|

|

The State of India

The world’s largest manufacturing center is relatively upbeat about the domestic jewelry market ahead of Diwali, but it is less optimistic about global prospects.

Sep 1, 2022 9:59 AM

By Avi Krawitz

|

|

|

The world’s largest manufacturing center is relatively upbeat about the domestic jewelry market ahead of Diwali, but it is less optimistic about global prospects.

RAPAPORT... When demand slides, India’s diamond industry faces its fair share of challenges. As the largest manufacturing center, accounting for an estimated 90% of global polished goods, it is the market maker: How it buys rough and sells polished sets the tone for the rest of the trade. With both rough supply and polished demand declining in recent months, diamond cutters are navigating a complex market dynamic.

Geopolitical uncertainty, a slowdown in China due to its strict Covid-19 policies, and the seasonal summer lull in the US and Europe have led to a softening in appetites for diamonds. Meanwhile, when Russian production dropped out of the market around March, volume fell.

These forces have balanced each other out to some extent. If polished demand were as robust as a year ago, there would be more severe shortages, which would support polished prices, many have observed. Instead, prices have weakened, and there are still large quantities of polished inventory available.

The number of stones on RapNet remained high at nearly 1.9 million on September 1, up 16% from a year ago. Prices consequently declined as the market waned. The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 3.6% in August, following a 2.6% drop in July.

China and the US

Nonetheless, the Indian trade is calm about its prospects for the rest of 2022. This was evident in conversations Rapaport had during a recent visit to Mumbai and Surat, attending the India International Jewellery Show in early August.

For manufacturers, the biggest factor behind the downturn has been the slump in China, which still maintains restrictions related to Covid-19. Considering the quarantine requirements for international travelers, suppliers are unwilling to visit the country, and Chinese buyers are not on the international circuit. The same applies to Hong Kong, although the precautions there are not as stringent and are gradually easing.

China’s retail sector has also slowed. Recent updates from Chow Tai Fook and Luk Fook, two of the largest jewelers in the region, revealed that their same-store sales on the mainland had plunged 19% and 28%, respectively, during the quarter that ended June 30. As a result, these high-volume buyers have significantly curtailed their orders.

Indian suppliers are naturally keeping a close watch on the US, their largest market, amid all the recession and inflation talk. But even as they report an overall dip in orders, the US has remained steady — even if trading there does not match last year’s bumper levels.

US retail has weakened, with Signet Jewelers, the country’s largest specialty jeweler, lowering its full-year outlook. The company expects revenue of $1.75 billion in the second fiscal quarter, which ended July 31 — 2.1% less than last year, according to Rapaport records.

“We saw sales soften in July, as our customers have been increasingly impacted by rapid inflation, so we’re revising guidance to align with these trends,” CEO Gina Drosos said at the beginning of August.

The large manufacturers are concerned about the drop in US orders during the current quarter. But the US continues to support the market, and there is some hope it will stabilize for the holiday season.

Changes in India

For now, India is focusing on the domestic arena as it heads into the wedding and festive season. While the cost of living has risen — with inflation at around 7% in June and the Reserve Bank of India’s interest rate at 5.4%, a return to pre-pandemic levels — sentiment remains upbeat among jewelers.

The recent India International Jewellery Show (IIJS), which took place from August 4 to 8, saw encouraging foot traffic and record visitor numbers, according to the Gem & Jewellery Export Promotion Council (GJEPC), which organizes the show. There were significant orders for gold and rising interest in diamond jewelry amid continued shifts in cultural taste.

The move toward less heavy jewelry in India accelerated during Covid-19, with IIJS vendors displaying more lightweight pieces and delicate designs featuring diamonds. For example, fewer women are wearing the traditional gold mangalsutra — a necklace presented to brides at Hindu weddings and worn throughout the marriage. While they might use it during the ceremony, they often switch to a lighter diamond pendant for everyday wear to express their matrimonial commitment.

Jewelry retail is robust in India: Economic growth is projected to stay above 7% in 2022, while gross domestic product (GDP) rose 8.9% in 2021, according to the World Bank. The Reserve Bank of India has noted that consumer confidence continues to rise. Sales at Titan Company, India’s largest branded jeweler, nearly tripled to INR 83.51 billion ($1.05 billion) in the first fiscal quarter, which ended June 30, from INR 30.5 billion ($383.2 million) the year before.

Jewelers are optimistic for Diwali — which falls on October 24 this year — and the wedding season, which extends through April. That has given the rest of the trade a lift, even if the local market constitutes a small proportion of polished supply. India accounts for about 6% of global diamond jewelry sales, according to De Beers. It seems set to take some market share from China; the latter has slid, while India has continued its recovery in 2022.

