With a rich history of over 275 years, the auction house has successfully adapted to the digital era and is appealing to tech-savvy collectors. Three of its senior jewelry executives discuss their strategies and the market.

With a rich history of over 275 years, the auction house has successfully adapted to the digital era and is appealing to tech-savvy collectors. Three of its senior jewelry executives discuss their strategies and the market.

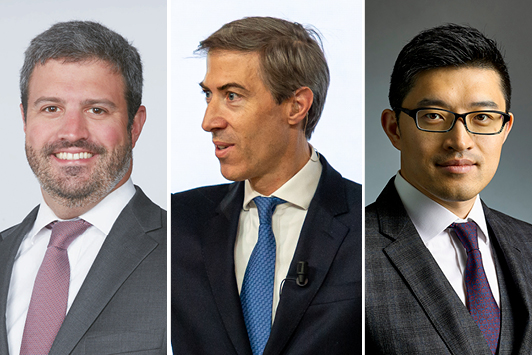

Quig Bruning

Senior Vice President, Head of Jewelry, New York

What has been the biggest development for the Sotheby’s jewelry department in 2021?

This is the case throughout our entire business: It is undoubtedly the digital transformation. Nothing will replace or replicate the individual connections and relationships we have with our clients, but the reach we’re able to achieve digitally is enormous. We’re able to interact with so many more clients in so many more locations, and our sales have benefited accordingly.

How does your cross-category approach answer the contemporary collector’s desires?

Our clients are, first and foremost, Sotheby’s clients. They’re not only looking to buy or sell jewelry, but rather, they’re looking across categories. The more we can integrate our sales into a client-centric approach, the more we can truly cultivate cross-category transacting. We’ve seen this in our Luxury Weeks in all of our locations, as we consolidate our division’s sales into a tight calendar and allow our clients to peruse multiple categories in one space at one time.

How have online sales and apps changed the way you connect with customers and conduct business?

Firstly, we’re able to connect with so many more clients than ever before. As many of them are self-serving, we’ve had to shift how we present our sales. Now we show multiple images of every lot, as well as worn images to show scale. We’ve also been able to — in partnership with our consignors — take some more risks. A great example is the 50-carat round diamond that we offered without reserve earlier this year. It ended up comfortably within its estimate range, selling to a private collector with whom our department had not previously worked.

How would you describe the demand for diamonds in 2021?

Way up, especially from 18 months ago. The number of bidders is higher, the prices are higher, and the interest seems to continue to climb. What’s been interesting is that pinks and blues, while they continue to dominate the market in terms of total value and per-carat prices, have grown relatively incrementally. White diamonds, on the other hand, have shot up. Part of that is a market correction from the doldrums of the first half of 2020, but there’s a spike in interest that we haven’t seen in over five years. We’ve also started to see a bump in yellow diamonds, which we anticipate will continue for the rest of the year.

What were the three key jewels that came up for auction at Sotheby’s New York this year?

In the Magnificent Jewels sale in June, there was a beautiful 23-carat, D, internally flawless, type IIa, emerald-cut diamond ring. We had priced it based on the existing diamond market, with a low estimate of just about $75,000 per carat. The final purchase price was almost $124,000 per carat. This ring showed just how strong the white-diamond market currently is. Interestingly, most of the bidding on this diamond was online, in advance of the auction.

In the Important Jewels: Part I sale in October, we knew a pair of beautiful Van Cleef & Arpels turquoise and diamond ear clips would exceed their $8,000 to $12,000 estimate, as they checked every box for the market: Turquoise is popular, they’re by Van Cleef & Arpels, they’re vintage, and they’re wearable. We certainly, however, didn’t expect them to go for 11 times their estimate! This shows the power of our online sales to capture exceptional prices.

As strong as diamonds are, colored stones are still a major driver of our auction market, and an amazing Tiffany & Co. no-oil emerald ring [that sold at the Magnificent Jewels sale in April] was no exception. The bidding was fast, furious and entirely global.

What makes a good auctioneer?

As an auctioneer myself, this is a loaded question! To me, there are a lot of qualities that good auctioneers must possess. They must be clear; auctions move at a rapid clip, so it must be immediately apparent who has the bid and at what level. They must be at once confident and welcoming — a tricky rope to walk, as one must at once manage a room that can get quite rowdy, while also trying to elicit every bid.

