|

|

Rapaport TradeWire December 8, 2016

Dec 8, 2016 6:00 PM

By Rapaport

|

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

Rapaport Weekly Market Comment

December 8, 2016

|

|

|

Polished

market stable during peak jewelry selling season. Small melee significantly

weakened by India’s currency demonetization. Larger stones relatively

unaffected. Nov. RAPI 1 ct. +0.5%, 0.30 ct. +0.5%, 0.50 ct. -1%, 3 ct. +1.2%. Manufacturing

profitability better than last year with De Beers Jan. to Nov. rough price

index -5%. Lukoil to sell Grib mine to Russian Otkritie investment group for

$1.5B. Christie’s NY sells $51M with

rectangular, 51.35 ct., D, VVS1 diamond sold for $5.6M ($108,422/ct.). Belgium

Nov. polished exports -6% to $878M, rough imports +60% to $1.1B. GIA opens synthetic

melee testing service.

|

|

| Diamonds |

1,279,046 |

| Value |

$7,900,529,253 |

| Carats |

1,355,391 |

| Average Discount |

-30.18% |

www.rapnet.com

|

|

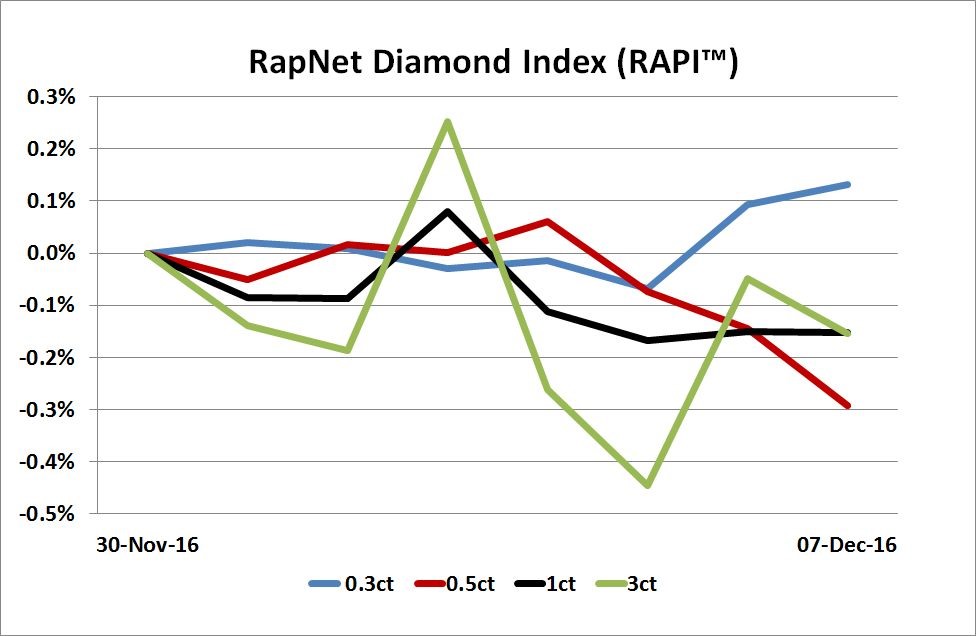

| The RapNet Diamond Index (RAPI™) is the average asking price in hundred $/ct. of the 10 percent best priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet - Rapaport Diamond Trading Network. |

|

|

|

|

Get Current Price List | Subscribe to Rapaport | Join RapNet |

|

| |

QUOTE OF THE WEEK

I would like to have more diamonds, to be very explicit. That’s a priority area.

I would like to have more diamonds, to be very explicit. That’s a priority area.

