|

|

Rapaport TradeWire June 30, 2016

Jun 30, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

June 30, 2016

|

|

|

Sentiment weak as Brexit vote adds to economic

uncertainty and Hong Kong show disappoints. Stock markets volatile, currencies

weak, gold rallies (+4% to $1,320/oz) as investors seek assets with store of

value. Polished trading slow with Chinese buyers pushing for deeper discounts

and U.S. dealers heading for July vacation. Rough markets stable with 3 to 6

grainers softening at auctions. De Beers sells $560M in June, 1H sales +12% to

estimated $3B. Lucara’s 1,109 ct. ‘Lesedi la Rona’ rough diamond does not sell

with high bid $61M ($55,000/ct.) at Sotheby’s London. U.S. May jewelry retail

sales +4% to $6.3B. AWDC reelects Stéphane Fischler president.

|

|

| Diamonds |

1,209,787 |

| Value |

$8,046,872,741 |

| Carats |

1,301,184 |

| Average Discount |

-29.34% |

www.rapnet.com

|

|

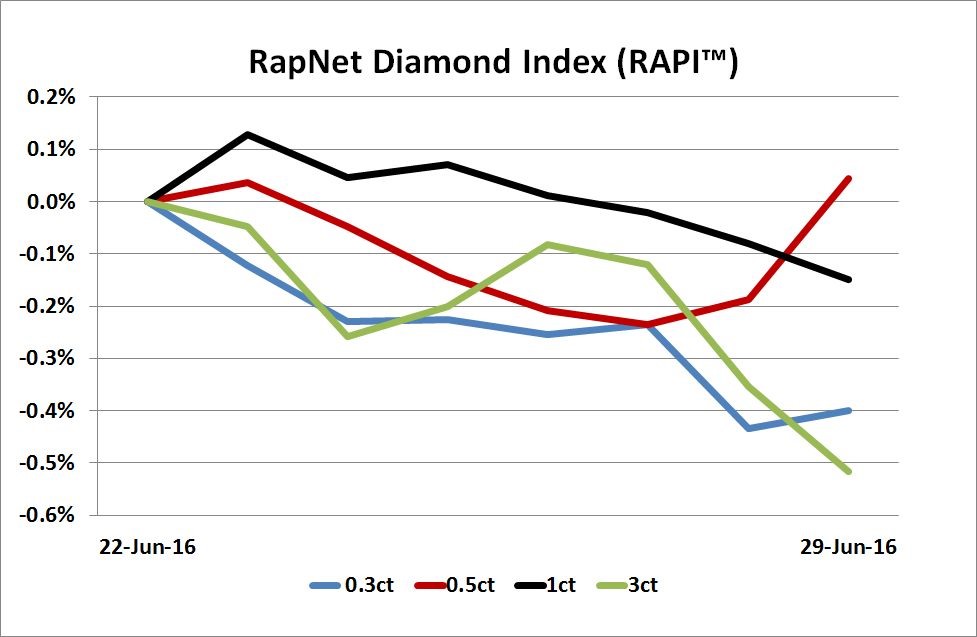

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

There will be continuing volatility in global markets since this is completely uncharted waters. And we have already seen how the price of gold has jumped as investors seek the traditional safe haven. Both of those developments are unfortunate as they may tend to persuade consumers not to buy jewelry.

There will be continuing volatility in global markets since this is completely uncharted waters. And we have already seen how the price of gold has jumped as investors seek the traditional safe haven. Both of those developments are unfortunate as they may tend to persuade consumers not to buy jewelry.

Ernie Blom, president of the World Federation of Diamond Bourses, on the post-Brexit turmoil

|

|

|

|

MARKETS

|

|

|

|

| |

United States: Polished trading stable with dealers filling orders

before two-week July vacation period. Steady demand for 1 to 3 ct., G-I,

VS2-SI2 diamonds, while larger stones remain weak…

Belgium: Polished trading slow at quiet Hong Kong show and

Antwerp market sluggish. Wholesalers avoiding large inventory purchases with

concern prices will soften in coming months…

Israel: Market slow as dealers return from Hong Kong show.

Overall concern about lagging demand as lower prices fail to stimulate sales…

India: Sentiment weak with dealers disappointed at Hong

Kong show. Chinese demand cautious and fewer buyers in Mumbai ahead of U.S.

vacation period…

Hong Kong: June show small and quiet. Retailers went to assess

market trends and push for bargains. Suppliers willing to compromise on price

had relatively busy show...

