|

|

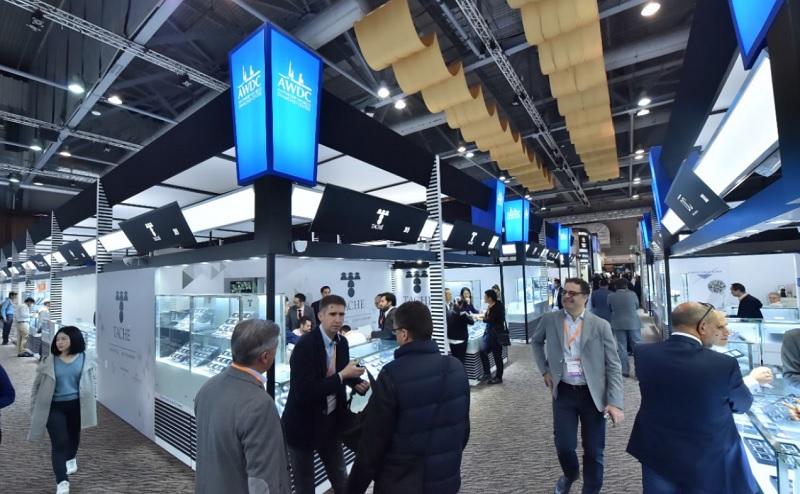

5 Lessons from the Hong Kong Show

Insights

Mar 7, 2017 1:45 AM

By Avi Krawitz

|

|

|

RAPAPORT... The Hong Kong show was better than expected for the diamond trade, as Chinese jewelers were looking for goods after being absent from the market for some time. But while exhibitors were simply happy to be doing business again, conditions ultimately favored buyers.

Suppliers took the opportunity to reduce stock and generate some cash flow, and they were therefore prepared to accept offers at slightly higher discounts in certain categories.

“There are a lot of goods on the market and a definite hunger to sell,” noted a Jakarta-based jeweler looking to buy at the Diamond, Gem & Pearl Show. “You feel there is flexibility among suppliers.”

Manufacturers’ profit margins remain tight, after rough prices firmed in the first two months of the year and polished prices softened slightly. Therefore, suppliers were hoping the show would stimulate stronger polished trading for the coming months. After all, the first quarter is supposed to be an upbeat period for diamond dealers – a time when jewelers in the U.S. and China restock after the Christmas and Chinese New Year periods.

While that inventory replenishment hasn’t yet happened in a significant way, there was sufficient activity at the show to inspire optimism about the short term.

However, a number of factors were apparent in Hong Kong that will influence the market moving forward. Here are five trends we’re keeping an eye on after the Hong Kong show:

1. Retailers Don’t Want to Overstock

Jewelers are owning less inventory than they used to, with Chinese retailers taking a lot of goods on memo, according to Vincent Yiu, a manager at Hong Kong-based diamond manufacturer Brilliant Trading Company.

They’re also very careful not to get stuck with too much inventory the way they have in the past, influencing them to purchase more selectively, added Jeremy Medding, owner of EMA Diamonds, which supplies round diamonds up to 10 carats.

As jewelers expanded aggressively across China earlier in the decade, they bought a lot of stock to fill those new stores and satisfy rising consumer demand. However, as economic growth slowed and that expected consumer demand did not fully materialize, store expansion stagnated in the past two years. Jewelers have consequently been working through excess stock and only replacing what they need.

There’s been a clear destocking trend among the major jewelry retailers, noted Stéphane Fischler, president of the Antwerp World Diamond Centre (AWDC). Dealers, meanwhile, are [for now] focused on moving greater volume, rather than maintaining their prices.

2. Jewelers are Shifting to Lower Price Points

Jewelers are also replacing their higher-value inventory with lower-priced goods, Fischler noted.

That trend is stemming from the retail sector, as larger jewelers are shifting to lower-end products, which are their fastest-selling items, Yiu observed.

“Today, Hong Kong is competing with the U.S. for SI-clarity and piqué goods,” he added.

Exhibitors noted strong demand for SIs at the show, whereas a few years ago, the Far East was recognized as a market for VVS- to VS-clarity goods.

There was also a shift to lower colors. About two months ago, there was good demand for G to H colors, but at the show, buyers were looking for I, J and K colors, reported Motti Amit, a manager at Tel Aviv-based polished-diamond supplier Leo Schachter.

The latter goods are difficult to supply because there’s less rough available in those lower colors, Amit explained. “Therefore, you’re selling a smaller portion of your stock,” he said.

3. There’s a Cash Crunch in Asia

Chinese buyers are also working with tighter budgets than they were a year ago, given that the yuan has depreciated 6 percent against the U.S. dollar since March 2016.

While Chinese wholesalers buy in U.S. dollars from the trade, they sell in their local currency.

“Their budgets are therefore in renminbi [yuan], so they look for goods that will fall within their tighter budget,” Amit explained.

In addition, exhibitors are increasingly reluctant to give credit terms to buyers, given the large number of delayed payments from Chinese clients. There’s a lot of bureaucracy involved in importing goods to China, and a 4-percent import duty on polished diamonds further limits their budgets, exhibitors observed.

4. Lab-Grown Diamond Suppliers Are More of a Presence

There was a notable rise in suppliers of lab-grown diamonds exhibiting at the show. Furthermore, lab-grown providers were positioned alongside natural diamond dealers.

“This is an issue for us, as we don’t see it as the same product,” Fischler said. “In previous years, there’s been a clear separation between the lab-grown and natural diamond suppliers.”

Meanwhile, both De Beers and the Gemological Institute of America (GIA) noted a continued rise in production of lab-grown diamonds as costs have declined, particularly for High Pressure-High Temperature synthetics. Both companies, in their respective presentations at the show, expressed increased concern about undisclosed synthetics reaching the market.

5. The Trade-Show Business Model Has Peaked

The Hong Kong show is a well-timed opportunity for dealers to tap demand after the Chinese New Year jewelry-selling season. But diamantaires have acknowledged that there are simply too many shows on the calendar, and they are reassessing which ones are worth their while to attend.

In Hong Kong alone, there are trade fairs in March, June and September, and some have more recently also started to attend the International Jewelry Manufacturers’ Show in November.

“The show model has passed its peak in terms of generating new business and excitement,” Medding said. “Apart from the expense of your booth and staff flights and accommodation, there’s also a sizable inventory cost, as your goods are in transit for nearly two weeks around the event, and not available in other centers.”

Importantly, the shows are no longer exposing suppliers to new buyers. As one exhibitor noted, “you see the same faces at every show.”

Furthermore, deals are not necessarily made on the spot, as they were in the past. The follow-up after the show is therefore more important for securing the deal, the exhibitor stressed.

Ultimately, the shows present an opportunity to see existing clients and to network within the trade. And while that may be important, many companies are finding it difficult to justify the expense of attending all the events.

“I feel we have to go back to basics,” said Harsh Maheshwari, a director at the Hong Kong-based Kunming Diamonds, which supplies fancy color diamonds. “The shows are not where the main business happens. You have to have a good footprint globally and work with clients on a continual basis.”

* Pictures courtesy of the Hong Kong Trade & Development Council (HKTDC).

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, De Beers, diamond, diamonds, Gem & Pearl Show, GIA, Hong Kong Diamond, Hong Kong International Jewellery Show, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|