|

|

Volatility Looms Amid India’s Covid-19 Crisis

Apr 29, 2021 5:20 AM

By Avi Krawitz

|

|

|

RAPAPORT... The dramatic spike in Covid-19 infections in India has injected uncertainty into the diamond market. As the country struggles with the severe humanitarian crisis, the industry has reduced its manufacturing and trading activity significantly.

The rate of new daily coronavirus cases started to rise in mid-March and escalated rapidly. That left hospitals stretched beyond capacity, without enough beds, oxygen or doctors to cope with the unprecedented influx of patients.

The country recorded a world-record number of new cases for several days this month, peaking at 379,459 on April 28, according to the latest data by statistics website Worldometers. In total, more than 18 million people in India have been infected and over 200,000 have died since the pandemic began.

The central government is working to get more supplies to the country and to accelerate the vaccine rollout, while the various state governments have implemented rules to help curb the pandemic’s effects. In Maharashtra — the state containing the major diamond trading hub of Mumbai — the restrictions allow only essential services to operate. Exports and imports of commodities fall under that category, meaning the diamond sector was able to carry on after the rules went into effect, reported the Gem & Jewellery Export Promotion Council (GJEPC) earlier this month. Similarly, Surat-based manufacturers continued to operate despite Gujarat state’s rising numbers.

Still, the diamond market has felt the impact. Companies have reduced capacity and adhered to social distancing requirements. About 25% of workers remain absent, as they or their family members were infected or had to quarantine for other reasons, explains GJEPC chairman Colin Shah in an interview. Many also returned to their rural homes during the lockdown period.

Cutting down

Diamond manufacturing in India has fallen by 30% to 40%, according to executives who spoke with Rapaport News. Cutters have shifted their focus to higher-value and more profitable certified diamonds rather than the large volume of small goods that typically sustain India’s polishing industry.

While the country manufactures an estimated 92% of the world’s diamonds, the drop in output has fueled speculation about pending shortages — especially since polished demand remains robust.

Shah is expecting to gain better insight into the market’s prospects after Mother’s Day on May 9. “If Mother’s Day sales are good, we may run into shortages of a few items if manufacturing stays at lower levels in May and June,” he predicts. “But if we start to see a [Covid-19] recovery toward the end of May, as is anticipated, and Mother’s Day is normal, then I think things will be okay.”

He notes that there are too many moving parts to say for sure at this stage.

Questions of supply

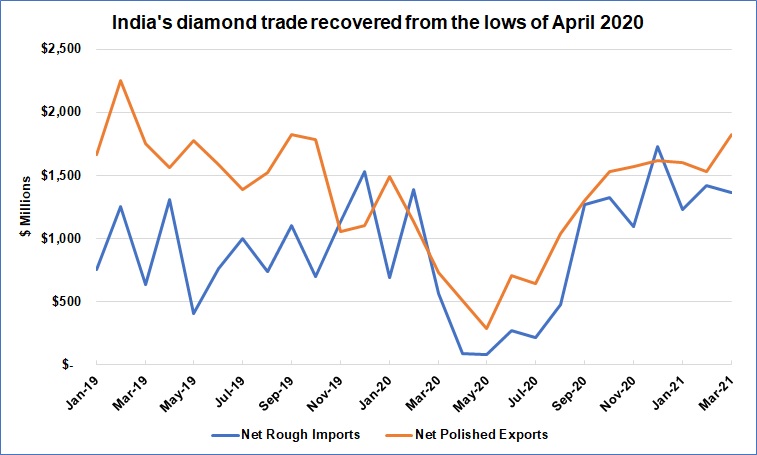

Meanwhile, manufacturers have goods in the pipeline, having bought high volumes of rough in the first quarter (see graph). A backlog of more than a month has developed at the Gemological Institute of America’s (GIA) Mumbai and Surat grading labs due to the restrictions.

Based on data from the GJEPC.

Polished inventory levels have consequently declined in key categories. For example, the number of round, 1-carat, G to J, VS to SI diamonds on RapNet fell 11% between February 26 and April 26. In the last month, the volume of 0.30-carat, G to J, VS to SI goods on the trading platform slid 23%.

All of this means the diamond industry can expect supply volatility in the short term.

For now, the volumes on RapNet are still reasonable; there appear to be enough available goods to satisfy demand over the next month, given that orders tend to slow at the start of the summer. But with little new supply coming through the system, inventory levels are expected to decline further during May.

If India’s Covid-19 situation improves toward the end of May, as some forecast, there will be an influx of goods to the market in June or July as the GIA reduces its turnaround time. The GIA should deplete its backlog fairly quickly, since there will be fewer new submissions to grade due to the current drop in manufacturing levels. Shortages may appear around September as demand improves for the holiday season.

Familiar cycles

A similar pattern occurred in 2020.

Last year, manufacturing and rough purchases froze from April through June when the coronavirus first spread globally. Polished suppliers focused on selling in the interim, allowing them to deplete inventory that had previously been difficult to move. Shortages emerged around August as jewelers started to place orders for the holiday season, driving a sharp recovery in polished prices and enabling manufacturers to profit from their rough purchases.

A year later, demand is once again set to outstrip supply. Manufacturers will likely exercise restraint in the rough market because of their factory limitations, while the outlook for polished demand is even higher than in 2020. The market recovery is robust in the US and China, thanks to continued growth in e-commerce coupled with consumer excitement to get out and shop again.

That paints a favorable picture for Indian manufacturers and the global diamond trade in the second half of 2021, since the expected polished shortages will support prices and improve margins. But with Covid-19 continuing to influence the market in unpredictable ways, the trajectory is unlikely to be smooth.

Main image: Medical staff wearing protective gear monitor people’s body temperatures during a Covid-19 testing drive in 2020. (Shutterstock)

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, COVID-19, diamonds, GIA, GJEPC, India, Jewelry, pandemic

|

|

|

|

|

|

|

|

|

|

|

|

|