Click here for deeper analysis |

|

|

|

RAPAPORT STATEMENT

|

|

|

|

| |

Brexit Impact

Brexit will not have a sustainable negative impact on polished diamond demand. The EU has not been a dominant diamond consumption center for many years...

Click here to read statement

|

|

|

|

INSIGHTS

|

|

|

|

| |

The Rough Guide: Who's Buying Where and Why

Rapaport publishes its annual list of manufacturers and dealers buying rough diamonds from the major mining companies...

Click here to continue reading

|

|

|

|

FIVE-MINUTE INTERVIEW

|

|

|

|

| |

Diamonds Driving Growth as Consolidation Continues

The U.S. jewelry market continues to consolidate but there are also areas of growth, says Tony Capuano, president of the Jewelers Board of Trade, in his first interview with Rapaport News...

Click here to read the interview |

|

|

|

INDUSTRY

|

|

|

|

| |

Brexit May Prove Costly for U.K. Jewelers

The cost of

manufacturing and importing jewelry to the UK is expected to rise after the

nation voted to leave the European Union, the National Association of Jewellers

warned. Gold surged and the pound depreciated to its lowest level in more than

30 years after results from the Brexit referendum came in last week. The

fallout may also affect the timing of Russia’s sale of a 10.9% stake in ALROSA

if market conditions deteriorate, according to Sberbank CIB, the bank

organizing the sale.

The cost of

manufacturing and importing jewelry to the UK is expected to rise after the

nation voted to leave the European Union, the National Association of Jewellers

warned. Gold surged and the pound depreciated to its lowest level in more than

30 years after results from the Brexit referendum came in last week. The

fallout may also affect the timing of Russia’s sale of a 10.9% stake in ALROSA

if market conditions deteriorate, according to Sberbank CIB, the bank

organizing the sale.

|

| |

Shock as Lesedi La Rona Unsold at Auction

Lucara's share price tumbled 15% after the company's 1,109-carat Lesedi La Rona failed to sell at Sotheby’s London. The diamond drew a highest bid of $61 million, below its reserve price, which was not disclosed.

Lucara Diamond Corp., which discovered the type-IIa diamond last November, will retain the stone. The diamond is the second largest rough ever

found and was expected to fetch more than $70 million at the auction.

Lucara's share price tumbled 15% after the company's 1,109-carat Lesedi La Rona failed to sell at Sotheby’s London. The diamond drew a highest bid of $61 million, below its reserve price, which was not disclosed.

Lucara Diamond Corp., which discovered the type-IIa diamond last November, will retain the stone. The diamond is the second largest rough ever

found and was expected to fetch more than $70 million at the auction. |

| |

De Beers June Sales Valued at $560M

De Beers reported sales fell to $560 million in June from $636 million the previous month. Rough prices were stable and sightholders rejected only lower-quality goods, buyers said. However, De Beers adjusted its assortments resulting in some boxes becoming more expensive. De Beers rough sales jumped 12% year on year to $3.02 billion in the first half of the year, according to Rapaport estimates.

De Beers reported sales fell to $560 million in June from $636 million the previous month. Rough prices were stable and sightholders rejected only lower-quality goods, buyers said. However, De Beers adjusted its assortments resulting in some boxes becoming more expensive. De Beers rough sales jumped 12% year on year to $3.02 billion in the first half of the year, according to Rapaport estimates.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

U.S. Jewelry Sales Rise in May

U.S. jewelry and watch sales increased 4.2% to an estimated $7.17 billion in May, according to provisional

government data for all retail outlets. May was the 13th consecutive month of

year-on-year growth. Jewelry sales advanced 4.1% to $6.33 billion,

according to Rapaport News estimates.

Jewelry and watch sales for the first five months of the year grew 4.7% to an estimated $28.14 billion.

U.S. jewelry and watch sales increased 4.2% to an estimated $7.17 billion in May, according to provisional

government data for all retail outlets. May was the 13th consecutive month of

year-on-year growth. Jewelry sales advanced 4.1% to $6.33 billion,

according to Rapaport News estimates.

Jewelry and watch sales for the first five months of the year grew 4.7% to an estimated $28.14 billion.

|

| |

De Beers Opens First Store in Kuwait

De Beers

opened its first retail store in Kuwait, adding to its Middle East

locations in Dubai and Bahrain. The 145-square-meter outlet in the prestigious

‘Avenues’ shopping mall complements current De Beers stores in London, New

York, Paris, Beijing, Shanghai, Hong Kong and Tokyo.

