|

|

Demand for Diamond Traceability Spikes

Interview with Sarine Technologies’ CEO David Block

May 16, 2022 11:16 AM

By Avi Krawitz

|

|

|

RAPAPORT... The diamond and jewelry industry is seeing a surge of interest in traceability programs as companies throughout the pipeline seek to avoid Russian supply. So says Sarine Technologies CEO David Block.

“There has been huge interest from all the different players in the industry over the last month or two since the conflict broke out with regards to traceability,” Block said in an interview with Rapaport News. “What used to be regarded as something that’s nice to have and maybe will happen in the future, people now understand this is something that is needed, and they must start taking action in order to adapt their processes and the supply chain to enable traceability.”

Several companies have announced new traceability initiatives or fast-tracked existing programs since the Russia-Ukraine war began and the US government imposed sanctions on miner Alrosa.

De Beers scaled up its Tracr platform at a faster pace than initially intended, while the Gemological Institute of America (GIA) said it was planning to launch a consumer-facing service called GIA Source Verify that would validate the country of origin for diamonds. Last week, iTraceiT, an Antwerp-based technology provider, launched its traceability solution for the diamond and jewelry industry based on QR-code and blockchain technology. Sarine has had its Diamond Journey program in development for some time.

Retail driven

While there has been a notable rise in interest from miners and the midstream to tap into such programs, Block stressed it is the retail sector that is driving demand: Major US jewelers such as Signet Jewelers and Tiffany & Co., along with most of the high-end luxury jewelers, disclosed they’d stopped buying diamonds sourced in Russia.

Sarine announced at the end of April its Diamond Journey solution was chosen to drive diamond traceability for the Aura Blockchain Consortium. The group is an initiative of luxury companies LVMH, Prada, Cartier and OTB Group addressing responsible sourcing and sustainability in a secure digital format.

Given the cooperation Aura facilitates between different brands, the consortium hopes to set a standard on traceability from which the luxury market can build. It has appealed to other brands to join its program. The deal with Sarine was closed before the conflict began, Block clarified.

Scaling up volume

The diamond-technology company is working with suppliers of rough to scan their diamonds to its systems, after which it can track the goods along the supply chain. That includes goods at the mine site where it has an agreement with the producer, but also at the second stage of delivery — whether at an auction house or manufacturing factory — in cases where it doesn’t have such a deal with the primary source.

When a parcel of rough is opened, Sarine has personnel present to take a record of the goods. That registration process will eventually be automated, with its AutoScan solution currently in the testing phase and expected to be ready for commercial use “in the next few months,” Block said. AutoScan will enable Sarine to scan log larger quantities of rough and thus scale up the data available for traceability, he added.

Revenue adjustments

Steadfast in its belief that retail is driving traceability, Sarine has shifted its focus to the US, whereas it had previous concentrated on introducing its Diamond Journey program to the Asian market. Block noted, however, that the rise in interest in traceability solutions since the war started had spanned all geographical regions, even though the US has arguably seen the sharpest rise. Rather, the company’s change in strategy stems from its expectation that the US would recover from Covid-19 at a faster pace in 2022 than key Asian markets. Recent lockdowns in China and Hong Kong have continued to stifle retail activity in those locations.

Regardless, the recent uptick in demand for traceability may prove to be a boon for service providers such as Sarine, De Beers’ Tracr, the GIA and iTraceiT. Sarine, which has traditionally been a provider of equipment to the diamond-manufacturing sector, has seen trade revenue from traceability, 4Cs grading and digital tenders rise from about a 4% share in 2020 to 8% the following year. The company is aiming for such revenue to account for more than half its total within “a number of years,” Block said.

Sarine reported total revenue fell 10% year on year to $15.6 million in the first quarter of 2022. It stressed the drop was due to a strong comparison base in 2021 and that geopolitical tensions didn’t have a material impact on manufacturing during the period.

“Sanctions notwithstanding, the flow of rough diamonds into the value chain, including those of Russian origin, continued unabated in the first three months of 2022,” Sarine said in a statement on May 15. “Midstream polishing activities were commensurately robust, as evidenced by the utilization of our inclusion-mapping systems, which continued throughout the first three months of 2022 on levels similar to those realized in late 2021, with averages exceeding 100,000 stones daily.”

“I think now you’re starting to see manufacturing starting to be impacted by the sanctions,” Block added in the interview.

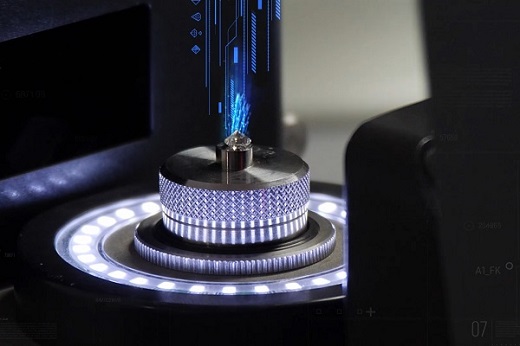

Image: Depiction of Sarine's DiaExpert rough planning system collecting data. (Sarine)

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Aura, Avi Krawitz, Cartier, De Beers, diamonds, GIA, Jewelry, LVMH, OTB Group, Prada, Rapaport, Russia, Sarine Technologies, traceability, Ukraine

|

|

|

|

|

|

|

|

|

|

|

|

|