|

|

Certified Polished Diamond Prices -1.7% in October

Polished Markets Selective Toward 0.30-0.50ct Diamonds

Nov 5, 2013 9:30 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, November 5, 2013, New York: Certified polished diamond prices fell in October as trading volume did not meet expectations for this time of the year. The U.S. continues to be the dominant market for polished ahead of the Christmas season. India’s pre-Diwali demand was weak and Chinese demand soft after the National Day Golden Week (October 1). Trading is selective with steady demand for 0.30-carat to 0.50-carat goods in commercial qualities (H-K, SI-I1).

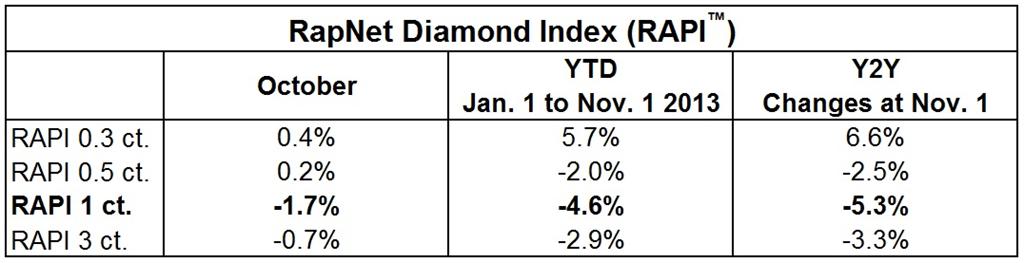

The RapNet Diamond Index (RAPI™) for 1-carat certified diamonds fell 1.7 percent in October. RAPI for 0.30-carat diamonds rose 0.4 percent during the month, while RAPI for 0.50-carat diamonds increased 0.2 percent. RAPI for 3-carat diamonds declined 0.7 percent.

Copyright © by Martin Rapaport

The Rapaport Monthly Report – October 2013, “Price Uncertainties,” noted that polished prices softened in October due to weak global demand and tight market liquidity. U.S. retail buyers are delaying inventory purchases for the holiday season amid persistent price uncertainty and diminished consumer confidence. The political stalemate in October over the debt ceiling weakened retailers’ Christmas expectations.

Indian diamond traders faced uncertainty prior to the Diwali festival that began on November 1 amid unconfirmed reports that the government may raise the import duty on polished diamonds from 2 percent to 5 percent. Initial reports about Diwali signal a slump in gold and diamond jewelry demand. Liquidity in India’s manufacturing sector is tight due to low profit margins and high rough prices with weaker domestic demand throughout 2013.

Rough diamond trading on the secondary market remains quiet with most De Beers boxes selling for discounts or with long-term credit. Small-to-medium size factories in Surat are taking extended Diwali vacations (November 1 – 25) due to liquidity difficulties. Many have reduced their manufacturing levels and shifted to polished trading in search of better margins.

Polished diamond trading is expected to improve before the end of the year influenced by a late surge in U.S. holiday demand and strong, selective competition to source the right “in-demand” goods. Forecasts for the season remain below that of previous years.

Read the attached Rapaport Research Report, “Price Uncertainties,” at www.diamonds.net/report or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

U.S.: Sherri Hendricks +1-702-893-9400; International: Lisa Miller +1-702-425-9088; Mumbai: Manisha Mehta +91-97699-30065

About the Rapaport: RapNet Diamond Index (RAPI™):The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 1 million diamonds valued over US$6.9 billion and 12,400 members in over 82 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of fair, transparent, efficient, and competitive diamond and jewelry markets. Established in 1978, the Rapaport Diamond Report is the primary source of diamond price and market information. Group activities include Rapaport Information Services providing research, analysis and news; RapNet – the world's largest diamond trading network; Rapaport Laboratory Services provides GIA and gemological services in India, Belgium and Israel; and Rapaport Trading and Auction Services with monthly sales of over 50,000 carats. The Group employs 180 people with offices in New York, Las Vegas, Antwerp, Ramat Gan, Mumbai, Surat, Dubai, Hong Kong and Shanghai. Additional information is available at www.Rapaport.com.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|