They must treat every lot as a unique transaction; my auctioneer mentor told me, before I ever got into a podium, that I had to remember that each lot we sell is important and special to its consignor, and we must treat them as such. And ultimately, the auctioneer must enjoy what he or she is doing. There’s no greater auction rush than being in the podium for an auction, and clients want to see that.

What is the main challenge the estate jewelry sector is facing?

Currently, I think the biggest challenge is simply keeping up with demand. But moving forward, it really is all about cultivating a new generation of buyers. We’ve done this in large part through our digital shift, and our growth in the under-50 demographic has been exponential, but we still need to continue to educate a new generation. One massive headwind that our industry faces is the fact that the larger market still doesn’t view jewelry as the art that it is. Why are there not more jewelry collections or curators in American museums? In a world where exceptional paintings routinely exceed $10 million, why should exceptional jewels not reach that same level? Once we as an industry can position jewelry as a tactile art, to be viewed and appreciated just as one does a work of art in a museum, then jewelry can continue to be exalted across the generations.

Olivier Wagner

Head of Sale, Senior Specialist, Geneva

How would you describe the Geneva auction scene? What makes it stand out?

There is a long-standing tradition of jewelry auctions in Geneva, especially since the record sale of the famous jewelry collection of the duchess of Windsor in 1987. Since then, Geneva has become the international center for major private collections, important gemstones or historical diamonds offered at auction. The discretion, high level of financial services, central location within Europe, safety and stability of Geneva has been appreciated by collectors who come every year in May and November for the week of sales, from all around the world.

How important is provenance?

Provenance is very important. Firstly, a jewel coming from a treasured private collection and fresh on the market will be more sought after than a piece which is known and which has already been offered on the market. Secondly, jewelry is very personal and intimately connected to the person who wears the jewels. If that person is a queen or a famous actress, the added value is what collectors will be ready to pay a premium for. The pearl from French Queen Marie Antoinette sold at Sotheby’s Geneva for over $36 million, 36 times its low estimate, during the historic Royal Jewels from the Bourbon Parma Family sale in November 2018. If the history and provenance are known and documented, it brings great added value. The trick is putting a value on something that is priceless.

What is the most exciting noble jewel you handled this year? What was its story?

A sapphire and diamond brooch and matching ear clips with Romanov provenance taken out of Russia for safekeeping during the 1917 revolution. They more than doubled their low estimate to sell for $884,972 (estimate: $300,000 to $500,000) during our Noble Jewels auction in Geneva this November. They belonged to the Grand Duchess Maria Pavlovna of Russia, the wife of Grand Duke Vladimir, son of the tsar. Her love for jewelry was legendary, and she had a fantastic collection.

How do you appeal to the younger demographics? What are they looking for?

Sotheby’s as a business has been working for some years to nurture and engage our base of younger clients, as they are the future. We have undertaken initiatives worldwide for curated and themed edits, cross-category presentation of our luxury categories, [and] collaborations with key influencers, focusing on online engagement and building our presence on the platforms that younger audiences are likely to engage with. [We have also been] showcasing jewelry as wearable art, providing an innovative and exciting buying experience with no-reserve lots and introducing non-fungible tokens (NFTs) to jewelry. Digital is inevitably best understood by younger generations who live more of their lives digitally.

The tastes of young clients have become more sophisticated. They are looking increasingly at different styles but searching also for pieces that offer good value. Signed jewelry pieces or fine colored gems perform particularly well.

How do you help customers appreciate unsigned pieces?

Until the beginning of the 19th century, jewels were rarely signed, and very often only the fitted case would bear the mark of a jeweler. Many antique pieces have survived, but without their cases, and therefore are often offered unsigned. However, the quality of manufacture and the design can be exceptional. It is also true for more modern pieces, which could have a special design or be set with a gemstone of top quality. An unsigned jewel can sometimes be more interesting in terms of design and therefore unique and more appealing than a signed piece or a design which has been reproduced many times. It is best to look at each jewel individually.

Do you think Covid-19 impacted supply and demand, and if so, how?

Interestingly, the demand for jewelry and gemstones has become stronger with the pandemic. Clients are looking for alternative investment and for something they can enjoy and wear at the same time, especially among a younger demographic group. The strong demand and high prices achieved motivates people to part with their jewels. Clients were able to take more time to thoroughly browse and participate in the sales, finding the perfect piece to start or add to a collection.

What is the most interesting or important piece of jewelry you have ever sold?

