|

|

Trade Uncertainty Clouds US Holiday Optimism

1ct. RAPI -3.6% in August

Sep 6, 2022 5:11 AM

By Rapaport

|

|

|

RAPAPORT PRESS RELEASE, September 6, 2022, Las Vegas… Diamond prices declined in August, reflecting caution in the trading centers and weakness in China. The US is supporting the market with solid demand from retail programs and steady memo calls from independent jewelers.

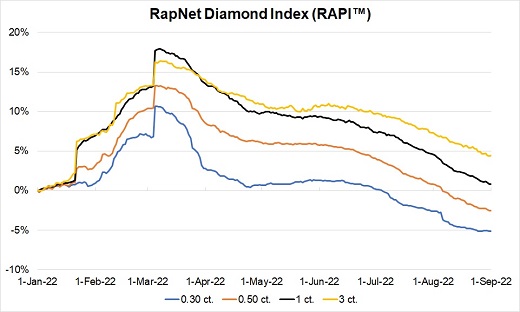

The RapNet Diamond Index (RAPI™) for 1-carat diamonds fell 3.6% in August. It was up 0.8% from the beginning of the year as of September 1.

| RapNet Diamond Index (RAPI™) |

|

August |

Year to date

Jan. 1 to Sep. 1 |

Year on year

Sep. 1, 2021, to Sep. 1, 2022 |

| RAPI 0.30 ct. |

-2.6% |

-5.2% |

-6.2% |

| RAPI 0.50 ct. |

-3.4% |

2.5% |

2.4% |

| RAPI 1 ct. |

-3.6% |

0.8% |

6.3% |

| RAPI 3 ct. |

-2.7% |

4.4% |

16.0% |

© Copyright 2022 by Rapaport USA Inc.

Polished inventory levels increased due to a slowdown in trading during the summer. There were 1.9 million polished diamonds listed on RapNet on September 1, 16% more than a year earlier. This was despite a drop in rough supply; Russia-sourced polished remained largely off the market due to US sanctions on Alrosa. The Russian miner is reportedly selling rough again at competitive prices, but at lower volumes than before the Ukraine conflict. Polished inventory will likely increase further as more Russian goods enter the market.

The secondary rough market saw premiums decline in August. Primary supply was expensive, fueling concerns about manufacturing profit margins. De Beers kept prices stable at its August sight, with $630 million in rough sales during the month. The decrease in Russian supply meant De Beers sold large volumes despite sightholder restraint.

Manufacturers are maintaining lower production due to a slowdown in overall demand. US retail programs and European luxury brands are still placing consistent orders. There are also steady memo calls with reasonable sell-through from independent jewelers. China remains weak as Covid-19 lockdowns and travel restrictions continue to have a negative impact on the country’s wholesale and retail sectors.

Activity in international trading centers has slowed due to price uncertainty and a drop in demand. Buyers are being selective and cherry-picking the top-quality diamonds they need to fill orders. While there is relative optimism for the US holiday season, dealers are hesitant to buy in a downward-trending market.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.diamonds.net.

Main image: Diamond jewelry. (Shutterstock)

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, jewellery, Jewelry, Rapaport, RapNet

|

|

|

|

|

|

|

|

|

|

|

|

|