|

|

India’s Wealthy Consumers Continue to Spend Despite Weak Economy

Jul 3, 2012 6:40 AM

By Dilipp S Nag

|

|

|

RAPAPORT... India’s ultra-high-net-worth individuals (HNIs) have not curtailed their spending on luxury items due to the current economic slowdown, but they have turned cautious regarding their investments, according to a study conducted by Kotak Wealth Management and CRISIL Research.

“The second edition of the 'Top of the Pyramid' report has thrown up some interesting trends in various behavioral aspects of the ultra HNIs,” said C. Jayaram, the joint managing director of Kotak Mahindra Bank Ltd. “While, overall, this segment seems to be relatively unaffected by the slowdown in Indian economy, their patterns in spending, investing and savings present huge opportunities…”

The number of Indian ultra-high-net-worth households (HNHs) is estimated to have grown by 30 percent year on year to around 81,000 in 2011 and is expected to triple to around 286,000 over the next five years, the report stated.

CRISIL defined HNH as having a minimum average net worth of $4.5 million (INR 250 million) accumulated over the past 10 years and, based upon its analysis, a minimum income of $630,517 to $720, 590 (INR 35 million to INR 40 million).

The net worth of HNHs is projected to surge five-fold from an estimated $1.17 trillion (INR 65 trillion) in 2011 to $5.73 trillion (INR 318 trillion) by 2016, the report said. More than 50 percent of HNHs reside in the four main metro cities, while the next top six cities account for around 12 percent.

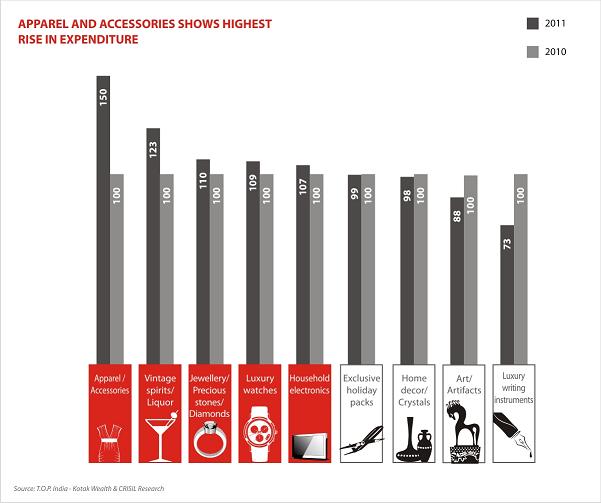

The study noted that apparel and accessories showed the highest increase in purchases followed by vintage spirits/liquor, jewelry and diamonds, luxury watches and household electronics.

It also revealed that the destination weddings were popular in 2011, but these appear to have lost their appeal this year. Instead, throwing lavish parties for ad hoc events such as business success or launch parties, has constituted a new area of spending. Some HNIs also cut down their spending on charity in order to maintain their lifestyles.

The report further highlighted that exclusivity is a major driving force behind luxury car purchases and even established brands are not considered by these shoppers because they lack exclusivity or are seen as mass-market luxury cars. With an increase in the number of youth among the HNIs, the preference for cars that project a youthful image and models that are seen as exclusive is growing steadily. High-end luxury cars from Japan are still preferred for regular use as they are seen as most suited for India's roadways. SUVs/crossovers continue to be the most preferred car among HNIs.

“The fact that so many HNIs said that their spending habits have not changed due to the slowdown is an indication that they do not expect the slowdown to continue for long,” said Mukesh Agarwal, the president of CRISIL Research. “However, it would be interesting to see whether the caution that has crept into their investments will spill over into their spending if the economic crisis persists longer than expected.”

The reported noted that HNIs have turned very cautious on investments as their focus moves to protect capital and low-risk financial instruments. Real estate investments have declined compared with 2011, although their share among the asset classes remains relatively high since HNIs expect healthy returns over the long-term. But, generally, the appetite to take risks was subdued, with a greater preference shown for a disciplined approach than an opportunistic one, particularly in high-risk instruments.

The survey, which took place between December 2011 and April 2012, was given to about 150 HNIs. The respondents were spread across Mumbai, Delhi, Bengaluru Hyderabad, Chandigarh, Ahmedabad, Vadodara, Chennai, Pune, and Kolkata.

*Note: All data was published in rupee. Any references to U.S. dollar amounts were made according to exchange-rate conversions by Rapaport News.

|

|

|

|

|

|

|

|

|

|

Tags:

Crisil, diamonds, Dilipp S Nag, Economy, HNIs, India, Jewelry, Kotak Mahindra Bank, luxury, Rapaport, watches

|

|

|

|

|

|

|

|

|

|

|

|

|