|

|

China’s Diamond Market on Path to Recovery

How well has the prominent Asian country weathered the crises of the past year, and what are its prospects for growth?

Feb 15, 2021 8:48 AM

By Julius Zheng

|

|

|

RAPAPORT... Despite the ravages of the Covid-19 pandemic, China saw improvement in its jewelry market as 2020 drew to a close. This was a welcome outcome for the diamond industry, as China is both a major trade center and a significant consumer buying force in the sector.

In 2019, the value of China’s jewelry market came to CNY 610 billion ($92 billion), a 5% increase over the previous year, according to Bi Lijun, vice president and secretary general of the Gems and Jewelry Trade Association of China (GAC). While the pandemic then took a toll on the country’s jewelry retail sector in the first half of 2020, the industry gained momentum in the third quarter and was expected to recover to the year-on-year level in the fourth, Bi said during the 2020 International Jewelry Summit in Shanghai this past November.

The latest figures from China’s National Bureau of Statistics back this up: Jewelry retail for the full year decreased by 4.7%, but the sector gained year on year in September, October, November and December by 13%, 17%, 25% and 12%, respectively.

In particular, e-commerce has become a new engine of sustainable growth for jewelers, Bi noted. Online jewelry sales showed an estimated increase of over 15% in 2020, and companies have been accelerating their digital marketing with tools such as livestreaming.

As a country, China enjoyed an annual GDP growth of 2.3% in 2020 for a total of CNY 101.6 trillion ($14.7 trillion), according to the National Bureau of Statistics — the first time the nation’s GDP has exceeded CNY 100 trillion. It was also the second year in a row that China’s GDP per capita passed the $10,000 threshold. And while the International Monetary Fund predicted in October that the global economy would contract by 4.4% for 2020, it forecast 1.9% growth for China, and a further 8.2% increase for the country in 2021.

All of this is promising for the Chinese diamond industry, which is among the biggest in the world today.

Import ups and downs

China’s diamond market first started to develop in the late 1980s, and the nation became the second-largest consumer country in 2010, trailing only the US. In 2018, the World Federation of Diamond Bourses (WFDB) listed Shanghai as a top world diamond hub.

This past October marked the 20th anniversary of the Shanghai Diamond Exchange (SDE). As China’s only gateway for importing polished diamonds under a favorable tax policy — 0% duty and 4% value-added tax (VAT) — it is an important stakeholder and barometer of the country’s diamond industry; the SDE’s net import data accurately reflects China’s official imports of diamonds for domestic consumption each year. This is notable, since nearly all diamonds in China are imported rather than produced locally.

“The SDE is a modern technological diamond exchange, very friendly and accessible to international traders,” says WFDB president Yoram Dvash. He praises SDE president Lin Qiang — who is also vice president of the WFDB — as “open and accommodating to foreign diamantaires. China is the second-largest market for diamond consumption, and its potential for future growth is huge. Clearly, the Chinese market is integrated into the world diamond market and has huge importance for the entire world diamond business.”

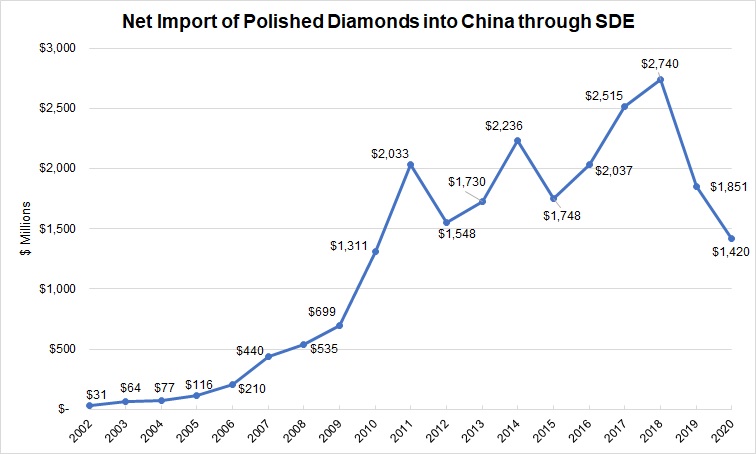

Before 2020, net polished imports through the SDE kept up a steady momentum, averaging an annual increment of 27% from 2002 to 2018 (see graph below). After the SDE adopted the favorable tax policy in 2006, it saw a surge in imports through 2011, and then three major drops during the intervening years. The biggest of these occurred in 2019 as diamond values declined worldwide due to price cuts — but unlike with the first two drops, the curve failed to turn upward again the following year.

Based on data from the Shanghai Diamond Exchange (SDE).

When the Covid-19 crisis hit the global industry, it had an unprecedented impact on the retail market and supply chain. In the first eight months of 2020, diamond transactions through the SDE showed a major decline. Nevertheless, as the epidemic got under control in China, retail, import and wholesale activities gradually regained ground. The net import of polished diamonds in 2020 recovered to 77% of the figure for the same period in 2019, reaching a total value of $1.42 billion. The value of net diamond imports in October and November respectively increased around 60% and 84% year on year. From September to November, the monthly import value exceeded $200 million, while December saw 54% year-on-year growth at $191 million.

