|

|

How Two Crises Shaped the Diamond Trade

Jun 15, 2021 4:16 AM

By Avi Krawitz

|

|

|

RAPAPORT... For just over a decade, the diamond midstream — consisting of manufacturers and dealers — has served as a repository for the trade’s inventory and absorbed much of its credit risk. Manufacturers pay up front for rough, process the stone, and then typically sell the polished on credit, offering terms of 30 to 60 days. Since it can be six to nine months before they recoup their initial outlay, they have relied on banks to finance their rough purchases and sustain their operations.

However, the 2008 financial crisis marked a drastic change for the banks and a turning point for the trade. Lenders became increasingly reluctant to extend credit to the diamond sector, putting pressure on manufacturers just when they were taking on a higher level of risk.

Changes in the landscape

Historically, De Beers bore the industry’s inventory burden by stockpiling rough, while jewelry retailers were willing to purchase inventory and hold it until it eventually got sold, says industry advisor Varda Shine, a former De Beers executive. However, two things changed this financing landscape. In the late 1990s, she relates, many retailers moved to memo, or consignment, arrangements with diamond suppliers, requiring dealers to hold more of the trade’s inventory. Then, in the early 2000s, De Beers sold its rough stockpile as part of efforts to break its monopoly, shifting more of that rough toward manufacturers.

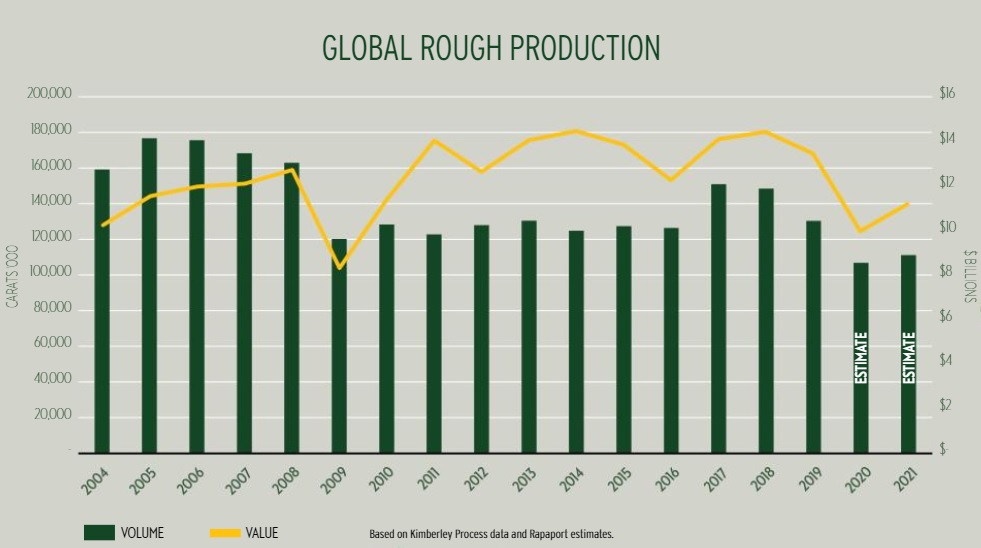

Following the 2008 crisis, retailers required even less inventory, and global rough production dropped to align with the lower demand (see graph). At the same time, De Beers turned its focus toward branding efforts, and further avoided accumulating supply by selling off unprofitable mines.

On top of all this, millennials were just emerging as the core engagement ring customers. Consumer habits and tastes began to change, and retailers became more selective in the goods they were stocking. Demand for diamond jewelry also stagnated in the absence of any industry-wide category marketing and as new luxury products in the tech space competed for shoppers’ wallets. Retailers avoided holding excess inventory, having found themselves stuck with a surplus that had lost value during the 2008 downturn.

Meanwhile, the financial crisis drove the banks to raise their compliance requirements via the Basel Accords — regulations that aimed to reduce the hazards of lending. Companies with tight margins and non-transparent practices — traits common in the diamond world — became less desirable clients.

Squeezing the midstream

All those developments created the perfect storm for the diamond midstream. It had to take on the industry’s inventory to satisfy retailers’ just-in-time needs and growing memo orders, while also tightening operations to appease the banks.

Of course, not all banks were on board. The trade in India had access to financing that other centers did not. Many non-specialist banks in the country took advantage of government incentives that aimed to support export industries. Lenders could get better interest rates if they allocated a certain percentage of loans to exports, and one way to reach those targets more quickly was to finance high-value diamond shipments. That created an uneven playing field: While companies in Belgium, Israel and the US were being squeezed by their lenders, companies in India had the funding to buy rough, helping strengthen the country’s position as the world’s largest manufacturing center.

The excess financing led to excess inventory and unsustainable rough prices. Miners continued to push rough onto the market at ever-rising prices, and manufacturers continued to buy, even as polished prices softened. Rough-market corrections occurred from time to time, but the cycle would inevitably start again. The latest round saw three new mines come onstream in 2017, adding some 6 million to 7 million carats to annual global production. The midstream’s polished inventory subsequently rose until the market could no longer sustain such high levels and such low-to-nonexistent profit margins. Polished supply peaked in 2019, and prices continued their long-term downward spiral.

A healthier state

It was under those circumstances that the trade began 2020. A rough-price correction was underway, and the industry was expecting further price declines even before the pandemic started. However, Covid-19 helped the industry restore the balance. The rough market froze during 2020’s second-quarter lockdowns, while polished sales continued online, enabling the midstream to reduce its inventory.

Still, as in 2008, the crisis accelerated a fundamental change in the way business was done, setting the scene for further midstream inventory adjustments. This time, Generation Z emerged as the driving force behind the market, with trends such as environmentally friendly and gender-neutral jewelry gaining traction. Consumers increasingly care about sustainability, and they are hyper-aware of online trends. That’s pushing jewelers to be selective again in their sourcing and more thoughtful in the collections they display. In addition, the digital revolution is empowering retailers to sell more while owning even less inventory.

Miners, for their part, have opted to lower supply rather than reduce prices. That policy will likely continue, as the pandemic-induced drop in global rough output is now setting a lower bar for the foreseeable future (see graph). Miners are also striving to supply according to demand, meaning there should be fewer excess goods floating about. We can expect rough prices to rise in this constrained supply environment.

Based on Kimberley Process data and Rapaport estimates.

All of that may put pressure on the midstream in the long term. Polished suppliers will continue to bear the inventory burden even as their costs rise. But they are better equipped to deal with that challenge because of the financing shifts that began in 2008 and intensified during the Covid-19 crisis. The drop in bank funding will hopefully keep rough prices in check and result in a more profitable trade going forward.

|

|

|

|

|

|

|

|

|

|

Tags:

Avi Krawitz, Basel Accords, COVID-19, De Beers, diamonds, Gen-Z, Jewelry, Millennials

|

|

|

|

|

|

|

|

|

|

|

|

|