|

|

Lab-Grown Diamond Firm Files for IPO

Jun 6, 2022 8:32 AM

By Rapaport News

|

|

|

RAPAPORT... Lab-grown diamond producer Adamas One will raise money through a public stock listing amid uncertainty about the future of its business, it said in a US Securities and Exchange Commission (US SEC) filing last week.

The company, which acquired synthetics creator Scio Diamond for $2.1 million in 2019, has applied for an initial public offering (IPO) on Nasdaq. Adamas indicated the total value of assets it purchased from Scio was $8.65 million.

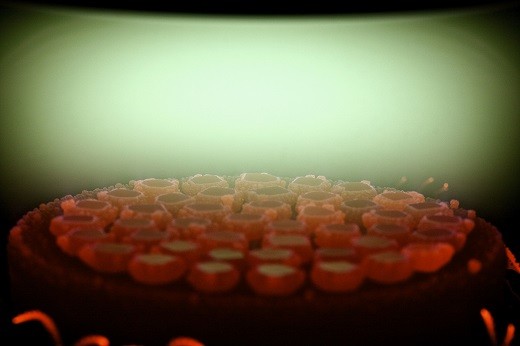

Scio was unable to continue because it lacked the capital and time needed to shift production from industrial diamonds to gem-quality rough, according to the filing. Believing it can make that segue, Adamas has already begun to produce diamonds for the fine-jewelry market. It is also working on creating colored lab-grown. The manufacturer has opened a facility for producing synthetic diamonds by chemical vapor deposition (CVD) and it is planning to expand its business by developing its own diamond seeds — thin slices of diamond upon which it grows its stones. It is also building up to 300 diamond-growing machines, up from its current 12, it said.

However, Adamas’s debts and newness to the industry introduce a degree of instability, the company warned.

“We have just started to commence commercial sales of our product as of March 31, 2022,” the filing stated. “These conditions raise substantial doubt about our ability to continue as a going concern. We currently have limited available commercial products, and have sold minimal diamonds or diamond materials to consumers or commercial buyers. While we are unable to predict the timing of our entry into any market in the future, we will strive to produce on a large scale high-quality finished and raw diamond materials, and to pursue related commercial opportunities.”

Adamas posted a net loss of $12.1 million for its fiscal year ending September 30, 2021, and ended the period with debts of $30.2 million. For the six months finishing March 31, 2022, it incurred a net loss of $5.2 million, while its debts increased to $35.5 million.

Image: Diamond seeds growing in a reactor. (Scio Diamond)

|

|

|

|

|

|

|

|

|

|

Tags:

Adamas One, chemical vapor deposition, cvd, Jewelry, lab-grown diamonds, Rapaport News, scio diamond

|

|

|

|

|

|

|

|

|

|

|

|

|