demand as major manufacturers raise production levels.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|