|

|

Diamond Prices Soften During Summer Quiet

Aug 2, 2017 5:00 AM

By Rapaport

|

|

|

RAPAPORT PRESS RELEASE, August 2, 2017, New York… Polished diamond trading was seasonally slow in July as the US wholesale market closed for summer vacation. Polished prices softened as midstream inventory levels increased due to the slowdown in demand and increased supply.

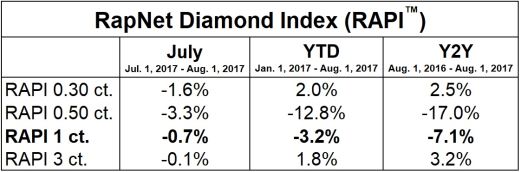

The RapNet Diamond Index (RAPI™) for 1-carat, GIA-graded, RapSpec A3+ diamonds fell 0.7% during July, and was down 3.2% since the beginning of the year.

© Copyright 2017, Rapaport USA Inc.

The Rapaport Monthly Report – August 2017 notes that manufacturing profit margins have come under pressure since rough prices increased an estimated 3% on average in the first half of the year, while polished prices softened.

Excess rough inventory has shifted from the mining companies to the manufacturing sector. Rough sales at De Beers and Alrosa exceeded their production by a combined 7.9 million carats in the first half. Manufacturers have absorbed that rough, and their polished inventory levels have grown significantly as a result. The number of diamonds listed on RapNet increased 23% since January to 1.47 million unique stones on August 1.

While rough demand slowed slightly in July, manufacturing levels are expected to remain high until factories in India break for the Diwali festival on October 19.

Polished diamond buyers are selective, as demand has slimmed to narrower ranges. Jewelry retailers are careful not to buy stock they cannot move. US jewelry sales growth is being driven by smaller chains and independents, while the major retailers are struggling to adjust to changing consumer trends. Sales in China and Hong Kong have begun rising again after prolonged declines, providing some optimism ahead of the fourth-quarter holiday season.

Polished trading is expected to remain slow in August as dealers in Belgium and Israel take their summer vacations. Demand, meanwhile, is expected to improve and support polished prices from the September Hong Kong show onward, as retailers prepare for the holiday season.

The Rapaport Monthly Report is available at store.rapaport.com/monthly-report.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Gabriella Laster +1-718-521-4976

Mumbai: Priyanka Vaidya +91-97699-38102

About the Rapaport RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet – Rapaport Diamond Trading Network. www.RapNet.com has daily listings of over 1.4 million diamonds valued at approximately $7.8 billion. Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the Group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet – the world’s largest diamond trading network, with over 15,000 members in 95 countries and daily listings of over 1.4 million carats valued at over $8.3 billion; Rapaport Laboratory Services, providing GIA and Rapaport gemological services in India, Israel and Belgium; and Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 500,000 carats of diamonds a year. Additional information is available at www.diamonds.net. |

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, Jewelry, Rapaport, RapNet

|

|

|

|

|

|

|

|

|

|

|

|

|