|

|

Is Diamond Demand Determined in Beijing and Washington?

Editorial

Aug 20, 2015 10:12 AM

By Avi Krawitz

|

|

|

RAPAPORT... Don’t be surprised if diamantaires are suddenly talking about Zhou Xiaochuan and Janet Yellen. The actions of the two – who respectively lead the People’s Bank of China and the U.S. Federal Reserve – may put additional pressure on diamond demand and ultimately polished prices.

Simply put, the sudden depreciation of China’s yuan and a looming U.S. interest rate hike couldn’t come at a worse time for the diamond market.

Last week, Zhou’s People’s Bank of China allowed the yuan to depreciate by about 3.5 percent so that the currency is now trading at around CNY 6.4 against the U.S. dollar. At a glance, Beijing sought to give the country’s economy a much-needed boost since a devalued yuan should encourage exports as Chinese products became cheaper in overseas markets – particularly in the U.S.

For the diamond industry, a cheaper yuan has a different effect since, unlike other products, China is a major consumer of diamonds.

A devalued yuan makes China’s diamond imports more expensive for buyers who are converting their currency to buy goods in U.S. dollars – or trading diamonds in the local market in yuan from a dollar base. Michael Huang, managing director of Diamond Index Group, a supplier of high-end diamonds and diamond jewelry in China, told Rapaport News that dealers and wholesalers already raised prices by about 5 percent to compensate for their currency losses. Retailers haven’t yet adjusted their prices but are likely to do so in the coming weeks, he said.

As a result, Chinese diamond buyers, who have been cautious throughout 2015, could push for deeper discounts to offset the effect of the weaker currency, Huang noted. Buyer sentiment at the upcoming September Hong Kong Jewellery and Gem Fair will be a good barometer of Chinese demand.

Contrarian View

Efraim Zion, managing director of Hong Kong-based Dehres Limited, which specializes in large stones and in fancy shapes and color, already has low expectations for the show. However, he dismissed that the yuan at current levels would have a major impact on consumption.

“It may weigh on the market but if the yuan devalues further to CNY 6.70 or 6.90, then it will have a real impact,” he said. Instead, he sees deeper market challenges as the general slowdown in China’s economic growth and the government’s clampdown on corruption and extravagance.

To be sure, the weaker yuan is expected to influence greater consumer restraint. In particular, the scores of Chinese tourists traveling overseas on luxury shopping excursions, will now have fewer dollars to spend at the likes of Tiffany, LVMH and Cartier.

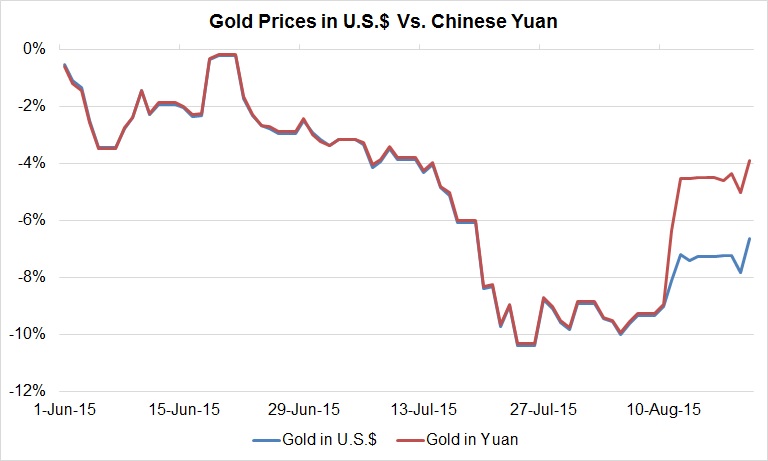

Within China, the yuan’s new level will probably also inhibit gold jewelry demand, countering the effect of lower dollar-based gold prices (see graph). Chinese consumers historically rush into gold when prices decline. That occurred in April 2013 when the sharp drop in gold prices boosted jewelry sales in China and Hong Kong. While a more subdued gold rush was reported this past July when gold prices slid 6 percent during the month, consumers will likely view the market with greater caution after the yuan’s subsequent slide.

The price of gold in China's local currency has followed the U.S. dollar gold price until last week's yuan depreciation, making gold more expensive for local Chinese buyers.

Seeking Safer Haven

It’s not all gloom for the industry by any means. China’s currency and stock market volatility – along with the deflation of its real estate bubble - should increase investment demand for gold and diamonds as people shift their wealth to hard safe-haven assets. That may become more relevant as China’s economy experiences prolonged growing pains as it transitions from an infrastructure-and-export centric model to a consumption-driven economy.

