|

|

Auction Pause Pushes Gemfields to Steep Loss

Mar 30, 2021 6:30 AM

By Rapaport News

|

|

|

RAPAPORT... Gemfields recorded a loss in 2020 as it was forced to cancel the bulk of its regular auctions for the year due to coronavirus restrictions.

The miner reported a net loss of $93.2 million for the year, compared with a profit of $39.1 million in 2019, it estimated in a trading update last week. The company was unable to hold any of its traditional gem auctions since February.

“[The] 2020 auction schedule was severely impacted by the many travel, quarantine and congregating restrictions put in place to mitigate Covid-19 contagion,” the miner said.

While Gemfields conducted a series of mini-auctions for emeralds from its Kagem mine in Zambia in November and December, it could not generate revenue from its Montepuez ruby mine in Mozambique during the year, the company noted. In total, auction revenues came to $22.3 million for the full year, an 89% drop over the $200.5 million reported in 2019.

Additionally, Gemfields noted an $11.5 million devaluation of its assets at its Fabergé retail brand, due to an impairment charge for reduced revenue expectations arising from Covid-19. The company’s share in the Sedibelo platinum mine has also incurred a $27.9 million write-down in value.

Earlier this month, the miner restarted operations at the Kagem and Montepuez sites. It expects to reach full production by the end of April. The company began its first full-scale auction series since February 2020 on March 15, which it plans to complete by April 17.

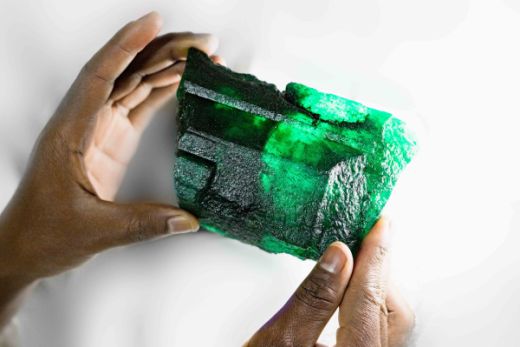

Image: The Lion Emerald, from Gemfield’s Kagem mine.

|

|

|

|

|

|

|

|

|

|

Tags:

COVID-19, Fabergé, Gemfields, Kagem mine, Montepuez ruby mine, Mozambique, Rapaport News, Sedibelo platinum mine, zambia

|

|

|

|

|

|

|

|

|

|

|

|

|