|

RAPAPORT... U.S. combined jewelry and watch sales in May rose 5.6 percent year on year to $7.192 billion, according to preliminary government estimates. Sales data for April was unchanged, however, the figures were revised slightly lower for March. Preliminary jewelry and watch sales for the first five months of the year rose 3.4 percent to $29.95 billion.

While sales growth has been holding steady in the low single-digits this year, the increase in May was the best performance since November. Jewelry and watch sales combined rose 3.8 percent in December, 3.9 percent in January, 3.7 percent in both February and March, and 2.3 percent in April. (Read more after the chart.)

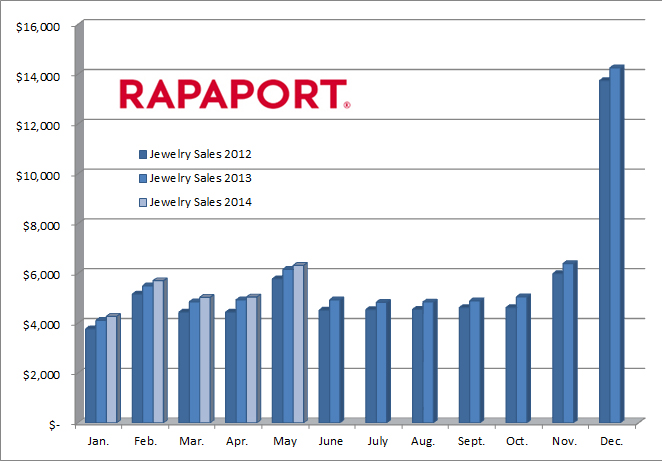

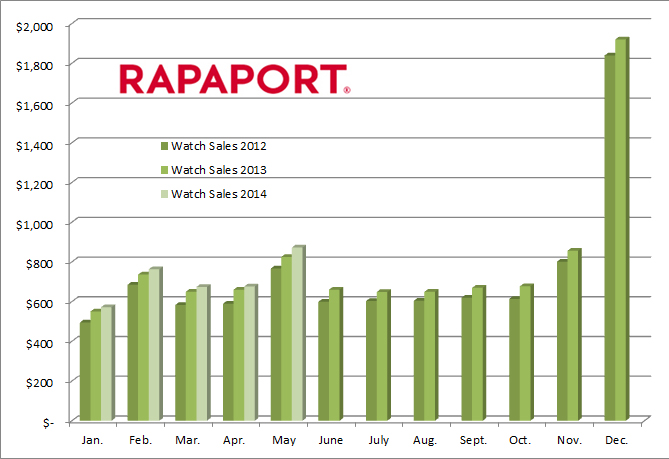

Jewelry sales across all retail establishments in May increased 5.4 percent year on year to $6.321 billion, according to Rapaport News estimates. The U.S. consumer price index (CPI) for jewelry in May declined 4.3 percent as price pressures continued to ease for supplies, especially gold. Watch sales increased 6.8 percent in May to $871 million as the CPI fell 0.9 percent for this category. (Read more after the chart.)

Jewelry sales in the U.S. for the first five months of 2014 have risen 3.1 percent year on year to $26.394 billion, while watch sales increased 3.9 percent to $3.556 billion, according to Rapaport News estimates. The increases are well below the average in 2013 when jewelry sales rose 7 percent and watch sales jumped 8 percent.

Meanwhile, advanced estimates for sales at department stores disappointed analysts by declining 1.5 percent in May to $13.838 billion. During April, department store sales had increased for the first time in more than one year. Advanced estimates for all product and food sales in the U.S. during May, however, jumped 4.3 percent year on year to $437.6 billion. Retail trade sales increased 4.3 percent and nonstore retail sales rose 7.4 percent in May. Also, the government revised April's retail sales growth rate slightly higher compared with March.

"On one hand, the disappointment in May was offset by the upward revision to April. On the other hand, after an outsized increase in March, spending has now clearly lost momentum, declining further for the second consecutive month," according to Lindsey Piegza, the chief economist for Sterne Agee.

The data revealed that automobile sales provided a boost to the growth rates for May, but excluding auto and gasoline station revenue, retail sales were flat, Piegza said in a note to clients.

"In other words, after spending on a new car and filling up the tank, there was nothing left over for other goods this month," she added.

While some analysts are anticipating a surge in retail sales due to pent-up consumer demand in coming months, Sterne Agee noted that shoppers haven't been "sitting at home since the start of the year, most were busy spending on other services."

On average, the typical household's health care services jumped by $600, while utility costs surged $1,000, according to Sterne Agee. "In other words while we expect consumption to remain positive, any rise in goods consumption will likely be offset by a decline in service spending," Piegza wrote.

|