Diamond mines are on Rio Tinto CEO Jean-Sébastien Jacques' wish list this holiday season.

|

|

|

|

MARKETS

|

|

|

|

| |

United

States: Positive

sentiment due to improved trading during the holiday season. Many inquiries for

memo goods from independent jewelers…

Belgium: Steady

last-minute orders for specific goods from U.S. and European independent

jewelers. Dealers relatively satisfied with holiday trading but still cautious

about the market…

Israel:

Dealer

trading quiet with most orders complete for the U.S. holiday season. Steady demand

for under-the-carat GIA goods with some weakness and rising inventory for 0.50

to 0.89 ct., D-I, IF-VVS diamonds…

India: Dealers

trying to normalize operations after Nov. government demonetization liquidity

crisis. Larger exporters resuming regular activity with full manufacturing

capacity after Diwali break…

Hong

Kong: : Dealer sentiment slightly improved with steady

orders for the Chinese New Year season. Buyers shifting to lower price points

with good demand for 0.30 to 1 ct., G-J, VS-SI diamonds…

Click here for deeper analysis

|

|

|

| RAPAPORT STATEMENT

|

|

|

|

| |

Diamond Prices Firm Slightly with U.S. Optimism

Diamond

trading slowed in November as Indian liquidity dried up and manufacturing shut

down for Diwali. U.S. jewelers completed their inventory purchases and focused

on selling during the holiday season rather than buying from overseas

suppliers. Sentiment improved as the season began and polished prices

firmed despite slow dealer trading. The RapNet Diamond Index (RAPI™) for

1-carat, RapSpec A3+ diamonds gained 0.5% in November.

Purchase the full Rapaport

Monthly Report – December 2016

|

|

|

|

INSIGHTS

|

|

|

|

| |

Diamond Industry Now Banking on Legitimacy

The diamond industry has added several layers of legitimacy this year as more companies are complying with standards set out by banks, regulators and suppliers. Encouragingly, the trade ended 2016 in a far healthier place than a year ago with officials starting to view the industry as a more 'normal' market...

Click here to continue reading

|

|

|

|

INDUSTRY

|

|

|

|

| |

De Beers Rough Prices Drop 5% in 2016

De

Beers rough diamond price index fell 5% in 2016 despite a vastly improved

diamond market. Diamond prices declined for the period January to

November, while prices rose among other commodities in parent Anglo American’s

portfolio. De Beers is still expected to drive growth at Anglo American this

year as diamond sales grew in the first half whereas revenue fell from each of

its other core businesses. Including this week’s final sight of the year, De

Beers sales are expected to exceed $5.6 billion for 2016, from $4.1 billion

last year.

De

Beers rough diamond price index fell 5% in 2016 despite a vastly improved

diamond market. Diamond prices declined for the period January to

November, while prices rose among other commodities in parent Anglo American’s

portfolio. De Beers is still expected to drive growth at Anglo American this

year as diamond sales grew in the first half whereas revenue fell from each of

its other core businesses. Including this week’s final sight of the year, De

Beers sales are expected to exceed $5.6 billion for 2016, from $4.1 billion

last year.

|

| |

Bain Warns of Looming Rough Bubble

Strong

growth in rough sales this year may lead to a repeat of last year’s damaging

inventory pile-up if consumer demand does not improve, Bain & Company

warned. Rough sales grew 20% in the first half as the midstream restocked

following an inventory sell-off. However, jewelry retail might not be keeping

pace as sales were hit by weaker economic conditions in parts of the U.S. and a temporary drop in overall consumer expenditure, Bain explained.

Strong

growth in rough sales this year may lead to a repeat of last year’s damaging

inventory pile-up if consumer demand does not improve, Bain & Company

warned. Rough sales grew 20% in the first half as the midstream restocked

following an inventory sell-off. However, jewelry retail might not be keeping

pace as sales were hit by weaker economic conditions in parts of the U.S. and a temporary drop in overall consumer expenditure, Bain explained.

|

| |

ABN AMRO Forecasts Polished Price Recovery

ABN

AMRO predicted polished diamond prices will increase next year as it expects

improved economic conditions will boost U.S. and Chinese demand. U.S. jewelry

consumption will benefit from a stronger labor market, rising housing prices

and the impact of President-Elect Donald Trump’s fiscal stimulus, the bank

argued. Polished prices have declined this year, with the RAPI for 1-carat

polished diamonds dropping 3.8% in the first 11 months.

