|

|

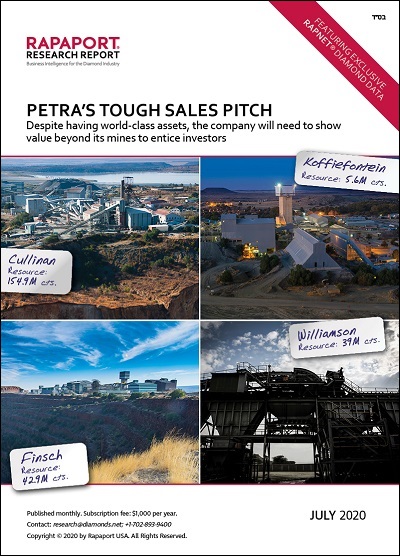

Petra’s Tough Sales Pitch

Insights

Jul 16, 2020 8:35 AM

By Avi Krawitz

|

|

|

RAPAPORT... The current plight of Petra Diamonds is a frustrating example of the impact Covid-19 has had on the diamond industry, highlighting the lack of readiness for such a downturn.

As an important mid-tier diamond miner, the company has annual production of around 3.5 million to 3.8 million carats, but is burdened by high debt from its efforts to extend the life of its operations and maintain a promise of long-term growth.

The pandemic has caused rough sales to plummet and some mining operations to shut down temporarily. With zero revenue coming in, Petra’s $650 million bond has left it vulnerable. It missed an interest payment that was due in May, but managed to negotiate an extension to that payment and is now deliberating its strategy moving forward.

Restructuring its debt would give the company leeway to continue as previously planned, and should lenders back the move, it would probably be with more stringent credit terms in place. But the miner is also exploring the possibility of a buyout, considering offers for parts or the whole of its business.

Petra’s portfolio consists of the Cullinan, Finsch and Koffiefontein mines in South Africa, and Williamson in Tanzania. It built the portfolio on the back of De Beers’ decision around 2007 to streamline its operations and divest from less profitable assets. De Beers’ sale of Cullinan and Finsch

were head-scratchers for many, as they have proven to be cash cows for Petra. They continue to be the jewels in the company’s crown and its strongest selling point.

The ideal outcome for Petra would be to sell Koffiefontein and Williamson and carry out the aforementioned debt restructuring — possibly through a debt-equity swap, as some analysts expect. But selling a mine in today’s market environment — even good ones like Cullinan and Finsch — is going to be a challenge.

The pitch that mining companies maintain is a linear one. They tend to play up the promise of a long-term supply shortage, coupled with an exponential rise in demand due to growth in China and India, and argue that this will support prices and prospective profits. However, miners have under-delivered on that promise, largely because the diamond industry’s economic models are more complicated than that. Simply put, the market is not efficient.

Diamond mining companies such as Petra need to innovate to raise the investment profile of their operations. That extends beyond innovations in actual mining; it includes sales and marketing as well. They need to bring about more efficient processes further along the pipeline — such as digital sales and bespoke rough supply — that will ultimately raise demand for their product.

The pandemic has left a gaping hole in the investment model the mining industry has used for decades, but diamond producers have an opportunity to fill it. That will require companies like Petra to change the way they do business, rather than just focus on how they can recover diamonds.

This article is an excerpt from the July Rapaport Research Report, depicted in the image above. The report also presents in-depth market analysis and exclusive RapNet data for 0.30-carat, 0.50-carat, 1-carat and 3-carat stones, including average prices, discounts, inventory by country, and search volume. Subscribe here.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, Cullinan, diamonds, Finsch, Jewelry, Petra Diamonds, Rapaport, Rapaport Research Report

|

|

|

|

|

|

|

|

|

|

|

|

|