It’s been a long, cool summer — that was the consensus among

diamond dealers participating in the India International Jewellery Show (IIJS),

which took place at the Bombay Exhibition Center in early August.

In fact, the first half of the year was “not so charming”

for the polished market, according to one manager of a large Surat-based

manufacturer. “But we’ll see what happens at the Hong Kong [Jewellery &

Gem] Fair,” he said. “I feel that people are starting to buy again.”

With dealers in Belgium and Israel on holiday for most of

August and those in India focused on filling domestic jewelry demand during

IIJS, the trade was looking forward to the Hong Kong show — beginning September

13 — for a boost in diamond trading ahead of the fourth-quarter holiday season.

Few were expecting a bump in activity in August, with Europe

experiencing its seasonal slowdown and IIJS offering Indian jewelers an

opportunity to stock up on gold and set jewelry, rather than diamonds, ahead of

the Diwali festival.

Sentiment among Indian jewelry wholesalers was relatively

positive. Orders were steady at IIJS, as consumer spending has returned to

normal since demonetization and the July implementation of the goods and

services tax (GST). A relatively good monsoon season also raised expectations

that consumer spending in India would advance during Diwali, which begins on

October 19 this year.

However, that didn’t inspire an improvement in loose-diamond

trading, and polished prices continued to soften throughout the month. The

RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 0.7% from August 1 to

press time on August 23. RAPI for 0.30-carat diamonds declined 1.1%, while RAPI

for 0.50-carat diamonds slid 1.7%. RAPI for 3-carat diamonds dropped 0.7%

during the period.

As polished demand and prices declined, diamond

manufacturers noted that their profit margins were under pressure in the third

quarter. As a result, rough prices on the secondary market softened, with

dealers reselling boxes of De Beers goods for very low premiums, or even at a

loss.

Polished-diamond production remained steady, although

manufacturers were more cautious about the rough market than they were in the

first half of the year. India’s rough imports fell 6% year on year in July,

according to data from the Gem & Jewellery Export Promotion Council

(GJEPC).

However, De Beers noted steady demand at its sight in late

July-August. Indian manufacturers had to make their rough purchases in time to

complete their polishing before the Diwali break, when factories close,

explained De Beers CEO Bruce Cleaver. With Diwali a week or two earlier than

usual this year, many moved up their rough buying so they would be ready, he

added.

In contrast, Alrosa vice president Yury Okoemov noted a

seasonal drop in rough demand at the Russian miner’s July sale in the run-up to

the August vacation period.

Manufacturers appear to have sufficient inventory for the

holiday season, particularly since US jewelers are maintaining lower stock

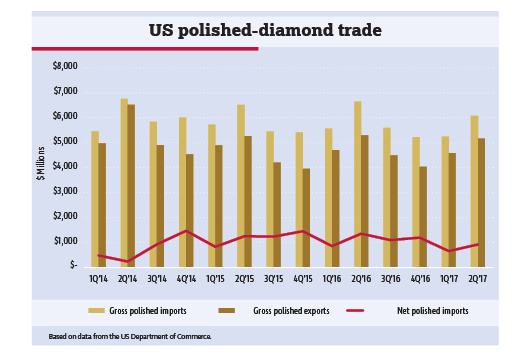

requirements. The latest government data showed the country’s polished trade

continuing to contract.

Polished imports to the US fell 9% year on year during the

second quarter — a peak period for trade there, as it includes shipments of

goods for the Las Vegas shows in June. Exports declined 3%, while net polished

imports — the excess of imports over exports, indicating the amount of goods

that remained in the country for consumption — dropped 32%.

The declines also reflect a challenging retail market in the

US as jewelers continue to adjust to changing consumer trends. Jewelers have

been taking goods on memo and concentrating on filling specific orders in

August rather than making inventory purchases for the holiday season.

Dealers are hoping for a rise in US demand in October, as

jewelers are making their holiday purchases later each year. In both the US and

China, the mid-tier jewelry retailers are the ones driving demand, while the

majors continue to manage their inventory with caution, suppliers at IIJS

noted.

With one eye on the holiday season, dealers therefore spent

much of the summer preparing for the Hong Kong show. They expect buyers in the

Asia Pacific region to use the fair as an opportunity to buy goods before the

October 1 National Day holiday, and subsequently for Christmas.

Suppliers have been encouraged by signs that the China and

Hong Kong markets are starting to reawaken, with the major jewelers reporting a

recent improvement in jewelry retail sales — even if that hasn’t yet translated

to increased demand at the wholesale level.

“The Chinese are coming back, but they’re not buying like

before,” explained one Mumbai-based diamond supplier. “They’re replacing stock

they’ve sold, not buying inventory.”

Dealers and manufacturers are expecting that will change to

some extent with the approach of the traditionally busier fourth quarter. An

increase in polished demand would raise their profit margins, given that the

rough market is expected to slow as Diwali approaches. As such, there’s a great

deal of hope that the Hong Kong show will return some charm to an otherwise

cautious polished market.

Article from the Rapaport Magazine - September 2017. To subscribe click here.