Shift to Larger Sizes

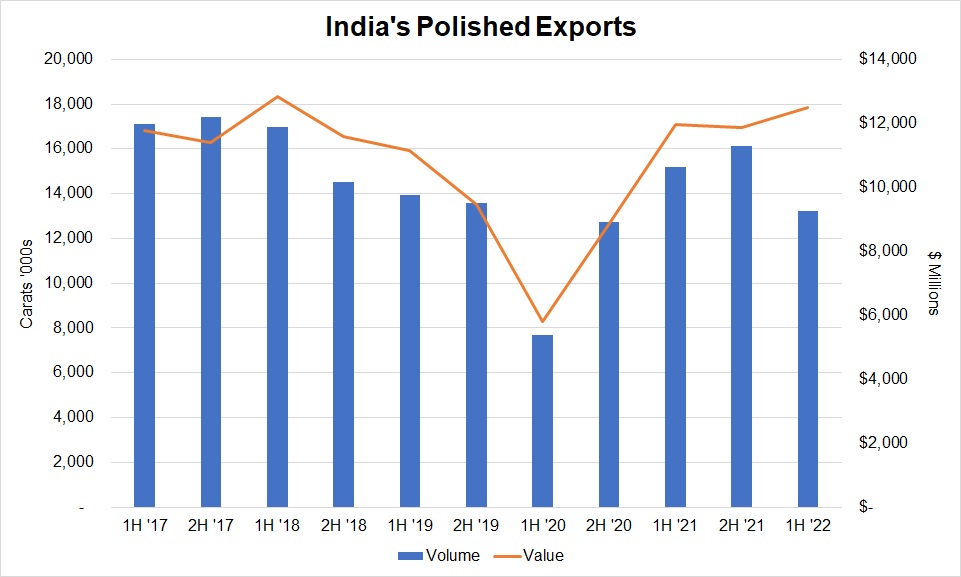

Overall, manufacturers estimate that their orders are down about 5% to 10% from last year, but still above pre-pandemic levels. India’s polished exports were flat at $6.27 billion in the second quarter, according to the latest data from the GJEPC. The figures for July declined 13%.

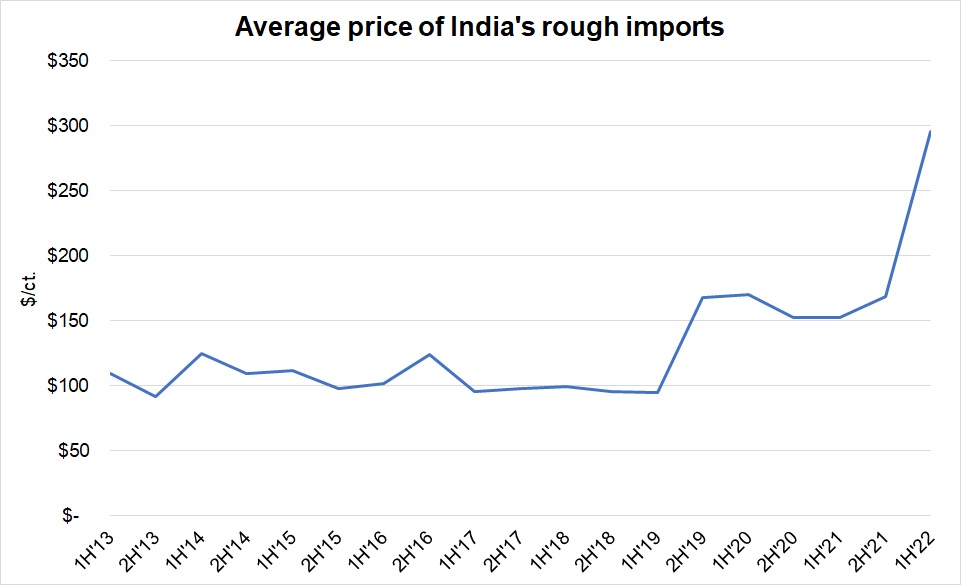

For the first half, polished exports rose 4% to $12.49 billion, but dropped 13% by volume to 13.2 million carats. That indicates a shift to larger sizes and higher-value stones, with the average price of exports up 20% at $946 per carat — the country’s highest on record, according to Rapaport data (see graphs below). That change appears to reflect the weakness in China — usually a strong market for smaller certified goods such as 0.30-carat stones, which showed steep declines so far this year.

Based on monthly data from the GJEPC. Exports rose by value, but volume dropped, indicating a shift to larger, higher-value goods.

Based on monthly data from the GJEPC. The average price of polished exports rose to record highs in the second half of 2022.

