|

|

Diamond Prices, Sentiment Slump in July

RAPI for 1ct. Laboratory-Graded Diamonds -2.5%

Aug 5, 2015 3:41 AM

By Rapaport News

|

|

|

RAPAPORT... PRESS RELEASE, August 4, 2015, New York … Diamond prices fell in July as market sentiment slumped to levels not seen since the 2008 downturn. Manufacturers rejected large quantities of rough supply as trading and manufacturing activity plummeted. Rough prices are unsustainable due to the significant gap between rough and polished prices, and are likely to fall as sightholders are preparing to refuse unprofitable rough again in August.

Meanwhile, polished prices fell as manufacturers felt pressure to reduce inventory levels amid sluggish Chinese demand and stable but cautious U.S. demand.

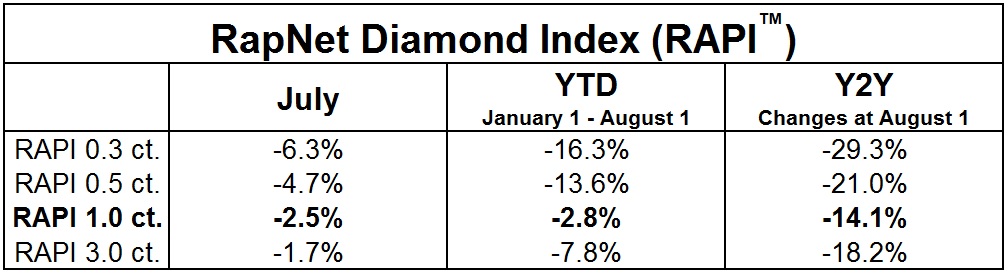

The RapNet Diamond Index (RAPI™) for 1-carat laboratory-graded diamonds fell 2.5 percent during July. RAPI for 0.30-carat diamonds declined 6.3 percent and RAPI for 0.50-carat diamonds dropped 4.7 percent. RAPI for 3-carat diamonds decreased 1.7 percent. During the first seven months of the year, RAPI for 1-carat diamonds fell by 2.8 percent, and was down 14.1 percent from one year earlier on August 1.

Copyright © by Martin Rapaport

According to the Rapaport Monthly Report – August 2015, polished inventory levels remain high. However, there are shortages in select goods due to a significant decline in manufacturing. Cutters, who usually make large-scale rough purchases in July and August in preparation for the Christmas season, are refraining from doing so this year. Manufacturers are refusing to buy rough that can’t be polished at a profit because both rough prices and polished inventory levels are too high.

De Beers will allow sightholders to defer up to 75 percent of their August purchases after sightholders rejected an estimated 65 percent of goods at the July sight. The sight closed with an estimated value of $200 million, a seven-year low for an individual sight. De Beers and ALROSA sales are expected to decline sharply in the second half of the year after both reported a tough first half.

Manufacturers are content to stay out of the rough market as they try to diminish their large polished inventory. Jewelers will be getting their supply for the holiday season mostly from existing excess polished inventory, rather than from rough, as there is almost no new rough entering the system.

It will take more than low supply to stimulate rough trading and diamond market activity. Frustrated manufacturers are making their rough buying decisions based on declining polished valuations rather than long-term supply concerns. Rough prices must drop significantly to enable manufacturing – and mining sector – profit growth, and lift the general market from its current crisis.

Read the attached Rapaport Monthly Report, "A Market in Crisis," at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400;

International: Lisa Miller +1-718-521-4976;

Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is based on the average asking price in hundred $/ct. of the 10 best diamonds, for the top 25 quality round diamonds (D-H, IF-VS2, RapSpec-A3 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1.3 million diamonds valued over $8.23 billion and 14,530 members in 90 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, competitive and efficient diamond and jewelry markets. Established in 1978, the Rapaport Price List and Magazine is the primary source of diamond price and market information. Group activities include Rapaport Information Services and Diamonds.net, providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services specializing in recycled diamonds and jewelry. The Group supports over 20,000 clients in 118 countries and employs 220 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai and Hong Kong. Additional information is available at www.Diamonds.net.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, Diamond prices, diamonds, Jewelry, Rapaport, Rapaport News

|

|

|

|

|

|

|

|

|

|

|

|

|