|

|

Diamond Trading Reflects Market Split

1ct. RAPI -3.2% in April

May 3, 2022 5:00 AM

By Rapaport

|

|

|

RAPAPORT PRESS RELEASE, May 3, 2022, Las Vegas… The diamond market slowed in April due to geopolitical tensions and the seasonal effects of the Passover and Easter holidays. Steady US retail demand supported the trade, but dealer activity was sluggish amid price uncertainty, Chinese lockdowns and Russian sanctions.

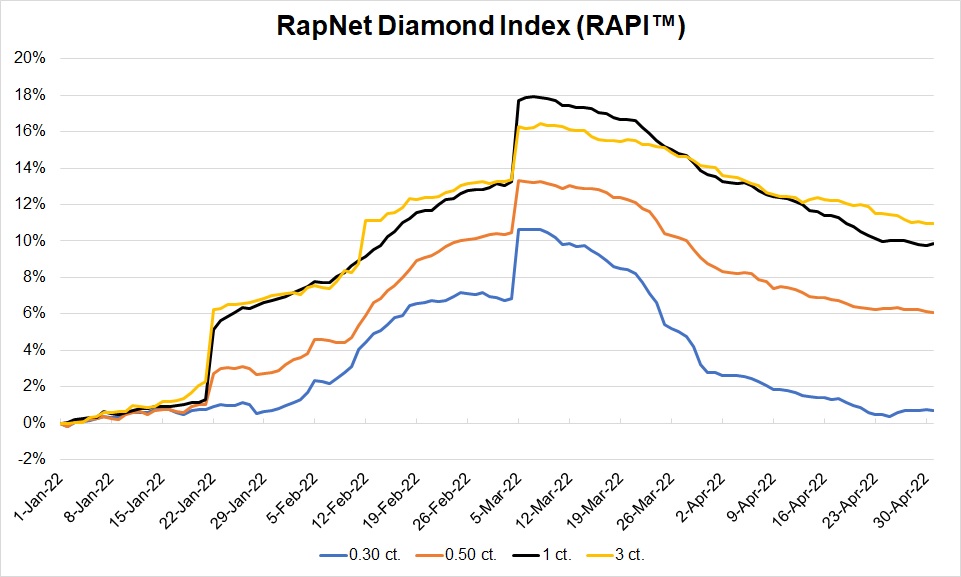

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 3.2% during the month, reversing the uptrend of the first quarter. The 1-carat index has increased 9.8% since the beginning of the year.

| RapNet Diamond Index (RAPI™) |

|

April |

Year to date

Jan. 1 to May. 1 |

Year on year

May 1, 2020, to May 1 2021 |

| RAPI 0.30 ct. |

-2.1% |

0.7% |

0.2% |

| RAPI 0.50 ct. |

-2.3% |

6.1% |

9.8% |

| RAPI 1 ct. |

-3.2% |

9.8% |

23.7% |

| RAPI 3 ct. |

-2.7% |

11.0% |

28.0% |

© Copyright 2022 by Rapaport USA Inc.

US retailers continue to see solid jewelry sales but are carefully managing their inventory and avoiding bulk orders. They expect a strong summer wedding season now that couples who delayed their nuptials due to Covid-19 are resuming their plans.

Jewelers are becoming more careful about source disclosure as the sanctions on Russian diamonds intensify. The US government has placed Alrosa on the Office of Foreign Assets Control (OFAC) list of banned entities.

The measures have led the industry to bifurcate its diamond supply. Manufacturers are preparing to separate Alrosa goods from others to serve different markets. Russian supply is expected to shift toward China, though demand there has declined due to the recent wave of Covid-19 infections and lockdowns.

There are also rising expectations that Russian sanctions will lead to shortages, especially in smaller goods. Suppliers are struggling to fill orders for large retailers that seek top-quality diamonds.

Rough trading was stable ahead of the De Beers sight beginning May 3. Premiums have declined on the secondary market after surging in January and February. De Beers and other non-Russian producers are set to gain from the separation of Russian supply.

The Russia-Ukraine war is pushing the industry to adopt more robust source verification programs. In addition to the legal considerations, more retailers are taking a stand on diamonds involved in human rights abuses, torture, environmental harm, or other social and ecological concerns. Creating an ethical supply chain will depend on buyers’ choices. Only by buying responsibly can the trade sell ethically.

Rapaport Media Contacts: media@diamonds.net

Sherri Hendricks +1-702-893-9400

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.rapaport.com.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, jewellery, Jewelry, Rapaport, RAPI, RapNet

|

|

|

|

|

|

|

|

|

|

|

|

|