|

|

Diamond Market Improves After Cautious 1Q

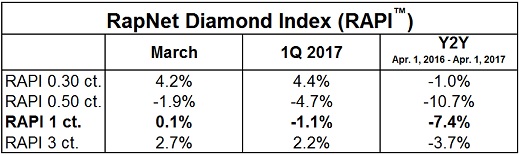

RapNet Diamond Index (RAPI™) for 1ct. Stable in March

Apr 3, 2017 4:05 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, April 3, 2017, New York… Diamond trading improved in March, with better-than-expected Chinese demand at the Hong Kong show. Suppliers were willing to compromise on price in order to generate liquidity before new, better-quality polished production becomes available.

The RapNet Diamond Index (RAPI™) for 1-carat polished diamonds edged up 0.1% in March and was down 1.1% during the first quarter. There was good demand for 0.30- to 0.49-carat diamonds, and the Hong Kong show was particularly positive for dealers specializing in these sizes.

© Copyright 2017, Rapaport USA Inc.

Momentum slowed toward the end of the month as buyers remained selective throughout the first quarter – typically a stronger period, when retailers replace inventory after the Christmas and Chinese New Year seasons.

The Rapaport Monthly Report – April 2017 demonstrates that jewelers have reduced their inventory requirements and are replacing higher-value inventory with lower-priced goods, reflecting consumers’ spending preferences.

The shift toward lower price points is placing additional pressure on the midstream. Chinese buyers are concentrating on SIs, rather than showing their traditional preference for better-quality VS and higher clarities. They’re competing with US buyers for similar qualities, and dealers are consequently supplying a narrower range of diamonds to the market.

Mining companies are raising production from last year’s reduced levels. Rough demand was steady during the first quarter as polished production continued to increase. The large Indian manufacturers are investing heavily in their operations, while the rest of the sector downsizes.

Manufacturing profits remained tight during the quarter as rough prices rose an estimated average 2% to 3%. Rough trading was strong during March as De Beers reduced supply during the month.

Diamond trading is expected to slow in April during the Passover and Easter spring break. While dealers remain optimistic following the Hong Kong show, they’re aware that market conditions continue to change, which will impact activity in the medium to long term.

The Rapaport Monthly Report is available at store.rapaport.com/monthly-report.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Gabriella Laster +1-718-521-4976

Mumbai: Priyanka Vaidya +91-97699-38102

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet – Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.2 million diamonds valued at approximately $8 billion. Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 16,300 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport Price List, research, analysis and news; RapNet – the world’s largest diamond trading network; Rapaport Laboratory Services, providing GIA and Rapaport gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services, specializing in recycled diamonds and jewelry. Additional information is available at www.diamonds.net. |

|

|

|

|

|

|

|

|

|

Tags:

De Beers, diamond, diamonds, Hong Kong, Jewelry, Martin Rapaport, Rapaport, Signet

|

|

|

|

|

|

|

|

|

|

|

|

|