|

|

Sustainable Growth

Factors such as US fiscal policy and Chinese jewelry demand are boosting the market for now, but inflation and other complications are on the horizon.

Jul 13, 2021 8:48 AM

By Martin Rapaport

|

|

|

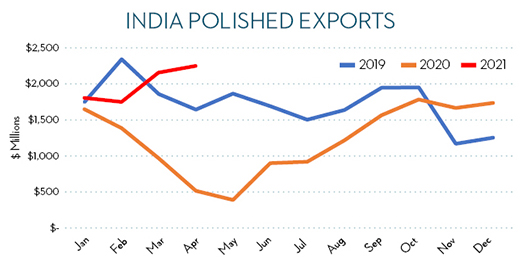

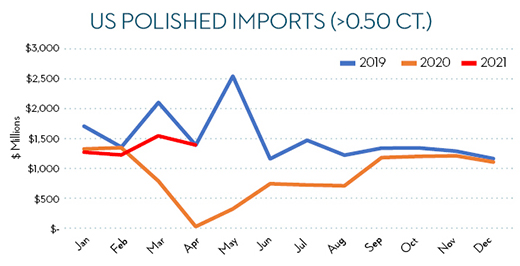

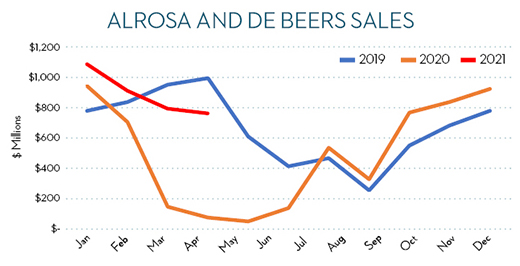

RAPAPORT... The diamond industry has come out of the Covid-19 pandemic much better than expected. While many have gone through and continue to go through extremely difficult times, some companies, particularly large firms, have prospered. For the first four months of 2021, total Indian polished exports were up 76% year on year, US polished imports rose 56% and rough sales at Alrosa and De Beers increased 73% (see graphs).

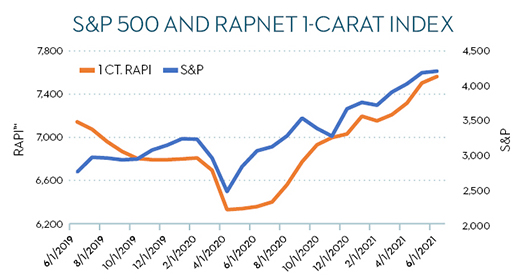

Covid-19 shutdowns created extreme polished shortages as Indian factories sharply reduced production. The combination of better than expected polished demand and reduced supply caused a surge in polished diamond prices. The post-coronavirus economic bounce-back has not been limited to the diamond and jewelry industry. Government stimulus created a broad increase in demand that has impacted the financial markets. The US S&P 500 went up 38% over the last year, and the 1-carat RapNet Diamond Index (RAPI™) went up 19% (see graph).

The big questions: Will growth continue? Are higher polished prices sustainable? What can we expect for the future?

It’s helpful to think in terms of stages or waves of growth driven by different factors. Ups and downs of supply interacting with ups and downs of demand. Diamond supply and demand interact with a broad range of economic, social and political forces beyond our industry. A booming stock market increasing the wealth effect, the millennial social trend against conspicuous consumption, a political decision to spend trillions of dollars — these can all have a major impact on diamond supply, demand and prices.

While we expect a short-term oversupply of diamonds as Indian manufacturing comes back online, the negative effect on polished prices will probably be mitigated by higher rough prices, which will keep replacement costs high as we move into the holiday season and demand rises.

Another vital factor supporting the diamond market is US monetary and fiscal policy. The US government has already pushed out $2.8 trillion. That’s $2,800,000,000,000, or $8,411 for every American. President Joe Biden is now talking about allocating another $4 trillion spend. While it’s not certain that the president will get to spend so much money, the markets are driven by expectations that US monetary and fiscal policy will stimulate significant consumer demand. Expectations and stock markets are at all-time highs.

We should also consider that US consumers will be creating significant Chinese economic growth. As money moves to low- and medium-income US consumers targeted by Biden, companies like Walmart, Amazon and similar sales channels will increase the sale of goods imported from China. US stimulus is China stimulus.

Since the US and China are the two most important diamond markets, we expect to see robust diamond and jewelry demand for the balance of 2021 and possibly well into 2022 depending on the level of US economic stimulus. The short-term outlook — the one-year outlook — is very good to excellent.

The long-term outlook is more complicated. At some stage, the party will be over. The overstimulation of the economy will have consequences. Inflation is on the way, and higher interest rates are not far behind. The current low interest rate regime is unsustainable. Higher inflation and interest rates are to be expected. So are their consequences; increasing taxes, economic socialism, currency warfare, and social and economic digitalization are all on the horizon.

It should be clear that no tree grows to the heavens. Our industry will face new realities, opportunities and challenges. While the road ahead will be vastly different than the current situation, some underlying values will remain the same. That is what our industry should concentrate on.

The role of meaningful gifting, diamonds as a store of value in an inflationary environment, social responsibility, personal human interaction, and the sharing of values — all of these things will remain. How our diamond and jewelry trade serves these needs and desires — that will change. The challenge for our industry is to identify and be relevant to the future needs and desires of our customers. Do that and you will be successful, come what may.

To learn more, attend the Rapaport Breakfast and Social Responsibility Conference at JCK Las Vegas on August 29, 2021, from 8 to 10 a.m. and 1 to 4 p.m. Pacific time. Register at rapaport.com/jck21. Proceedings will be available live online.

To comment on this article, please contact martin@rapaport.com.

|

|

|

|

|

|

|

|

|

|

Tags:

Amazon, Biden, COVID-19, diamonds, Jewelry, Martin Rapaport, Rapaport, S&P 500, Walmart

|

|

|

|

|

|

|

|

|

|

|

|

|