|

|

Rising Diamond Production

Insights

Feb 25, 2016 7:30 AM

By Avi Krawitz

|

|

|

RAPAPORT... The diamond mining sector is under pressure with production rising to peak levels at a time when rough sales are slumping and polished demand is sluggish. The major miners are holding above-average inventory that they have pledged to release slowly in an attempt to avoid over-supply to a market struggling in the face of its current downturn.

If there is one thing the industry needs right now, it is a measured approach in the release of rough supply – at prices that reflect polished demand – to ensure stability and profitability for manufacturers and rough dealers.

It appears that the miners are maintaining a cautious outlook for the year even as rough demand spiked in January and remained firm in February. “We’re selling what our customers want and need rather than doing anything that might not be in ours or the industry’s best interests,” Gareth Mostyn, De Beers head of strategy, recently told Bloomberg. “The key is to continue to build confidence through 2016.”

However, there are concerns about the rough held in the mining companies’ vaults. After all, the current downturn resulted from an oversupply of polished as manufacturers bought rough at higher prices in 2014 to satisfy Chinese demand that didn’t materialize. As polished inventories now diminish, there has been a build-up of rough inventory in the mining sector as the majors hold back supply to align with lower demand.

ALROSA, Rio Tinto on the Rise

That begs the question what are miners doing with unsold rough and whether output needs to be curbed? It’s not such a simple question as many factors are taken into consideration, particularly by the majors.

For example, now might be a good time to operate a mine as production costs are lower due to declining diesel costs and favorable exchange rates in South Africa and Russia. The Botswana government, which owns 15 percent of De Beers and has a joint venture with the company in the Debswana mining division, might need to maintain certain levels of production as diamond output is an important factor in its gross domestic product (GDP) growth calculation.

De Beers structure is also such that its selling division buys from its mining division as per sightholder demand. Therefore, the bulk of De Beers inventory is more likely being held at Debswana and is not readily available at its Global Sightholder Sales unit.

Still, De Beers was the only one of the top three miners that reduced production to align with a drop in demand in 2015 and the company has further adjusted its outlook for 2016. ALROSA and Rio Tinto both registered production increases last year and are forecast to ramp up output again this year.

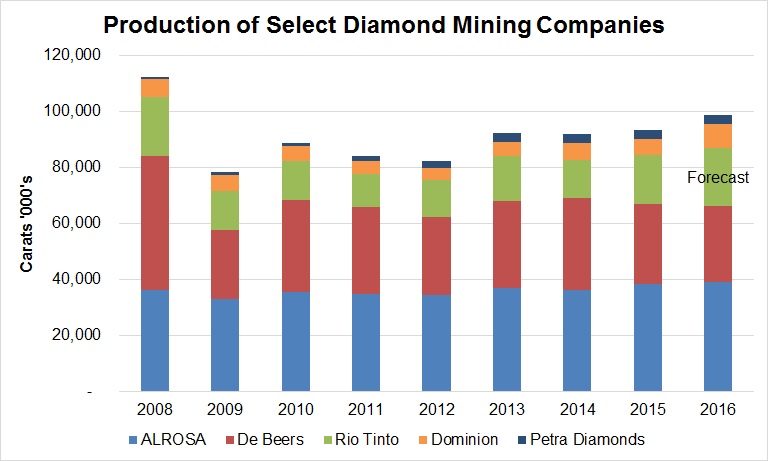

The combined output of ALROSA, De Beers, Rio Tinto, Dominion Diamond Corp., and Petra Diamonds – which account for an estimated 75 percent of global production by volume – increased 2 percent in 2015 and is projected to rise about 6 percent in 2016 (see graph).

Based on reported production by the respective companies and their stated outlook for 2016.

Projects in Progress

Such growth is arguably unavoidable since it is being driven by expansion projects and new developments that have been in progress for years.

De Beers has invested billions of dollars in the cut-8 program at the Jwaneng mine in Botswana, along with the underground project at the Venetia mine in South Africa, and its developnment of the Gahcho Kué mine in Canada.

While those projects will ensure the long-term viability of De Beers portfolio, in the near-term, the company is planning output of 26 to 28 million carats in 2016, down from 28.7 million carats last year. To lower production, the company shuttered the Snap Lake mine in Canada, put the Damtshaa mine in Botswana on care and maintenance, reduced its tailings processing at Venetia, and sold the Kimberley Mines to Ekapa Minerals.