ABN

AMRO predicted polished diamond prices will increase next year as it expects

improved economic conditions will boost U.S. and Chinese demand. U.S. jewelry

consumption will benefit from a stronger labor market, rising housing prices

and the impact of President-Elect Donald Trump’s fiscal stimulus, the bank

argued. Polished prices have declined this year, with the RAPI for 1-carat

polished diamonds dropping 3.8% in the first 11 months.

|

| |

Belgium’s Polished Diamond Exports Decline

Belgium’s

polished exports fell 6% to $878 million in November, according to the

Antwerp World Diamond Centre. Polished imports dropped 10% to $695

million, while net polished exports rose 14% to $183 million. Rough

imports grew 60% to $1.14 billion, while rough exports increased 63% to $1.05

billion. Net rough imports rose 32% to $87 million. Belgium’s November net

diamond account, representing total polished and rough exports minus total

imports, edged up 1% to $96 million.

Belgium’s

polished exports fell 6% to $878 million in November, according to the

Antwerp World Diamond Centre. Polished imports dropped 10% to $695

million, while net polished exports rose 14% to $183 million. Rough

imports grew 60% to $1.14 billion, while rough exports increased 63% to $1.05

billion. Net rough imports rose 32% to $87 million. Belgium’s November net

diamond account, representing total polished and rough exports minus total

imports, edged up 1% to $96 million.

|

|

|

|

RETAIL & WHOLESALE

|

|

|

|

| |

Christie's Sells 51 Carat Diamond for $5.6M

Christie’s

sold $51 million worth of jewelry at its New York auction with the top lot, a

rectangular, 51.35-carat, D-color, VVS1 diamond ring selling for $5.6 million,

or $108,423 per carat. A total 13 items fetched more than $1 million each, including

a cushion-cut, 75.41-carat sapphire ring that fetched $3.8 million. Christie’s earlier

reported a stronger than expected Paris auction, with total receipts of $4.1

million (EUR 4 million) as 45% of items sold above their estimates.

Christie’s

sold $51 million worth of jewelry at its New York auction with the top lot, a

rectangular, 51.35-carat, D-color, VVS1 diamond ring selling for $5.6 million,

or $108,423 per carat. A total 13 items fetched more than $1 million each, including

a cushion-cut, 75.41-carat sapphire ring that fetched $3.8 million. Christie’s earlier

reported a stronger than expected Paris auction, with total receipts of $4.1

million (EUR 4 million) as 45% of items sold above their estimates.

|

| |

Diamonds Shine in Bonhams London Auction

Bonhams

sold $8.6 million (GBP 6.8 million) worth of jewelry at its London auction. The

highlight of the diamonds on offer was a pear-shape, 12.08-carat, D-color,

VVS1-clarity diamond ring, which went to a telephone bidder for $975,797, or

$79,000 per carat. However, the selling price was surpassed by a 14.13-carat

Kashmir sapphire ring, which drew a winning bid of $1.7 million.

Bonhams

sold $8.6 million (GBP 6.8 million) worth of jewelry at its London auction. The

highlight of the diamonds on offer was a pear-shape, 12.08-carat, D-color,

VVS1-clarity diamond ring, which went to a telephone bidder for $975,797, or

$79,000 per carat. However, the selling price was surpassed by a 14.13-carat

Kashmir sapphire ring, which drew a winning bid of $1.7 million.

|

| |

Blue Nile Says Takeover Bid Unchallenged

Blue

Nile did not receive additional takeover bids during a 30-day period in which

it could consider proposals from third parties, according a company filing. The

online jewelry retailer agreed to a $500 million acquisition by Bain

Capital Private Equity and Bow Street last month. However, the terms permitted it

to solicit bids from other potential buyers during a ‘go-shop’

period. With the period now over, Blue Nile is subject to “customary

restrictions” when engaging with alternative proposals.