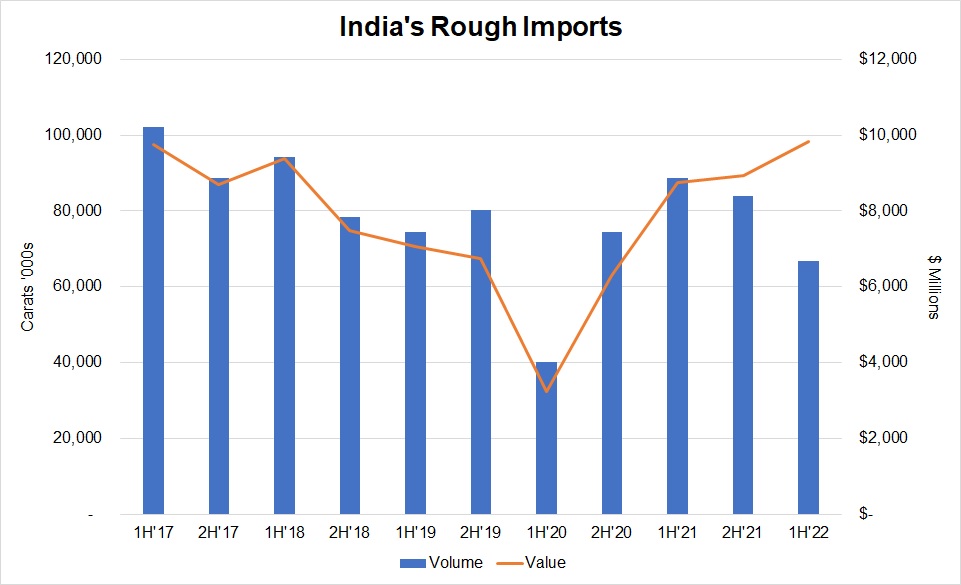

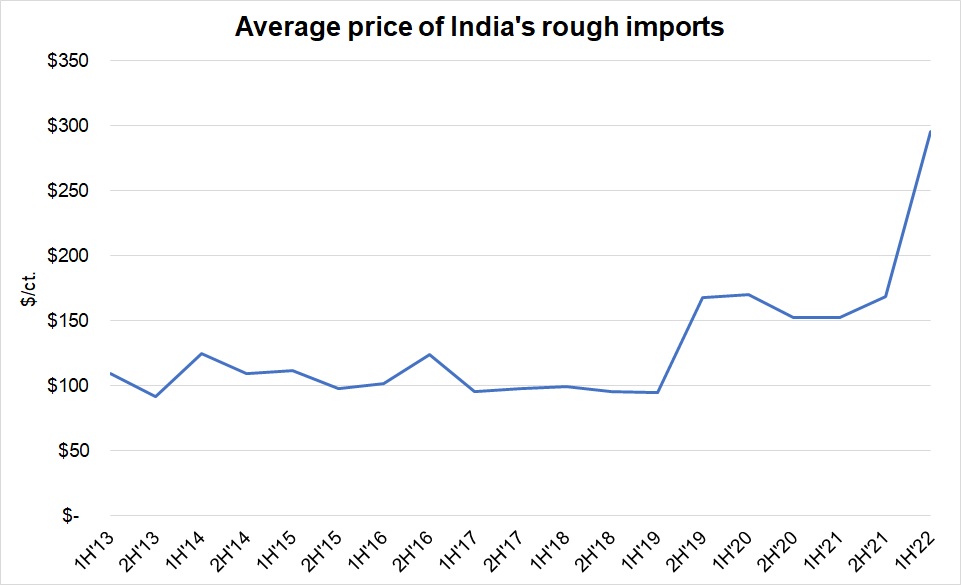

India’s rough data is similarly telling. Rough imports grew 12% to $9.82 billion in the first half, though they fell 25% to 66.8 million carats by volume. The average price jumped 94% to $296 per carat, another all-time high in Rapaport records (see graphs).

Based on monthly data from the GJEPC. Imports rose by value, but volume dropped, reflecting the lack of smaller goods typical of Alrosa production.

Based on monthly data from the GJEPC. The average price of rough imports spiked to a record high in the second half of 2022.

A Lack of Shortages

The rough data reflects the absence of Alrosa production in the market, since the Russian miner is a leader in smaller diamonds. The US has imposed sanctions on the company since March, and its sales have frozen. It therefore makes sense that manufacturers have imported fewer but higher-value diamonds on average for cutting and polishing.

That said, there are rumors that Russian rough has come into Surat, albeit at lower volumes than before the Russia-Ukraine war. There are Russian goods in India, and they’re not selling at a discount, one large manufacturer hinted, acknowledging that no one was prepared to admit to buying them. Besides, since India hasn’t placed sanctions on Alrosa or Russia, it can legally sell the finished polished stones to US customers. The diamonds would have been sourced in India under the sanctions’ “substantial transformation” loophole, whereby Russian product that has undergone a material change in a third country may be sold in the US.