De Beers

opened its first retail store in Kuwait, adding to its Middle East

locations in Dubai and Bahrain. The 145-square-meter outlet in the prestigious

‘Avenues’ shopping mall complements current De Beers stores in London, New

York, Paris, Beijing, Shanghai, Hong Kong and Tokyo.

|

| |

Macy's Pins Hopes on New CEO

Macy’s

appointed Jeff Gennette as chief executive officer, replacing Terry Lundgren as

part of a succession plan to revitalize the U.S. department store chain.

Gennette (pictured) has been president of the company since 2014 and will

take over the additional role of CEO in the first quarter of 2017.

Lundgren will continue as executive chairman and work side-by-side with

Gennette.

Macy’s

appointed Jeff Gennette as chief executive officer, replacing Terry Lundgren as

part of a succession plan to revitalize the U.S. department store chain.

Gennette (pictured) has been president of the company since 2014 and will

take over the additional role of CEO in the first quarter of 2017.

Lundgren will continue as executive chairman and work side-by-side with

Gennette.

|

|

|

|

MINING

|

|

|

|

| |

ALROSA Eyes Growth in Diamond Reserves

ALROSA plans

to increase its diamond reserves by 50.4 million carats. Growth will be

guaranteed by exploration of the Zarya field and follow-up exploration at the

Aikhal and Verkhne-Munsoye fields, Konstantin Garanin, ALROSA's head geologist,

said in an interview cited by Interfax. The miner's diamond reserves stood at

1.108 billion carats at the beginning of 2016.

ALROSA plans

to increase its diamond reserves by 50.4 million carats. Growth will be

guaranteed by exploration of the Zarya field and follow-up exploration at the

Aikhal and Verkhne-Munsoye fields, Konstantin Garanin, ALROSA's head geologist,

said in an interview cited by Interfax. The miner's diamond reserves stood at

1.108 billion carats at the beginning of 2016.

|

| |

Diamcor Sales Surge, Prices Fall

Diamcor Mining reported the average price of its sales declined to $142.40 per carat in the first fiscal quarter from $159 per carat a year earlier. The company sold 13,385 carats for $1.9 million in the three months that ended June 30, which was more than quadruple the amount sold last year. The diamonds are from the miner’s Krone-Endora at Venetia project in South Africa.

Diamcor Mining reported the average price of its sales declined to $142.40 per carat in the first fiscal quarter from $159 per carat a year earlier. The company sold 13,385 carats for $1.9 million in the three months that ended June 30, which was more than quadruple the amount sold last year. The diamonds are from the miner’s Krone-Endora at Venetia project in South Africa.

|

| |

Kimberley Completes First Lerala Rough Sale

Kimberley

Diamonds sold its first parcel of rough from the Lerala Diamond Mine in

Botswana for an average price of $98 per carat. Only gem-quality goods were

sold in the online auction, with the rest added to a sale scheduled for

September when the miner expects to see better market conditions.

Production resumed at Lerala in May after a nine-month upgrade and

recommissioning.

Kimberley

Diamonds sold its first parcel of rough from the Lerala Diamond Mine in

Botswana for an average price of $98 per carat. Only gem-quality goods were

sold in the online auction, with the rest added to a sale scheduled for

September when the miner expects to see better market conditions.

Production resumed at Lerala in May after a nine-month upgrade and

recommissioning.

|

| |

Lucapa Seeks Source of Huge Diamonds

Lucapa

Diamond Company has started a drilling program to identify the kimberlite

source of a series of exceptionally large diamonds it recovered at the Lulo

mine in Angola. These include a 404-carat rough gem which fetched $16 million

(AUD 22.5 million) in February. The project will test “high-priority”

kimberlite targets at the mine and is scheduled to run through the remainder of

2016.

Lucapa

Diamond Company has started a drilling program to identify the kimberlite

source of a series of exceptionally large diamonds it recovered at the Lulo

mine in Angola. These include a 404-carat rough gem which fetched $16 million

(AUD 22.5 million) in February. The project will test “high-priority”

kimberlite targets at the mine and is scheduled to run through the remainder of

2016.

|

| |

Dominion Contains Fire at Ekati Mine

Dominion

Diamond Corporation said a fire broke out at its Ekati mine in Canada’s

Northwest Territories on Thursday, prompting all staff to be evacuated from the

processing plant. All personnel were accounted for and no injuries were reported. Damage

was limited to a small area and did not affect the main structural components

of the operation.