For now, though, people are counting their losses. A lot of money was channeled into the stock markets during the boom of the past few years. A lot of that money has been lost in the past two months.

Huang sees something of a silver lining in the clouds hanging over the diamond industry. “People will be discouraged in the short term because they don’t have money to spend,” he explained. “But in the long term, the recent declines have shown that stock markets and other investments are volatile. They want assets that show their true value and are stable, which diamonds provide. So I believe they will turn to diamonds in the long run.”

Zion agrees that consumers are not thinking about diamonds at this point. Rather, he’d like to see the government take measures to restore confidence, such as lowering interest rates further – well below its current record low level of 4.85 percent.

Observers reason that the latest currency depreciation was an effort by the authorities to loosen its money supply as it navigates its economic transition along with changing global dynamics. Analysts at VTB Capital explained that Chinese monetary policy implicitly follows U.S. policy since it has a “crawling peg” system against the dollar.

Which brings us back to why diamantaires should pay attention to the Fed’s Janet Yellen.

“When the U.S. dollar was weak, Chinese authorities had to intervene to buy U.S. dollars which increases their foreign exchange reserves and increases their money supply (the end result being an increase in inflation),” the analysts wrote. “Now it is all going into reverse. As the Federal Reserve gets ready to tighten U.S. monetary conditions, China will want to avoid indirect upward pressure on domestic interest rates. China offsets this by depreciating the currency which in practical terms means widening the trading band.”

End of Cheap Money

Expanding the money supply should influence China’s growing wealthy class to look for places to put their money beyond the banks. It should encourage buying of investment quality products such as diamonds and diamond jewelry. Arguably, the diamond market was sustained in the U.S. in the past few years for the same reason. Because money was cheap, the stock markets offered better returns than the banks or government bonds. As stock markets soared, wealth increased and so did diamond demand.

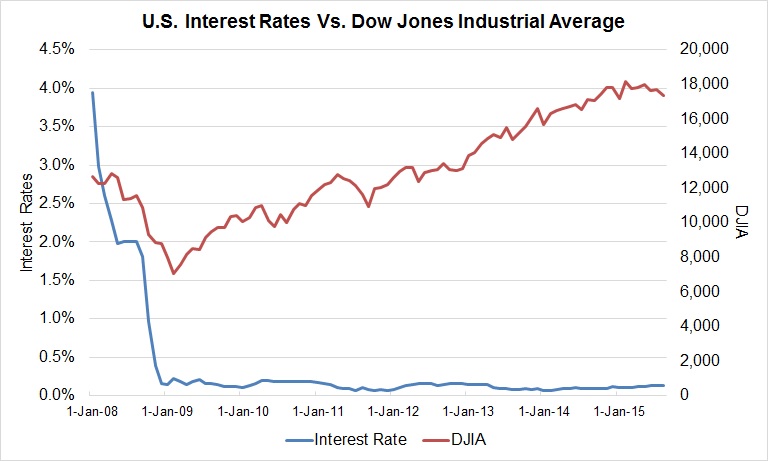

Rising stock markets have increased wealth as US interest rates were at record lows.

Adding to industry woes, that wealth effect might taper off as the Fed is expected to raise interest rates before the end of the year. Already, U.S. stock markets have turned bearish in anticipation of a rate rise, with the Dow Jones Industrial Average down 3 percent in the past month. As the perception of wealth falls, so does consumer discretionary spending.

The diamond trade, meanwhile, should be careful not to be overleveraged at this time as the cost of borrowing is expected to rise. To that end, the recent pull back in the banks’ exposure to the diamond industry is somewhat of a blessing.

It’s also worth noting that when shortages become more apparent, the strong dollar should favor the U.S. diamond market, likely after the fourth quarter holiday season. If there is going to be a competition for goods, U.S. dealers will be sourcing from a stronger position than their counterparts in China and India given the strength of the dollar.

Still, from a demand perspective, the latest developments in China and the U.S. will not encourage diamond industry growth as neither market can be viewed in isolation. Consequently, the yuan’s depreciation and the Fed’s pending interest rate decision brings additional uncertainty to the industry. Indeed, the current crisis -- and flat outlook for the rest of the year -- was largely brought about by imbalances within the trade: inflated rough prices, less manufacturing, high inventory levels and, most importantly, stagnant consumer demand for diamonds. Adding negative external economic influences to the mix was the last thing the trade needed at this time.

The writer can be contacted at avi@diamonds.net. Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, diamonds, Dow Jones, Fed, Interest Rates, Janet Yellen, Jewelry, Rapaport, Yuan, Zhou Xiaochuan

|

|

|

|

|

|

|

|

|

|

|

|

|