“One thing is clear: We are not going to jump straight back to normality,” acknowledges the SDE’s Lin, telling Rapaport Magazine that “we have seen limited goods and traders from abroad since the outbreak of the pandemic.” He predicts that “the supply chain and international travel will be affected for a long time, and the industry will be most likely to continue operating in the shadow of Covid-19 into 2021. All this means the recovery process will be much longer than we expected.”

Nonetheless, he adds, confidence in “the resilience and growing potential of China’s diamond market” remains strong.

Manufacturing and wholesale hubs

Although China has to import most of its loose diamonds and colored gemstones, the vast majority of its domestically consumed jewelry is manufactured in the country.

Shenzhen is China’s jewelry manufacturing and wholesale hub, as well as an important domestic wholesale market for loose diamonds and gems. The city hosts around 30 jewelry malls and wholesale centers, boasting over 30,000 jewelry business units in total and employing a quarter of a million people. Of those business units, 8,900 are in the Shuibei area of Luohu District.

Over 90% of Shenzhen’s jewelry supply is for domestic demand, according to Guo Xiaofei, secretary-general of the Shenzhen Gold & Jewelry Association, which was founded in 1990. The prevailing majority of the group’s 782 members deal with jewelry manufacturing, Guo adds. The annual value of jewelry manufacturing in Shenzhen is about CNY 150 billion ($22.7 billion), accounting for around 70% of the nation’s jewelry manufacturing volume.

Another major center is the Panyu district in the city of Guangzhou. The district is home to more than 400 jewelry-producing enterprises, according to data from the Guangzhou Panyu Jewelry Manufacturers Association. It also contains around 1,000 colored-gemstone cutting factories and 2,000 sales companies, employing some 100,000 people. Each year, more than 70 tons of colored gems are set into jewelry. Although the Panyu factories were mostly export-oriented before the global financial crisis of 2008, they have gradually shifted focus to domestic supply since then.

For foreign suppliers, the best way to penetrate China’s diamond market is either to establish wholesale or manufacturing companies in the country, or to work with local Chinese companies. New York-based firm Hasenfeld-Stein, for instance, operates its diamond manufacturing base in Qingdao, China. “We offer FireCushion and FirePrincess, two patented and branded cuts in China,” says company president Hertz Hasenfeld. He has found that round, 0.30- to 0.89-carat diamonds in H color and up are popular, as are 1-carat diamonds.

Evolving trends

China was among the first diamond markets to emerge from the trade hiatus that the 2020 pandemic imposed on the industry, though it came out far from unscathed.

“Business has been tough in 2020, and it will take a long time to return to a normal status,” comments Lydia Geng, president of diamond wholesaler and SDE member Huabi (HB) Diamond. That said, “from May through September, our wholesale improved remarkably compared with the first four months of 2020, especially in May, June and September. Our wholesale level reached over 70% of 2019’s.” Specifically, Geng has noted solid demand for 0.30- to 1-carat goods, “especially from 0.50-carat to [just under] 1 carat in G-H, SI.” She’s had fewer orders for stones under 0.30 carats, though she notes that “for 1-carat goods, G-J, SI sells well.”

Hasenfeld, whose company is a De Beers sightholder, reports that “our business in China is still active, but at a lower level than 2019.” He believes that “the weakened retail atmosphere brought on by Covid-19” is more to blame for the drop in business than is the recent trade war between the US and China. As such, he predicts that “2021 will be better than 2020.”

When it comes to retail, holiday sales in December, January and February — the period including the Chinese New Year — usually account for up to half the revenue of China’s jewelry stores. In 2020, however, most of them missed this vital selling season due to the nationwide lockdown that lasted until April, and many young couples had to defer their wedding plans. As such, retailers, manufacturers and wholesalers inevitably saw their financial statuses deteriorate, and some of them went out of business during the year.

In general, bigger firms with access to financing, established reputations, and well-structured products tended to survive and increase their market share. The country’s top 10 jewelry brands currently hold 30% of the market in mainland China, and the Covid-19 situation will likely accelerate the consolidation trend. Additionally, following a few months of disorientation, some other financially sound medium to large businesses are eyeing expansion into strategically important locations that are now easier and less expensive to enter than they were pre-pandemic.

Meanwhile, with 64% of the 1.4 billion Chinese nationals regularly surfing the internet on mobile phones, digital marketing and sales further gained prominence in 2020. Under the concept of “new retail,” the difference between traditional and online retailers has blurred. Chow Tai Fook Jewellery Group, which has more than 3,300 stores in mainland China, works with over 90 online platforms and has installed cloud kiosks in shops. China-based online diamond jeweler Zbird operates over 110 points of sale nationwide. Almost all wholesalers and retailers are presenting their products on the web and through social media. Whether small or large, such businesses might still thrive if they have the right strategy and financial structure.