De Beers continues to shift its focus toward what it considers value projects rather than maintaining high volumes. In contrast, ALROSA is relying on quantity to drive growth and is therefore reluctant to scale back production. Management has noted slowing mining operations is too costly and would be considered only if demand falls below certain levels and it becomes uneconomical to operate any given mine in the long term.

That day hasn’t come yet as the company opts to raise inventory rather than incur the cost of reducing production. Management reported in September it’s inventory at over 20 million carats was double the normal level and worth more than $2 billion at the time. It is expected to have added to that stock in the fourth quarter when demand, and sales, slumped further while production continued uninterrupted.

During a weak 2015, ALROSA’s production rose 6 percent to 38.3 million carats, while the company is planning 39 million carats this year. It launched the Botuobinskaya mine, which added nearly 1 million carats to its total, and growth was also driven by a significant increase at the Karpinskogo -1 pipe and the ramp-up of underground mining at the iconic Mir mine.

Minors Don’t Make a Difference

However, the largest production growth was recorded at Rio Tinto, which raised output 25 percent to 17.4 million carats in 2015. That was influenced by a 47 percent surge in production at the Argyle mine after it shifted from open pit to underground mining in 2013. Rio Tinto is planning to raise output another 21 percent to 21 million carats this year, which it must be noted is below previous forecasts.

It is uncertain whether Rio Tinto is able to sell all its production as the company doesn’t report sales volume or diamond inventory levels. Like De Beers and ALROSA, Rio Tinto sells most of its rough via long-term contracts, which enabled De Beers and ALROSA to introduce some flexibility in their supply as manufacturers refused goods in the second half of 2015.

Rio Tinto now has sufficient volume to make a difference in the market. And when market conditions turn for the worse, it is generally the major miners that are left with unsold production, as the trade witnessed last year.

Mid-tier and smaller miners, which generally sell via auction or tender, saw narrower declines in their sales volume, while revenue was impacted by lower prices. Petra Diamonds reported sales volume decreased 7 percent to 1.3 million carats in its fiscal first half that ended December 31, while the average price achieved by the company fell 23 percent year on year.

A Petra spokesperson explained the company contributes only a fraction of overall global supply and therefore its programs are not material in terms of affecting market conditions – even as it invests in expansion projects to achieve annual production of 5 million carats by fiscal 2019.

Avoiding an Over-Supply

The same might be true for other new mines and development programs outside of the portfolios of the three diamond mining majors.

Among those, the Grib mine in Russia and Gem Diamonds’ Ghaghoo mine in Botswana are steadily raising output following their respective launches in the past two years. Firestone Diamonds’ Liqhobong mine in Lesotho and Stornoway Diamonds’ Renard mine in Canada are coming on stream in the next year or two. Add to the mix, Gahcho Kué, which is scheduled to launch in the second half of this year by co-owners De Beers and Mountain Province, and Rio Tinto’s Bunder project is expected to start operations around 2019.

Those projects will ultimately add an estimated 14 million carats annually to global supply. While they will hardly compensate for the overall decline in production as some older, major mines are depleted in the long-term, they will ensure that global production peaks in the coming two years before a gradual decline takes hold from 2018/19.

In that sense, the timing couldn’t have been worse for the mining sector as demand is expected to remain cautious and polished manufacturing levels well below capacity at least through this year. A significant build-up of mining companies’ rough inventory is therefore expected as the market struggles to recover from its current downturn.

While the rate at which that excess supply is released to the market will largely depend on the majors, the trade is hoping they’ll maintain a cautious approach that will reflect the reality of demand and enable some profitability for manufacturers and rough dealers. The trade – and the miners for that manner – can ill afford the market to continue to be characterised by an over-priced, over-supply of rough. After all, that is what ultimately caused the downturn in 2015.

The writer can be contacted at avi@diamonds.net. Follow Avi on Twitter: @AviKrawitz and on LinkedIn.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Avi Krawitz, De Beers, diamond, diamonds, Dominion, grib, Jewelry, Petra Diamonds, Rapaport, Rio Tinto

|

|

|

|

|

|

|

|

|

|

|

|

|