|

|

Cautious Polished Lags Behind Strong Rough Market

RAPI for 1 ct. -0.3% in April

May 3, 2017 5:00 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, May 3, 2017, New York… Diamond trading slowed in April, marking the start of the traditionally quieter second quarter. Sentiment was positive despite lower trading volumes, due to improving retail expectations in China, where the jewelry market is showing signs of recovery.

The trade’s focus shifted to the US ahead of the Las Vegas shows as the hype surrounding the March Hong Kong fair subsided. Dealers held off from closing deals, hoping Las Vegas would boost activity.

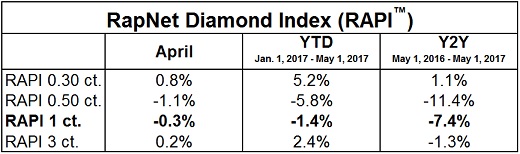

The RapNet Diamond Index (RAPI™) for 1-carat polished diamonds slid 0.3% in April and was down 1.4% since the beginning of the year.

© Copyright 2017, Rapaport USA Inc.

Amid sluggish polished markets, rough trading remained strong. Manufacturing returned to near-full capacity as the large Indian factories ramped up operations following the November Diwali break. Polished inventory is rising, with the number of stones listed on RapNet having increased 3.5% in April and 7.5% since January 1.

Strong rough markets enabled the major mining companies – Alrosa and De Beers – to reduce inventory as their combined first-quarter sales volume exceeded production by 11.9 million carats. Global diamond production is expected to rise an estimated 12% in 2017, as miners have committed to produce according to rough demand.

The Rapaport Monthly Report – May 2017 notes the buoyant rough market is not supported by current levels of polished demand. Rough prices firmed 2% to 3% since the beginning of the year, while polished prices softened. India’s rough imports by volume soared in the first quarter, while polished trading volumes in India and Belgium declined.

A continuation of these trends will put stress on the manufacturing sector, as liquidity and profitability may be eroded. After a period of improved profit margins and responsible trading in 2016, manufacturers must tread with caution, as the polished market tends to slow in the second quarter.

The Rapaport Monthly Report is available at store.rapaport.com/monthly-report.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Gabriella Laster +1-718-521-4976

Mumbai: Priyanka Vaidya +91-97699-38102

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet – Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.2 million diamonds valued at approximately $8 billion. Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 16,400 clients in over 120 countries. Group activities include Rapaport Information Services, providing the Rapaport Price List, research, analysis and news; RapNet – the world’s largest diamond trading network; Rapaport Laboratory Services, providing GIA and Rapaport gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services, specializing in recycled diamonds and jewelry.

Additional information is available at www.diamonds.net. |

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, Rapaport, RAPI, RapNet

|

|

|

|

|

|

|

|

|

|

|

|

|