The sale in Geneva of the legendary Beau Sancy, once the property of Henry IV of France. It was a privilege to have handled this exceptional and historical diamond, which was owned by four European royal families over four centuries. The only true Golconda diamond, it was never repolished, and with its unusual double rose pear shape, it is a true marvel in terms of diamond cutting.

Wenhao Yu

Deputy Chairman of Jewelry, Asia

How important have online auctions become?

In Asia, the young and stylish generation loves the convenience of shopping online and the excitement of auctions. Sotheby’s has combined the two. Online auctions have now become an integral part of our auction platforms, with a 39% increase in online buyers.

What innovations have you implemented this year to appeal to this younger client base?

Aside from regularly using our digital channels to communicate to our audience, we also looked at ways to best showcase our lots so they best speak to a younger audience. In the Magnificent Jewels: Part II sale [in October], 20% of our lots were offered with no reserve — an exciting and new buying experience that is not available in retail. NFT is also a hot topic among this demographic — hence we brought the innovative concept of introducing NFTs to jewelry to the same sale, with a pair of earrings that accompanies an NFT by the Kröller-Müller Museum. [It included] a certificate of authenticity, video and image of the jewel as a narrative of the lot.

How is technology helping broaden your offering?

For jewelry, I would say our milestone is having worked with the Swiss Gemmological Institute (SSEF) and Gübelin Gem Lab to introduce a grading system to help set an industry standard for top-quality jadeite, with the vision of providing better guidelines and transparency for consumers and the trade. The term “imperial green” refers to those with a Grade A superior quality.

What do you see as the biggest challenge for the high-end estate jewelry sector in 2022?

Demand in Asia for high-end estate pieces has always been strong, and collectors in Asia have great respect for culture and history. I am always amazed by their desire to learn. We are working out new methods to present high-end estate jewelry digitally to the audience, with more educational and historical perspectives. Technology will play an important role in this trend.

What are the most popular lots at the Hong Kong sales? Did you see surprising items perform well this year?

Jadeite pieces generated a lot of interest this year, as we saw bidding for our main sales from Asia, the US and Europe. For the spring auction, we saw a sensational jadeite bangle — weighing 277.67 carats and described by the SSEF laboratory as “a true treasure of nature” — achieve $3.9 million. A unique jadeite bead, diamond and ruby necklace — composed of 47 slightly graduated, intense green jadeite beads — achieved $3 million, and a pair of imperial green jadeite earrings soared to $895,080 — a record for a cabochon imperial green jadeite (price per carat: $35,101), marking this as the highest-value lot sold to an online buyer in the sale. Three fine jadeite pieces were also among the most valuable jewels sold during the autumn auction.

How important is a signature for your clients?

Signature is important for our clients, but there is a growing number of collectors looking to invest from a design-driven perspective and not necessarily signed pieces. For example, a pair of gem-set diamond brooches sold for almost three times their high estimate at the recent Hong Kong sale. From the recent autumn sale [in October], we saw intense bidding on signed pieces by renowned jewelry houses, including Cartier, Harry Winston and Van Cleef & Arpels, achieving prices in excess of — and in some cases double or triple — their estimates. In particular, a Cartier pearl, diamond and pink-sapphire pendant necklace sold for an impressive HKD 2.3 million ($291,597) from an estimate of HKD 600,000 to HKD 800,000, while a 1930s Zip necklace by Van Cleef & Arpels made HKD 3.3 million ($421,195), with an estimate of HKD 1.2 million to HKD 2.2 million.

What types of diamonds have been in demand in 2021? What does this say about the health of the market?

Diamonds, particularly colored diamonds, continue to be in hot demand. The autumn sale was led by a fancy-vivid-blue and pink diamond ring that sold for $4.5 million, and a fancy-intense-green and white diamond ring achieved $3 million. Unmounted white diamonds of 20.88 and 30.88 carats also topped the list, as Asian collectors regard the auspicious number 8 as a symbol of luck and fortune.

What is the most interesting or important piece of jewelry you have ever sold?

There are quite a few! But I would say the key moment this year was when Sotheby’s set the highest price achieved for any jewelry or gemstone purchased with cryptocurrency. The exceptional 101.38-carat, pear-shaped, D-flawless [diamond] sold for $12.3 million to an anonymous private collector in a landmark single-lot auction [in July]. The Key 10138 diamond was one of the largest pear-shaped diamonds to appear on the public market [and] came from world-leading diamond company Diacore.

Image: Sotheby’sArticle from the Rapaport Magazine - December 2021. To subscribe click here.