Advances in producing synthetic diamonds are pushing the natural diamond trade to improve its detection capabilities.

It’s not often a 10.02-carat, emerald-cut diamond captures global attention. But when New Diamond Technologies (NDT) unveiled the type II, E-color, VS1-clarity diamond in May 2015, people took note. As the largest, colorless synthetic diamond produced on record, the stone represented a milestone for the industry.

“The science and technology behind the processes synthesizing this stone are significantly more advanced than other man-made diamonds currently on the market,” said Marc Brauner, co-CEO of IGI Worldwide, after grading the diamond. “The stone’s large size, in combination with the very high color and breathtaking brilliance, will ensure it a prominent place among the pioneers in the diamond industry.”

While some hail the technological advancements that have enabled such stones, others see it as yet another challenge synthetics pose for the natural diamond market. As the quality of synthetics improves and the volume of production grows, the natural diamond trade becomes more vulnerable to unscrupulous traders trying to pass off synthetics as natural.

For now, production is relatively small as synthetic diamonds only accounted for about 4.5% of global diamond production in 2015, according to Neelesh Hundekari, a partner at A.T. Kearney. But they are expected to take a 15% share of the melee market and a 7.5% share of the larger-gems space, according to analysts at Morgan Stanley project.

4.5%

Estimated percentage of total diamond production in 2015

15%

Forecast share of melee market

7.5%

Forecast share of the larger gems market

Both chemical vapor deposition (CVD) and high pressure – high temperature (HPHT) synthetic technologies have significantly improved and more synthetics are expected to be produced in the future, explains Matthew Hall, director of lab operations at GIA India, in a recent panel discussion at the India

International Jewellery Show (IIJS).

RISING QUANTITY

Already, there has been an upsurge in HPHT production with an estimated 10,000 presses in China alone, whereby one press can produce up to 50 carats of 2 mm size diamonds in about 24 hours, Hall notes.

While the equipment can produce colorless and fancy color diamonds, from melee to large sizes “of several carats,” colorless melee is expected to have the biggest impact on the natural diamond trade.

There has been an upsurge in HPHT production with an estimated 10,000 presses in China alone.

Tens of millions of natural white melee could be manufactured annually making screening technology to separate natural from synthetic or treated diamonds essential, he stresses.

Detection equipment is checking for combinations of non-diamonds, CVD synthetics, HPHT synthetics and HPHT treated diamonds that might be mixed in parcels of natural melee diamonds.

A number of new detection machines have come to market in the past two years, demonstrating the ability to check for synthetics in loose stones and, more recently, set jewelry. Machines such as D-Secure and J-Secure by DRC Techno and Quick Check by the Gemological Institute of India (GII) use imaging to demonstrate the fluorescence and phosphorescence of the stone.

De Beers DiamondSure and Automatic Melee Screening machines use UV absorption in their screening. The GIA’s DiamondCheck machine uses IR spectroscopy for screening loose stones, while its DiamondView is a fluorescence imaging tool.

The GIA’s Melee Testing Service claims to increase the speed of screening while maintaining its accuracy, whereas achieving both has been a challenge for existing machines. Other screening service centers exist at bourses around the world.

What’s Your Diamond Type?

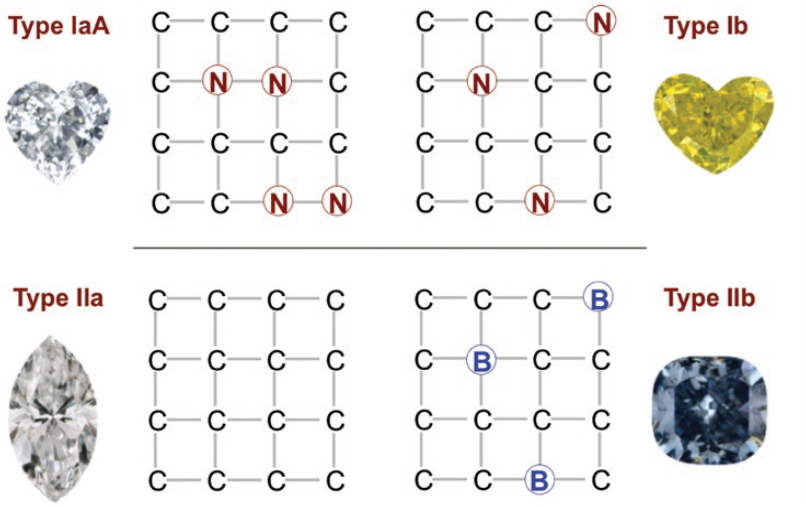

The most direct and accurate way to screen for synthetics is to determine diamond type. Diamonds are broadly divided into two types (I and II) based on the presence or absence of nitrogen impurities, and are further subdivided according to the arrangement of nitrogen atoms and the occurrence of boron impurities.

Natural diamonds exist in all types — Ia and Ib, IIa and IIb — but CVD synthetic diamonds can only be type IIa and IIb which means there is no detectable nitrogen impurity. HPHT synthetic diamonds can only be type IIa and IIb, or type 1b – which has isolated nitrogen and is rare in natural diamonds.

All colorless diamonds first undergo screening to test if they are type 1a, which comprises an estimated 98% of natural diamonds and excludes all synthetics. Any diamond that is determined to be type II will require further testing. Different methods of screening include infrared (IR) spectroscopy, ultraviolet (UV) absorption, UV transparency and photoluminescence (PL) imaging.

More people are using such facilities as awareness about synthetics has grown, assures Sanjay Kothari, spokesperson for India’s Natural Diamond Monitoring Committee. However, he foresees a time when each diamond company will have a detection machine in its own office. “It’s just a matter of bringing the cost down,” he says.

Equipment providers are all selling their machines and note growing interest from the trade and retailers alike. It’s crucial these solutions are technically robust and meet the requirements of the supply chain, stresses Jean-Marc Lieberherr, CEO of the Diamond Producers Association. “It is essential for retailers and jewelry manufacturers to ensure they implement solid sourcing and detection protocols that gives them and their customers the reassurance that they are dealing with natural diamonds.”