|

|

Japanese Yen and Diamond Dollars

Editorial

Apr 12, 2013 6:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... Japan’s new government, elected this past December, seems intent on depreciating its currency as a means to stimulate the economy. A weak yen has mixed implications for the diamond and jewelry trade. As a net importer of polished diamonds, and the world’s third largest diamond jewelry consumer market, companies operating there are facing higher costs for their imported goods.

But there are opportunities for others in the trade. Recent reports indicate that an increasing number of households are selling their jewelry to capitalize on the recent yen-based gold price appreciation. The trend should apply equally to selling their diamonds in the country’s efficient recycled jewelry market.

This week, the yen slipped to 99.72, a four-year low against the U.S. dollar, edging toward the 100 barrier that analysts expect is inevitable. The currency has lost about 15 percent in value since the beginning of the year after having depreciated 13 percent in 2012.

Prime Minister Shinzo Abe seeks to further weaken the yen in a bid to help exporters keep their products competitive and boost profits earned overseas, while continuing to fight deflation that has been prevalent in the past decade.

In the latest attempt, the Bank of Japan announced a stimulus via an aggressive plan to buy Japanese government bonds worth trillions of yen, and raised its inflationary target to 2 percent from 1 percent.

Analysts at UBS Investment Research expect further stimulus and consequently revised their year-end forecast for the yen to 114 in 2013 and 120 for 2014. "The strongest upside risk to our new USD/JPY forecasts will come if inflation remains stubbornly in deflationary territory despite the Bank of Japan's new easing this month," wrote UBS economist Larry Hatheway. "That will force the central bank to consider buying more assets in future, including equities and even foreign bonds. In those scenarios, USD/JPY would likely breach its pre-credit crunch 2007 highs of 125."

The country’s major exporters, primarily in the auto and electronics industries, stand to gain, and stocks have rallied with the Nikkei 225 up 24 percent so far this year.

But it hasn’t been an easy ride for Japan. Just as the country appeared to be recovering from two decades of recession, the 2008 Lehman crisis knocked it back. Then again, the economy was hurt by the devastating earthquake and tsunami that hit the country in March 2011.

Subsequently, 2012 was a year of ups and downs. Growth resumed in the first half of 2012, at least compared to the weak comparable period a year earlier, stimulated by rebuilding from the earthquake. But exports and production fell sharply in the second half as the global economy softened due to the European debt problem and as Chinese growth slowed. The Japanese economy contracted by 3.7 percent year on year in the third quarter of 2013 and grew a marginal 0.2 percent in the fourth quarter. Policy makers note that the economy seems to have stopped weakening more recently as export markets improve and private consumption remains resilient.

The weaker yen has already affected the diamond, jewelry and luxury sectors. The likes of Moët Hennessy Louis Vuitton (LVMH), Cartier, Tiffany & Co. and Harry Winston have reportedly raised prices at their local stores to offset the depreciating yen.

Tiffany & Co. reported that its sales in Japan fell 6 percent year on year to $192 million in the fourth quarter that ended January 31, 2013, reflecting the weak yen, but rose 4 percent to $639 million in 2012 due to an increase in the average price per jewelry units sold. The company expects the forecasted low-single-digit sales growth in yen will equate to a low-teens decline when translated and reported in dollars for the current year.

Tiffany & Co.’s management explained in a March 22 earnings conference call that it projects an average yen exchange rate of 93 to the dollar in 2013 compared to an average of 81 in 2012, leading to a 15 percent negative effect from translation.

Given the continued yen depreciation since then, Tiffany & Co. should be reviewing those numbers and consequently its outlook, as should other luxury jewelers which count a significant portion of their total sales in Japan.

A similar effect is in play for polished diamond importers. Japan’s polished imports fell 10 percent year on year to $127.8 million during January and February but rose 4 percent by yen value, according to the latest available data published by Momozawa on behalf of the Finance Ministry.

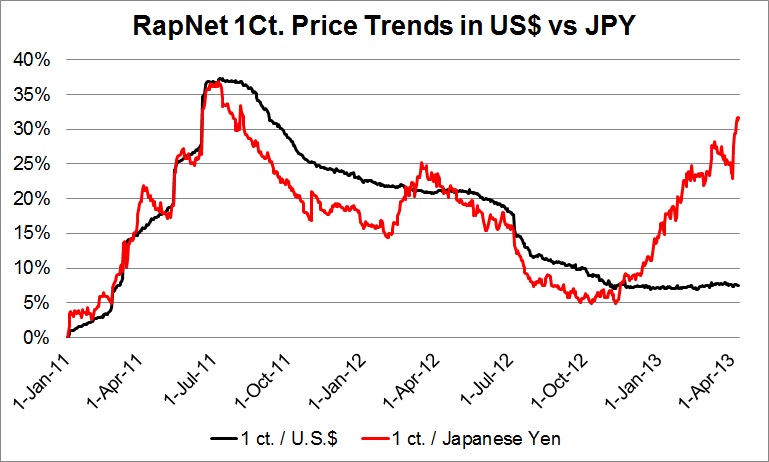

For local importers, dollar-based diamonds have become expensive to buy from overseas suppliers but they are likely profiting from older inventories they can now sell at higher yen rates. Indeed, while 1-carat diamond prices are basically flat so far in 2013, they have appreciated by 15 percent in yen terms (see Graph below).

But there is a deeper opportunity for the trade as Japan’s baby boomers, who were caught up in diamond fever in the eighties and nineties, have started to trade in their jewelry more recently. While the import of polished diamonds may have declined during the past two decades of recession, there remain a significant quantity of diamond jewelry in the country, which may now be ready to be tapped. Not quite the size of the U.S. jewelry recycling market, Japan’s pawnshop, second-hand jewelry trade is burgeoning and efficient.

Recycled jewelry markets tend to rise when gold prices hit highs, tempting households to take advantage and cash in. “In that sense, the headlines screaming record gold prices are our most effective marketing tool,” one trader told Rapaport News. Whereas the U.S. recycled jewelry market may have slowed recently since gold has slipped from its dollar highs, Japan’s yen-based gold prices are currently in that cycle, having increased 7.8 percent since the beginning of the year.

As is often the case, diamonds will tag along with gold for the ride. This provides an attractive buying opportunity for an international diamond trade constantly looking for new sources of supply. Indeed, most of the recycled Japanese diamonds are exported to India for re-cutting and distribution.

It is unlikely that Japan will become a net exporter of polished diamonds any time soon. After all, the country has a limited diamond manufacturing sector and is still an important luxury market. Japan accounts for about 10 percent of global consumption of diamond jewelry even if its stake is declining as China and India gain market share.

But the dynamics are changing and the deliberate yen depreciation represents another factor to hedge when operating there. Then again, if the government’s efforts are effective, Japan may well reposition itself as a growth market. And with an eventual stable currency, strengthen its position in the diamond and jewelry trade.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.rapnet.com or contact your local Rapaport office.

Copyright © 2013 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, Harry Winston, Japan, jewellery, Jewelry, LVMH, Rapaport, Shinzo Abe , Tiffany & CO., Yen

|

|

|

|

|

|

|

|

|

|

|

|

|