|

|

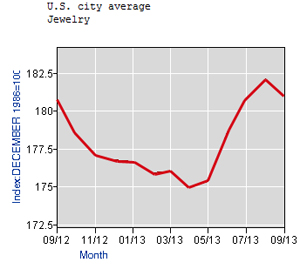

U.S. Jewelry CPI Flat in September

Consumer Price Index +1%, Reaches Record High

Oct 30, 2013 9:37 AM

By Jeff Miller

|

|

|

|

RAPAPORT... The U.S. consumer price index (CPI) for jewelry rose 0.2 percent year on year in September to 181.01 points, a full point lower than the August reading but also the second-highest reading of 2013. The highest CPI was 183.19 points in January 2012. The average monthly CPI for the first nine months of the year was 0.3 percent lower year-on-year at 177.97 points.

The CPI reading in September was the eleventh ever to exceed 180 points and it marked the 33rd consecutive month with a reading of more than 170 points, continuing to maintain a historically strong inflation trend.

After reaching a record early in 2012, the prices of gold, platinum and diamonds have remained under pressure, contributing to a slightly lower CPI for most of this year. Gold was about 20 percent lower year on year in September and platinum was down by nearly 10 percent. The RapNet Diamond Index (RAPI) for 1-carat polished diamonds was down 5.5 percent in September. RAPI for 0.50-carat diamonds was 3.8 percent lower and RAPI for 3-carat diamonds had fallen by 3.9 percent. But RAPI for 0.30-carat diamonds had risen 6.4 percent from one year earlier.

Meanwhile, the CPI for all product categories combined increased 1.2 percent year on year in September to 233.95 points, a new record that surpassed the previous high set just one month earlier.

|

|

|

|

|

|

|

|

|

|

Tags:

cpi, diamonds, gold, inflation, Jeff Miller, Jewelry, metals, prices, RAPI, record, september

|

|

|

|

|

|

|

|

|

|

|

|

|