Dominion

Diamond Corporation said a fire broke out at its Ekati mine in Canada’s

Northwest Territories on Thursday, prompting all staff to be evacuated from the

processing plant. All personnel were accounted for and no injuries were reported. Damage

was limited to a small area and did not affect the main structural components

of the operation.

|

|

|

|

GENERAL

|

|

|

|

| |

AWDC Backs Fischler for Third Term

The Antwerp

World Diamond Centre (AWDC) reelected Stéphane Fischler as president for a

third two-year term. Fischler (pictured) was voted in by the new AWDC board which

was elected earlier this month. Nishit Parikh was named vice-president.

The Antwerp

World Diamond Centre (AWDC) reelected Stéphane Fischler as president for a

third two-year term. Fischler (pictured) was voted in by the new AWDC board which

was elected earlier this month. Nishit Parikh was named vice-president.

|

| |

Diamond Bourse of Canada Ushers in New Board

The Diamond Bourse

of Canada has reelected David Gavin as president of its new board of directors.

It's Gavin's third two-year term. Minesh Shah will serve as vice president.

The Diamond Bourse

of Canada has reelected David Gavin as president of its new board of directors.

It's Gavin's third two-year term. Minesh Shah will serve as vice president.

|

| |

Law Enforcers Meet on Diamond Trafficking

Crime-catchers

from around the world gathered in The Hague this week in what was described as

the first global law enforcement forum on the illicit diamond trade. Europol,

the European Law Enforcement Agency based in the Dutch capital, hosted the

three-day conference to bring together senior law enforcement and customs

officials, regulatory bodies, anti-money laundering experts and private sector

experts.

Crime-catchers

from around the world gathered in The Hague this week in what was described as

the first global law enforcement forum on the illicit diamond trade. Europol,

the European Law Enforcement Agency based in the Dutch capital, hosted the

three-day conference to bring together senior law enforcement and customs

officials, regulatory bodies, anti-money laundering experts and private sector

experts.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Brexit hit global stocks in the immediate aftermath but the FTSE 100 was higher by mid-Thursday GMT. U.K. mining stocks varied greatly in their performance with Petra Diamonds (+9.4%) leading the pack but Gem Diamonds (-8.3%) suffering the steepest slide. Toronto-listed Lucara (-12%) declined on news that its 1,109-carat rough diamond failed to sell at auction. European industry stocks fell, headed by LVMH (-6.1%), while the U.S. and the Far East were mixed.

View the detailed industry stock report

| |

Jun 30 (12:01 GMT) |

Jun 23 (12:06 GMT) |

Chng. |

|

| $1 = Euro |

0.90 |

0.88 |

0.02 |

|

| $1 = Rupee |

67.51 |

67.29 |

0.22 |

|

| $1 = Israel Shekel |

3.85 |

3.82 |

0.02 |

|

| $1 = Rand |

14.81 |

14.46 |

0.34 |

|

| $1 = Canadian Dollar |

1.30 |

1.28 |

0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,317.28 |

$1,263.95 |

$53.33 |

4.2% |

| Platinum |

$1,001.26 |

$974.75 |

$26.51 |

2.7% |

| Silver |

$18.38 |

$17.32 |

$1.06 |

6.1% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,999.72 |

27,002.22 |

-2.50 |

0.0% |

| Dow Jones |

17,694.68 |

17,780.83 |

-86.15 |

-0.5% |

| FTSE |

6,357.09 |

6,338.64 |

18.45 |

0.3% |

| Hang Seng |

20,794.37 |

20,868.34 |

-73.97 |

-0.4% |

| S&P 500 |

2,070.77 |

2,085.45 |

-14.68 |

-0.7% |

| Yahoo! Jewelry |

947.06 |

956.95 |

-9.89 |

-1.0% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Sentiment weak with dealers disappointed at Hong

Kong show. Chinese demand cautious and fewer buyers in Mumbai ahead of U.S.

vacation period. Demand is order-specific with buyers avoiding inventory

purchases and pushing for higher discounts. Stable demand for 1 ct., D-H, VS-SI

diamonds. 3 ct. steady in SI’s, weak in other areas. Manufacturing levels

steady with new rough coming to factories after June sight. Rough trading

stable with good demand from smaller manufacturers.

Read the Polished Diamond Trading Report |

|

|

Advertisements

|

|

|

Advertisements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|