Top Stories

Swiss Watch Exports Plunge Amid Halt in Asia Demand

Shipments to China and Hong Kong were lower than in March 2020, at the height of Covid-19.

Jewelry Manufacturer Unique Designs Acquires China Pearl

New purchase will allow company to offer a broader selection of goods to its customers.

Most Popular

What Retailers Need to Know About Jewelry Websites: Magazine Highlights

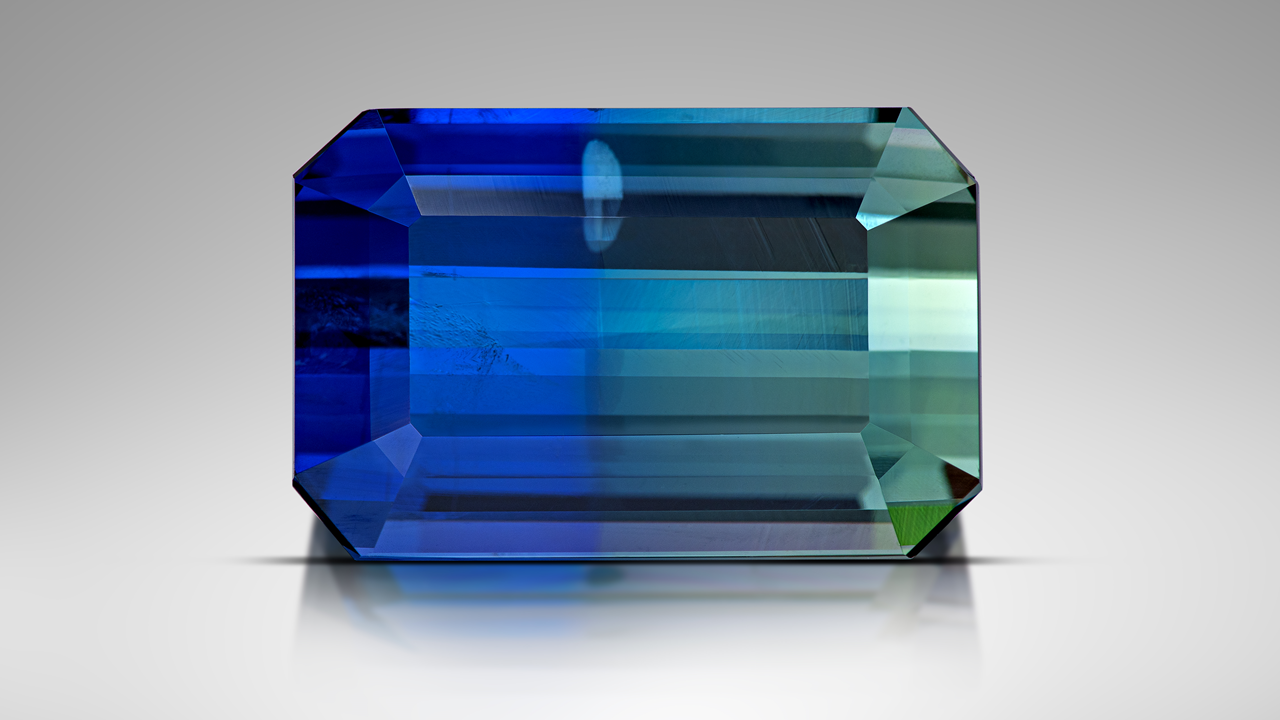

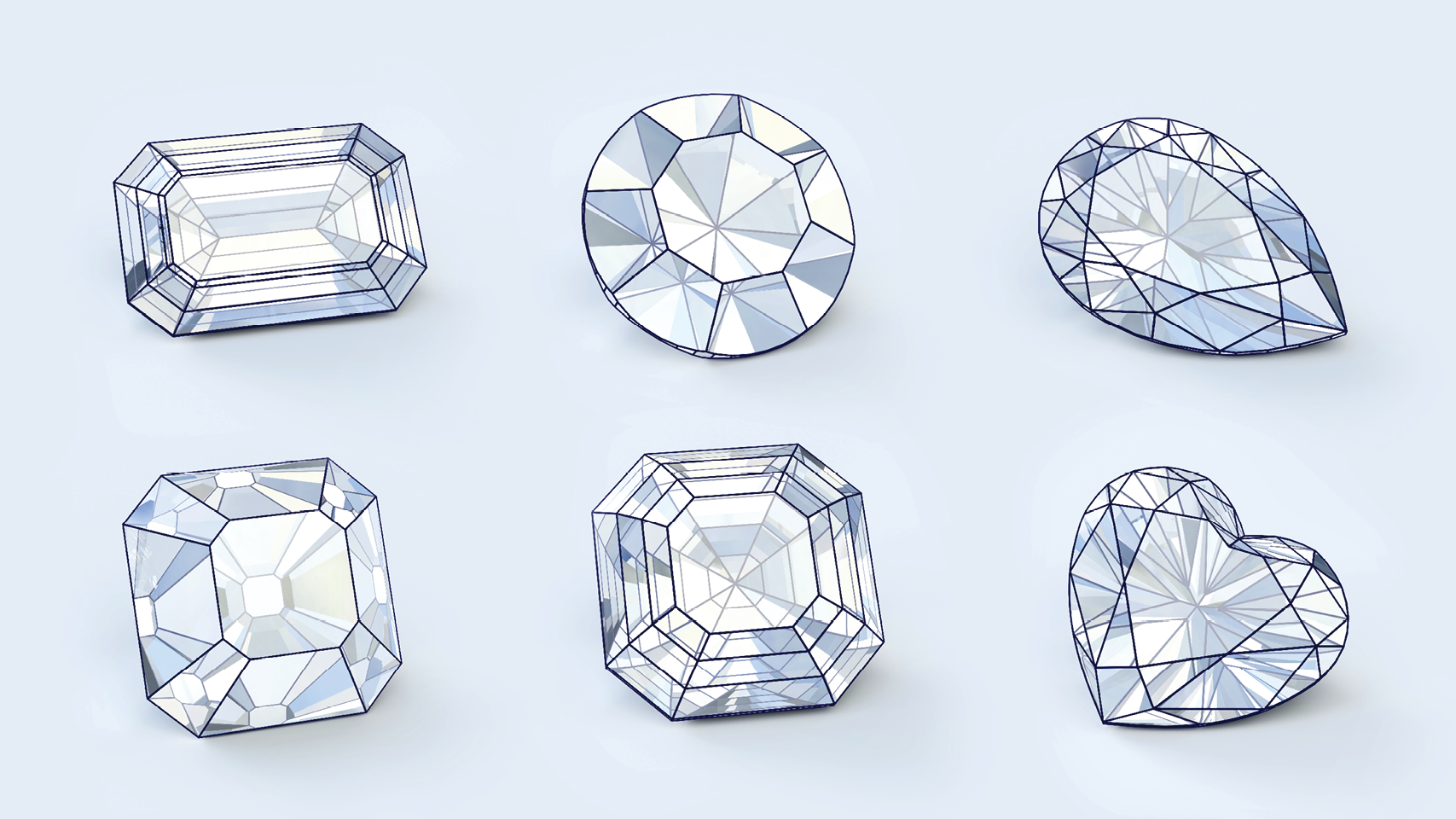

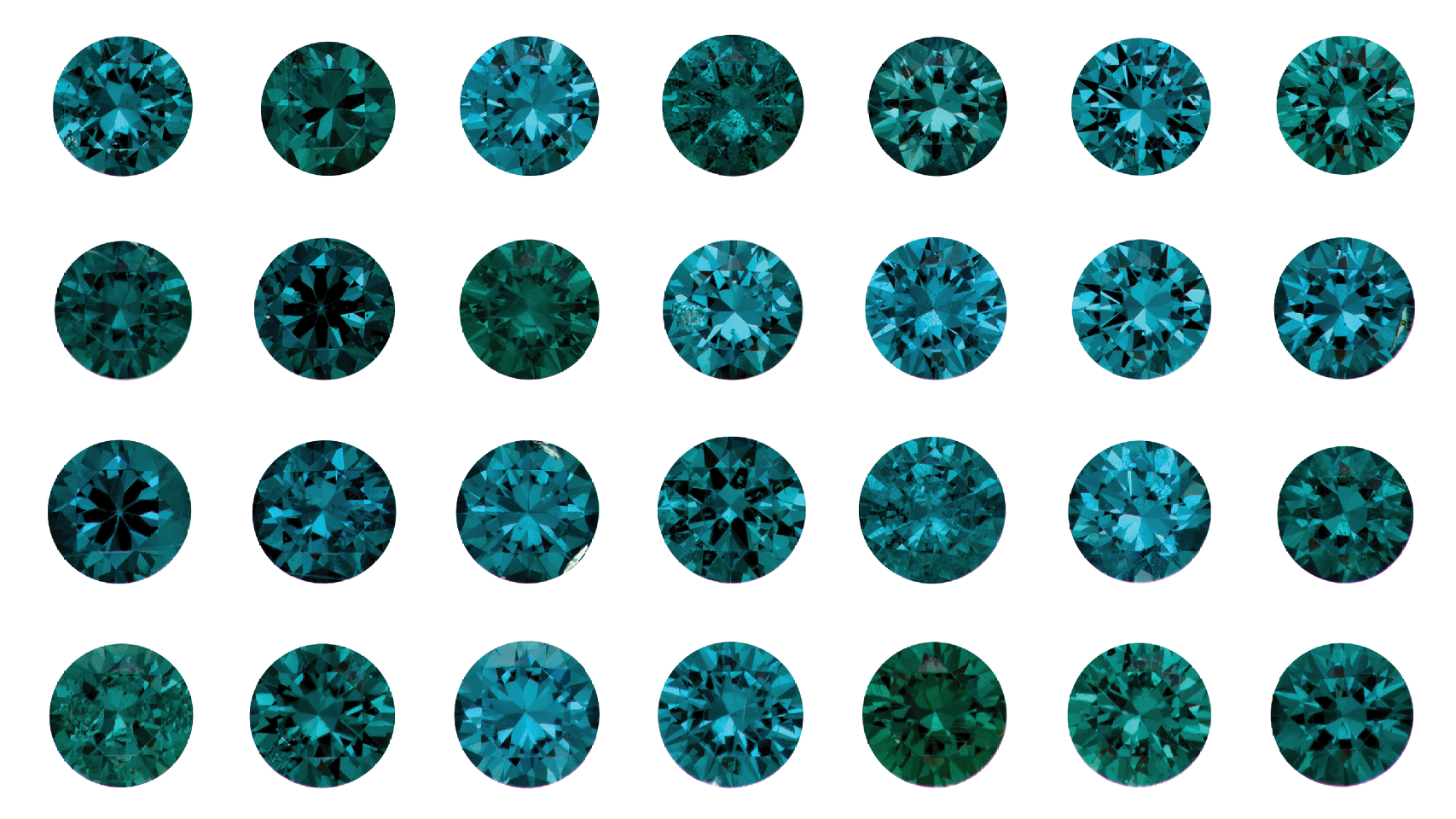

The Lowdown on Lab-Grown Diamonds

As synthetics gain ground in jewelry collections and the minds of consumers, Rapaport Magazine takes a look at some of the latest developments in this product category.

