|

|

Stable Rough Diamond Production

Editorial

Feb 6, 2015 8:00 AM

By Avi Krawitz

|

|

|

RAPAPORT... Rough diamond production was basically flat in 2014 and is projected to remain at similar levels this year. While De Beers is expected to maintain steady production, increases by ALROSA will likely compensate for declines at other companies.

Production is projected to rise in 2016 and 2017 as new projects come on stream, before gradually declining in the longer term. De Beers similarly predicted in its recent Diamond Insight Report that global production should peak in 2017.

Looking at the global portfolio of diamond mines and development projects, the mining companies are treading cautiously to match their supply with restrained demand in the current weak market. However, given the costs associated with scaling back their operations, they’re unlikely to respond by cutting production levels – unless there is a more dramatic downturn in demand, as there was in 2008/09.

In addition, among the top producers, only ALROSA and De Beers really have sufficient volume to influence the market through their supply, and neither is likely to change their planned production at this point. In fact, swings in production by any of the mid-to-large diamond miners should fall within their respective 2015 mining plans that are already in place.

ALROSA, the largest producer by volume, stated that it intends to increase production by 5 percent to 38 million carats in 2015. Whereas the Russia-based company’s production fell 2 percent to 36.2 million carats last year, ALROSA is currently ramping up operations at the Mir, Udachny and International underground mines, and two new kimberlite pipes are slated to launch early this year. The Botuobinskaya pipe is expected to peak at around 2 million carats a year and the Karpinskogo-1 pipes at 1 million carats, although it will probably take at least until 2016 for either to reach full capacity.

Those projects combined should be enough to preserve ALROSA’s position as the largest carat producer, in line with its strategy to drive growth through supply volume.

In contrast, De Beers has shifted its focus toward being a value producer in the past few years. With its higher-priced production compared with ALROSA, and, more importantly, its branding initiatives, the company is set on maintaining stable production, at least in the short term.

In 2014, De Beers in fact raised production 5 percent to 32.6 million carats, but output is forecasted to stay at around 32 million to 33 million carats this year. De Beers long-term production is being driven by expansions at its flagship Jwaneng and Venetia mines. Production at Gahcho Kué in Canada – De Beers only new development, which is owned in partnership with 49 percent stakeholder Mountain Province Diamonds – is expected to launch in the second half of 2016 with an eventual annual production of 4.3 million carats. De Beers is expected to provide its production guidance for this year when parent company Anglo American publishes its earnings on February 13.

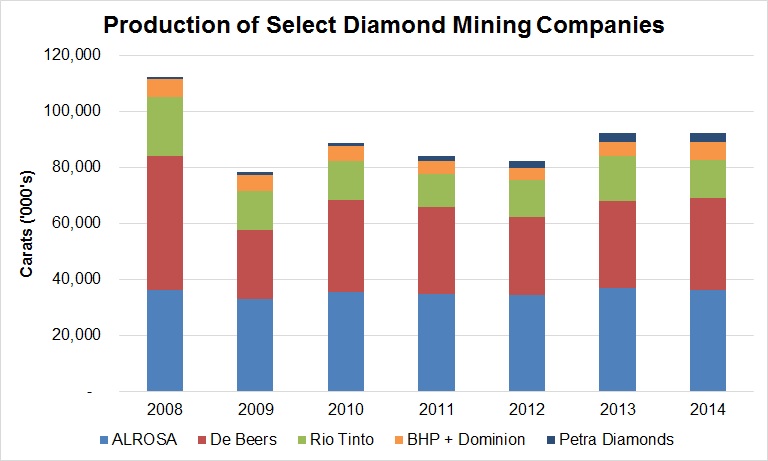

In 2014, the combined production of ALROSA, De Beers, Rio Tinto, Dominion Diamond Corporation and Petra Diamonds – which account for an estimated two-thirds of global production – was flat at 92 million carats (see graph).

Based on data published by ALROSA, De Beers and Anglo American, Rio Tinto, BHP Billiton and Dominion Diamond Corp, and Petra Diamonds. Dominion bought its majority stake in the Ekati mine from BHP Billiton in April 2013.

Only Rio Tinto recorded a decline of 13 percent to 13.9 million carats, due to a shift from open pit to underground operations at the Argyle mine and as the company has ramped up the processing of lower-grade ore. Production at Diavik, for which Rio Tinto has a 60 percent stake to Dominion’s 40 percent, was flat last year with production of 7.2 million carats but is expected to decline by 8 percent to 6.7 million carats in 2015, according to the mine plan approved by the two companies.

Dominion’s main focus is on the Ekati mine in Canada. Production at Ekati is expected to reach around an estimated 3.4 million carats in 2014 when the company reports its numbers in the coming weeks. Output is also projected to rise to about 3.8 million carats in 2015 as the operation shifts between existing pipes in the core mining area and as Dominion prepares to develop the Jay pipe in the buffer zone to drive growth in the longer term.

There are a few elephants in the room in terms of global production for 2015. The Grib mine in Russia, owned by Lukoil and launched last year, is expected to yield about 2 million carats this year on its way to full capacity of around 4 million carats a year. Similarly, the smaller scale Gem Diamonds Ghaghoo mine in Botswana that launched in September, is scheduled to reach a steady state of production in the second quarter and eventually yield around 220,000 carats a year.

In contrast, production from Zimbabwe’s Marange concessions is reportedly declining as surface mining is being depleted and companies are trying to assess the viability of mining the existing underground hard conglomerate rock. While official data for 2014 has not been published, Zimbabwe accounted for about 4 percent of global production by value in 2013, according to the Diamond Insight Report. Zimbabwe’s production, comprised predominantly of Marange rough, fell 14 percent to 10.4 million carats in that year, according to Kimberley Process data.

The respective increases and decreases appear to balance each other out and the diamond market can expect a stable supply of rough diamonds in 2015 – at overall levels similar to those experienced in 2014.

Whether there will be a similar level of demand to last year is not as clear. At least in the first quarter, this column expects the mining companies to hold larger inventories than usual, given the current softness in the rough market.

Regardless, although weak, the market has not yet influenced the mining companies to scale back on their mine plans. If anything, they continue to look longer term and keep their operations churning. A sterner test might come next year as analysts anticipate rough diamond production to peak in 2016 and 2017. Time, and rough market demand, will determine if such an increase will be warranted. For now, the mining companies will be happy to maintain that cautious balance in their seemingly stable outlook for this year.

The writer can be contacted at avi@diamonds.net.

Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

This article is an excerpt from a market report that is sent to Rapaport members on a weekly basis. To subscribe, go to www.diamonds.net/weeklyreport/ or contact your local Rapaport office.

Copyright © 2015 by Martin Rapaport. All rights reserved. Rapaport USA Inc., Suite 100 133 E. Warm Springs Rd., Las Vegas, Nevada, USA. +1.702.893.9400.

Disclaimer: This Editorial is provided solely for your personal reading pleasure. Nothing published by The Rapaport Group of Companies and contained in this report should be deemed to be considered personalized industry or market advice. Any investment or purchase decisions should only be made after obtaining expert advice. All opinions and estimates contained in this report constitute Rapaport`s considered judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Thank you for respecting our intellectual property rights.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Avi Krawitz, De Beers, diamonds, Rapaport, Rio Tinto

|

|

|

|

|

|

|

|

|

|

|

|

|