There is also room to expand the industry’s customer base. US and European brands such as Tiffany & Co. and Cartier, Hong Kong-based jewelers like Chow Tai Fook, and Chinese brands such as Lao Feng Xiang have managed to significantly penetrate first- and second-tier cities like Shanghai, Beijing, Guangzhou, Shenzhen, Hangzhou, Tianjin, Chengdu and Chongqing. However, China’s vast third- and fourth-tier cities contain 70% of the total population. Despite accounting for 43% of the country’s diamond consumption by value, the third- and fourth-tier cities are far behind the first- and second-tier ones when it comes to diamond market penetration and purchase rates. This suggests the third and fourth tiers hold great potential for the diamond and jewelry market on both the business-to-business (B2B) and consumer levels.

In demand: Bridal and high-end

What types of diamonds are most popular in the Chinese market? Within the trade, the common phrase “no black, no brown, no milky” makes it clear that goods with black inclusions in the center, a brownish or greenish tint, or a milky appearance remain undesirable. But unlike a decade ago, when people’s interest was limited to so-called “Shanghai goods” (round, G to H color, VS clarity) and “Beijing goods” (round, I to J, VVS), demand is much more diversified now. Eye-clean, “good SI1” diamonds with no black inclusions in the center have become sought-after because they are budget-friendly to consumers, who are placing greater value on color because it’s more noticeable to them than clarity.

In the wedding market, round, 0.30- to 1.10-carat, D to J, VVS to SI stones with Gemological Institute of America (GIA) certificates are bread-and-butter goods — preferably triple-Ex cuts with no fluorescence. Since the bridal market declined less sharply last year than the self-purchasing and gifting segments, there was a shortage of triple-Ex goods, what with the pandemic curbing manufacturing in centers like Surat and causing logistical difficulties with international shipments. This meant the category saw no decline in price overall.

High-end goods and anniversary buying are also going strong. The types of items commonly displayed on New York’s West 47th Street — top-quality large diamonds, fancy shapes, patented cuts, colored diamonds in yellow, pink and blue, and branded stones like Argyle pinks — have penetrated the Chinese market in recent years, thanks to suppliers from Belgium, Israel, India and the US. High-end diamonds and colored gems resumed selling after a few quiet months in the beginning of 2020, and many wealthy consumers believe now is a good time to purchase, as price points are reasonable.

Hong Kong-based luxury jeweler House of Dehres, which has a branch in the SDE, has found that its Chinese business has been “more active than other markets” in recent years, according to founder Ephraim Zion.

“Even though the international travel restrictions and quarantine policy pose a big problem/obstacle, the China market looks promising and is already in recovery, especially in the last few months,” he told Rapaport Magazine this past December. “Prices for large diamonds have become stronger than two to three months ago.”

Chinese consumers view high-end diamonds not just as decorative adornments, but as a store of value and a means of financial security, he continued. “Under the low-interest-rate environment in China, the wealthy upper-class consumers and investors want to hold on to something more tangible, with high quality in mind. Chinese clients are more quality-conscious than any other culture in the world. If they want to purchase a diamond for milestone events, like a 20th or 25th wedding anniversary, they will choose higher quality grades instead of bigger sizes with lower color and clarity, and those who buy large white diamonds and fancy-colored diamonds such as pinks and blues are sophisticated clients who are knowledgeable about the diamond quality and market price.”

Moving beyond Covid-19

By the middle of last year, Chinese consumers were already starting to acclimate to life in the Covid-19 environment. De Beers’ Diamond Insight Global Sentiment Report from August 2020 found that 85% of Chinese respondents felt they were settling into a new and familiar routine at minimum, while 24% said they had fully returned to their previous life and work routines. Of the men surveyed, 88% were “very or quite likely” to purchase diamond jewelry for a significant other, and 84% of women were likely to do so for themselves during the holiday season.

Meanwhile, international travel restrictions have limited overseas spending for the Chinese middle and upper classes, who have funneled their purchasing budgets back to the domestic market. This has resulted in improved China business for various international luxury brands. Tiffany & Co.’s mainland China sales for the third quarter of 2020, for instance, were up some 70% from the previous quarter, and were nearly double the year-on-year figure for the period.

“In February 2021, we will step into the ‘niu’ year — the year of the ox, which represents hard work, honesty, patience and perseverance,” comments Lin, with a pun on the Chinese name for the animal. “We have an optimistic outlook on the upcoming years. China’s economic growth will be more driven by consumption in the new decade. In 2019, domestic consumption represented 41% of the nation’s GDP.... As long as China’s economy maintains a 5% to 6% (high to medium) growth rate, the diamond market will most likely achieve another decade of desirable growth.”

This article was originally published in the February 2021 issue of Rapaport Magazine. To download a PDF of this article, click here.

|

|

|

|

|

|

|

|

|

|

Tags:

China, Dehres, diamonds, jewellery, Jewelry, Julius Zheng, Rapaport, Year of the Ox

|

|

|

|

|

|

|

|

|

|

|

|

|