Lab-Grown

April 2, 2024

Are You Clicking with Jewelry Customers?

Here’s how retailers can optimize their online engagement to draw in shoppers and boost the bottom line.

Retail

April 2, 2024

B Corp Beefs Up Certification Criteria

The ethical-standards program is making it tougher for companies to get its stamp of approval — a move that has pros and cons for jewelers.

Social Responsibility

April 2, 2024

Rapaport

Market Data

Diamonds

Metals

Currencies

Equities

Market Comment - Apr. 18, 2024

Market quiet during seasonal slowdown ahead of Passover holiday. Steady demand for round, 1 and 2 ct., D-H, SI1-SI2 diamonds.

Russia sanctions creating concerns.

De Beers sells $445M of rough in Apr. (-18% YOY, +3% from Mar.), boosted by sanctions.

Okavango Apr. auction grosses $35M.

Petra fiscal 3Q sales -1.5% YOY to $66M.

India Mar. polished exports -27% YOY to $1.2B, rough imports -16% to $1.4B.

Gold price +10% since Mar. 18 to $2,368/ounce.

LVMH 1Q watch and jewelry sales -5% to $2.6B.

Chow Tai Fook fiscal 4Q retail sales +12% as young Chinese consumers invest in gold.

Watch Martin Rapaport webinar on source certification here.

THE RAPAPORT PRICE LIST WILL NOT BE PUBLISHED NEXT WEEK DUE TO PASSOVER.