Blue

Nile did not receive additional takeover bids during a 30-day period in which

it could consider proposals from third parties, according a company filing. The

online jewelry retailer agreed to a $500 million acquisition by Bain

Capital Private Equity and Bow Street last month. However, the terms permitted it

to solicit bids from other potential buyers during a ‘go-shop’

period. With the period now over, Blue Nile is subject to “customary

restrictions” when engaging with alternative proposals.

|

|

|

|

MINING

|

|

|

|

| |

Grib Diamond Mine Sold for $1.5B

Lukoil

agreed to sell its Grib diamond project to Russian investment group Otkritie

Holding for $1.45 billion in cash. The deal is expected to close in the first

quarter of 2017 following government approval. Production at Grib

was launched in September 2014, with initial projections pointing to peak levels

of 4.5 million carats a year. The majority of the mine's production is sold by

tender via the Antwerp-based subsidiary Grib Diamonds, which won't be

affected by the acquisition, sources said.

Lukoil

agreed to sell its Grib diamond project to Russian investment group Otkritie

Holding for $1.45 billion in cash. The deal is expected to close in the first

quarter of 2017 following government approval. Production at Grib

was launched in September 2014, with initial projections pointing to peak levels

of 4.5 million carats a year. The majority of the mine's production is sold by

tender via the Antwerp-based subsidiary Grib Diamonds, which won't be

affected by the acquisition, sources said.

|

| |

Rio Tinto U-Turns to Prioritize Diamonds Again

Rio

Tinto plans to expand its diamond mining operations, new CEO Jean-Sebastien

Jacques (pictured) told Bloomberg. The miner mulled

divesting from diamonds in 2013 but held on to the business unit because of

growing luxury demand in Asia and continued strength of the North American market.

Rio Tinto intends to increase diamond production to a range of 19 million to 24

million carats in 2017, from 18 million to 21 million carats planned

for this year.

Rio

Tinto plans to expand its diamond mining operations, new CEO Jean-Sebastien

Jacques (pictured) told Bloomberg. The miner mulled

divesting from diamonds in 2013 but held on to the business unit because of

growing luxury demand in Asia and continued strength of the North American market.

Rio Tinto intends to increase diamond production to a range of 19 million to 24

million carats in 2017, from 18 million to 21 million carats planned

for this year.

|

| |

De Beers to Add 25 Years to Botswana Mine

Debswana,

De Beers mining joint venture in Botswana, is close to completing a tailings

project that will extend the Letlhakane mine’s lifespan by 25 years. The

Letlhakane Mine Tailings Resource Treatment Project will enable Debswana to

continue producing rough diamonds at the site even when mining at the main

deposit comes to an end next year. The project is 80% complete, and Debswana

expects it will be officially launched in the third quarter of 2017.

Debswana,

De Beers mining joint venture in Botswana, is close to completing a tailings

project that will extend the Letlhakane mine’s lifespan by 25 years. The

Letlhakane Mine Tailings Resource Treatment Project will enable Debswana to

continue producing rough diamonds at the site even when mining at the main

deposit comes to an end next year. The project is 80% complete, and Debswana

expects it will be officially launched in the third quarter of 2017.

|

| |

ALROSA Sales Weather Indian Liquidity Storm

ALROSA

reported diamond sales jumped 63% year on year to $255.2 million in November

with rough sales of $245.6 million and revenue from polished coming in at $9.6

million. The figures represented continued strength in the rough market even as

India's liquidity crisis damaged demand for smaller and lower-quality diamonds,

ALROSA’s vice president Yury Okoemov said.