This possibility would explain the high polished inventory still on the market despite the limitations on buying Alrosa goods. However, the high inventory may also be a function of the production cycle. Even though Alrosa has canceled all its official sales since March, many of its clients paid for three cycles’ worth of rough back in February, and therefore have had the diamonds to maintain their production at similar levels through at least May or June. As that polished became available in July, the market would have slowed, leading to the increase in inventory. Shortages are apparent in smaller, uncertified stones, where Alrosa accounts for an estimated 40% to 50% of global output.

A Blessing

These sourcing challenges, along with more goods going to southern Africa for beneficiation, have dented Indian polishing levels. But Surat factories have lab-grown to keep them busy. As that same manufacturing executive said: “It is a blessing of G-d that lab-grown came to India, because it gives us work.”

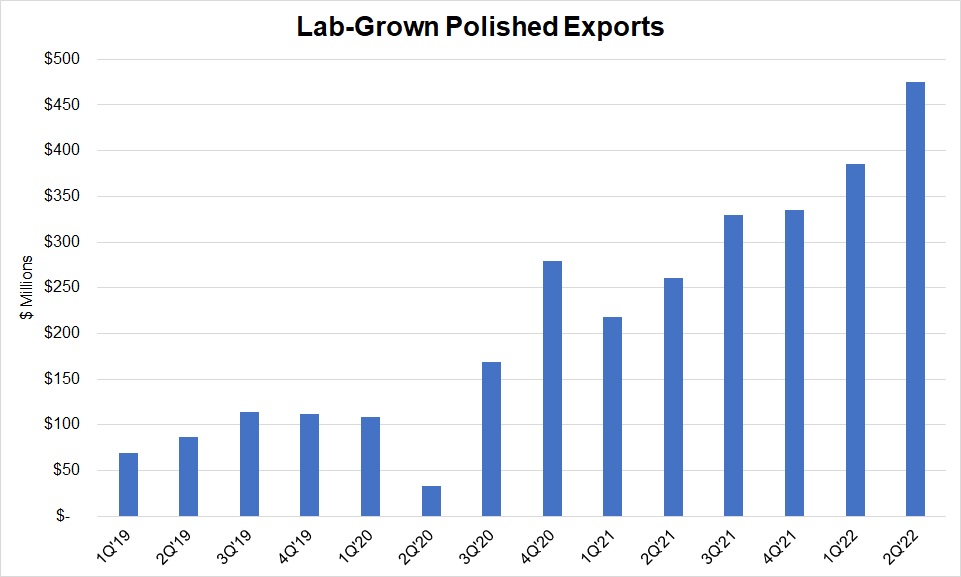

India’s lab-grown polished exports grew 80% year on year to $860 million in the first half (see graph below). The country accounts for an estimated 15% of global lab-grown supply, and the GJEPC is working with the government to expand the sector.

Based on monthly data from the Gem & Jewellery Export Promotion Council (GJEPC).

Lab-grown diamond demand has soared in the last two years. Still, natural diamonds remain the local industry’s bread and butter, and manufacturers have enjoyed a period of strong liquidity following last year’s windfall to see them through the current lull. Bank credit is not a problem, according to GJEPC chairman Colin Shah, who observed at IIJS that representatives of the approximately 30 banks attending the show did not view the industry with the same caution they had a few years ago. Others have noted that liquidity is under pressure due to supply-chain delays stemming from the Russia-Ukraine war.

Regardless, cutters are expected to step up their rough purchases and polished production in the coming months. They need stock ready for the US festive season before Diwali, when factories close for about two weeks. US retailers typically start to ramp up their holiday orders in September.

Manufacturers are therefore cautious, but by no means in a panic, over the current market slump. There is a sense that demand is sustainable at pre-pandemic levels, and this is fueling confidence for the rest of the year. Besides, the apparent lower availability of rough will likely support polished prices as holiday demand picks up and midstream inventory declines, as it is likely to do. Sentiment will certainly change if US consumer spending does drop in the economic fallout, but the bigger hurdle, Indian suppliers agree, will come if the current market conditions persist in 2023.

Image: Parliamentarian Hema Malini opens the IIJS fair in Mumbai on August 4. (GJEPC)

This article first appeared in the August issue of the Rapaport Research Report. Subscribe here.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Avi Krawitz, De Beers, diamonds, GJEPC, IIJS, India, jewellery, Jewelry, Signet Jewelers, Titan Company

|

|

|

|

|

|

|

|

|

|

|

|

|