ALROSA

reported diamond sales jumped 63% year on year to $255.2 million in November

with rough sales of $245.6 million and revenue from polished coming in at $9.6

million. The figures represented continued strength in the rough market even as

India's liquidity crisis damaged demand for smaller and lower-quality diamonds,

ALROSA’s vice president Yury Okoemov said.

|

| |

India Cash Crunch Stalls Gemfields Auction

Gemfields

pushed back a sale of higher-quality emeralds by two months to enable Indian

buyers to adapt to the government’s decision to invalidate higher-value currency

notes. The auction of stones from the Kagem mine in Zambia will now take

place in February instead of this month. India abolished its INR 500 and

INR 1,000 rupee notes in November to curb black-market transactions, resulting

in lower liquidity which hit the cash-focused jewelry and gem trade.

Gemfields

pushed back a sale of higher-quality emeralds by two months to enable Indian

buyers to adapt to the government’s decision to invalidate higher-value currency

notes. The auction of stones from the Kagem mine in Zambia will now take

place in February instead of this month. India abolished its INR 500 and

INR 1,000 rupee notes in November to curb black-market transactions, resulting

in lower liquidity which hit the cash-focused jewelry and gem trade.

|

|

|

|

GENERAL

|

|

|

|

| |

GIA Rolls Out Synthetic Melee Testing Service

The

Gemological Institute of America (GIA) has started accepting stones for its

automated melee testing service, which identifies potential synthetics in

batches of small melee diamonds. Following a five-month pilot, the service

is now open at most GIA laboratories for customers to submit round, 0.005 to

0.25-carat, D-Z color diamonds. GIA will charge $0.08 per stone for

smaller diamonds, starting at the 0.90-1.49 millimeter range, and increase its

prices gradually up to $0.40 per stone for the 3.50-4.00 millimeter highest

tier.

The

Gemological Institute of America (GIA) has started accepting stones for its

automated melee testing service, which identifies potential synthetics in

batches of small melee diamonds. Following a five-month pilot, the service

is now open at most GIA laboratories for customers to submit round, 0.005 to

0.25-carat, D-Z color diamonds. GIA will charge $0.08 per stone for

smaller diamonds, starting at the 0.90-1.49 millimeter range, and increase its

prices gradually up to $0.40 per stone for the 3.50-4.00 millimeter highest

tier.

|

| |

De Beers Expands Surat Grading Center

De

Beers plans to expand its diamond grading facility in Surat, India, increasing

the services it offers there. The International Institute of

Diamond Grading & Research (IIDGR), a subsidiary of De Beers, will invest

$5 million to enhance the center, adding 10,000 square feet to its existing

15,000 square feet of floor space. The expansion includes enlarging its

melee testing service, launching a new melee grading service next year, and a

new educational service.

De

Beers plans to expand its diamond grading facility in Surat, India, increasing

the services it offers there. The International Institute of

Diamond Grading & Research (IIDGR), a subsidiary of De Beers, will invest

$5 million to enhance the center, adding 10,000 square feet to its existing

15,000 square feet of floor space. The expansion includes enlarging its

melee testing service, launching a new melee grading service next year, and a

new educational service.

|

| |

Cameroon Enabling CAR Conflict Diamonds: NGO

Conflict

diamonds from the Central African Republic (CAR) are entering the supply chain

because of poor prevention controls, non-governmental group Partnership Africa

Canada (PAC) alleged. Rough stones are being smuggled across the border into

Cameroon and adjudged conflict-free after they receive Kimberley Process

certificates, PAC claimed. Ahmed Bin Sulayem, the United Arab Emirates-based

chair of the KP for 2016, said its monitoring team has been probing the issue

for several months.

Conflict

diamonds from the Central African Republic (CAR) are entering the supply chain

because of poor prevention controls, non-governmental group Partnership Africa

Canada (PAC) alleged. Rough stones are being smuggled across the border into

Cameroon and adjudged conflict-free after they receive Kimberley Process

certificates, PAC claimed. Ahmed Bin Sulayem, the United Arab Emirates-based

chair of the KP for 2016, said its monitoring team has been probing the issue

for several months.

|

| |

GIA, MJSA Unveil New Board Chiefs

The

Gemological Institute of America (GIA) elected industry veteran Dione Kenyon as

chair of its board of governors. Kenyon (pictured), who

recently retired as president and chief executive officer of the Jewelers Board

of Trade, will take over the role from John Green, president and CEO of jewelry

chain Lux Bond & Green, who remains on the board. Separately, Manufacturing

Jewelers & Suppliers of America (MJSA) elected Steven Cipolla as chair,

succeeding Ann Arnold, who has been appointed chair of the MJSA Education

Foundation.

The

Gemological Institute of America (GIA) elected industry veteran Dione Kenyon as

chair of its board of governors. Kenyon (pictured), who

recently retired as president and chief executive officer of the Jewelers Board

of Trade, will take over the role from John Green, president and CEO of jewelry

chain Lux Bond & Green, who remains on the board. Separately, Manufacturing

Jewelers & Suppliers of America (MJSA) elected Steven Cipolla as chair,

succeeding Ann Arnold, who has been appointed chair of the MJSA Education

Foundation.

|

|

|

|

ECONWATCH

|

|

|

|

| |

Diamond Industry Stock Report

Global markets continued to strengthen this week, with the Dow Jones Industrial Average up 2.2% and the FTSE gaining 3 percent. Rio Tinto (+11%) led mining stocks, with Anglo American (+7.2%) and Firestone Diamonds (+6.7%) also performing well. U.S. retail was headed by JCPenney (+10%), while resurgent European stocks were led by Swatch Group (+8.1%). Indian jewelry companies appear to be have recovered from the effects of the government's new cash policy for the time being, with Goenka Diamond (+6.5) growing in value the fastest.

View the detailed industry stock report

| |

Dec 8 (13:10 GMT) |

Dec 1 (13:54 GMT) |

Chng. |

|

| $1 = Euro |

0.93 |

0.94 |

-0.01 |

|

| $1 = Rupee |

67.37 |

68.37 |

-1.00 |

|

| $1 = Israel Shekel |

3.79 |

3.83 |

-0.04 |

|

| $1 = Rand |

13.67 |

14.10 |

-0.43 |

|

| $1 = Canadian Dollar |

1.32 |

1.34 |

-0.02 |

|

| |

|

|

|

|

| Precious Metals |

|

|

|

Chng. |

| Gold |

$1,174.97 |

$1,168.52 |

$6.45 |

0.6% |

| Platinum |

$947.75 |

$904.75 |

$43.00 |

4.8% |

| Silver |

$17.12 |

$16.38 |

$0.74 |

4.5% |

| |

|

|

|

|

| Stock Indexes |

|

|

|

Chng. |

| BSE |

26,694.28 |

26,559.92 |

134.36 |

0.5% |

| Dow Jones |

19,549.62 |

19,123.58 |

426.04 |

2.2% |

| FTSE |

6,911.92 |

6,708.46 |

203.46 |

3.0% |

| Hang Seng |

22,861.84 |

22,878.23 |

-16.39 |

-0.1% |

| S&P 500 |

2,241.35 |

2,198.81 |

42.54 |

1.9% |

|

|

|

|

|

|

INDIA MARKET REPORT

|

|

|

|

| |

Polished Trading Activity

Dealers

trying to normalize operations after Nov. government demonetization liquidity

crisis. Larger exporters resuming regular activity with full manufacturing

capacity after Diwali break. Smaller dealers and manufacturers adjusting to new

currency laws and lower demand from local jewelers. Steady foreign demand with

U.S. and Israeli dealers looking to fill U.S. orders. Rough trading stable during

De Beers and ALROSA Dec. sales.

Read the Polished Diamond Trading Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|