|

|

Certified Diamond Prices Relatively Stable in August

RAPI For 1 Ct. Diamonds -9.5% in 2012

Sep 4, 2012 7:45 AM

By Rapaport

|

|

|

RAPAPORT... PRESS RELEASE, September 4, 2012, New York: Certified polished diamond prices were relatively stable in August, easing the steep declines witnessed in previous months. Dealers have sensed a restrained improvement in demand from Far East and Indian buyers ahead of the fourth quarter season but trading volume remains low. Jewelry retailers, who have been largely absent from the diamond market in 2012, started to inquire about goods again but have yet to resume significant buying. They are content to maintain low inventory levels and are monitoring whether price levels will hold steady through the September Hong Kong show.

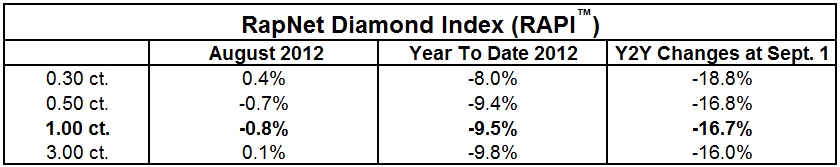

In August, the RapNet Diamond Index (RAPI) for 1 ct. certified diamonds fell 0.8 percent. RAPI for 0.3 ct. stones rose 0.4 percent while RAPI for 0.5 ct. diamonds declined 0.7 percent. RAPI for 3 ct. diamonds was basically flat, or up 0.1 percent, during the month.

During the first eight months of 2012, RAPI for 1 ct. diamonds fell 9.5 percent. RAPI for 1 ct. diamonds is down 16.7 percent from one year ago.

Copyright © 2012 by Martin Rapaport.

According to the just released Rapaport Research Report, “Fragile Improvement,” diamond markets were quiet for most of August but sentiment improved toward the end of the month. Indian diamond suppliers at the India International Jewellery Show (IIJS) were satisfied that the show met their low expectations, raising their hopes for the fourth quarter season. Indian and Far East buyers continue to focus on filling orders, but retailers have signaled some intention to raise their buying activity as they prepare for Diwali and India’s wedding season, and China’s week-long National Day holiday that begins on October 1. There is steady demand for inexpensive, lower-quality diamonds, while demand for better-quality stones remains weak.

Diamond miners have restricted production and withheld supply as sightholders rejected their high-priced De Beers and ALROSA rough in the May to July period. Sightholders welcomed the rough price reductions that took effect at the end of August as De Beers cut prices by about 10 percent. Cutters hope that cheaper rough will return profitability to the manufacturing sector and stimulate rough trading on the secondary market in the coming weeks. Diamond cutters have restricted manufacturing due to low profit and tight liquidity and hope that the recent rough price declines will relieve those pressures.

Expectations remain low for the Hong Kong show, beginning on September 19, but the trade is hoping the show will signal a return of Chinese diamond buyers to the market. While the Mumbai show, and the subsequent rough price reductions, helped lift market sentiment slightly at the end of August, steady Far East buying will indicate whether the better mood, and stable polished prices, can be maintained in the fourth quarter.

Read the Rapaport Research Report, “Fragile Improvement”, at www.diamonds.net/reports or email: specialreports@diamonds.net.

Rapaport Media Contacts: media@diamonds.net

International: Shira Topiol +1-702-425-9088 <> U.S.: Sherri Hendricks +1-702-893-9400 <> Mumbai: Manisha Mehta +91-97699-30065 <>

About the Rapaport - RapNet Diamond Index (RAPI): The RAPI is based on the average asking price in hundred $/ct. for the top 25 quality 1 ct. round diamonds (D-H, IF-VS2, RapSpec-2 and better) with GIA grading reports offered for sale on RapNet – Rapaport Diamond Trading Network. The RAPI is provided for various sizes. www.RAPNET.com has daily listings of over 970,000 diamonds valued over US$6.1 billion and 7400 members in over 80 countries.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added value services that support the development of free, fair and competitive global diamond markets. Established in 1978, the Rapaport Diamond Report is the primary source of diamond prices and market information. Group activities include publishing, research and marketing services, internet information and diamond trading networks, global rough and polished diamond tenders, diamond certification, quality- control, compliance, shipping, and financial services. Major activities of the group include the development of markets for Fair Trade Diamonds and Jewelry as well as the creation of diamond futures markets. Additional information is available at www.Rapaport.com.

Martin Rapaport (Publisher) grants limited permission to use copyrighted data appearing in this press release in and in conjunction with journalistic copy, reporting or articles concerning diamond pricing and information in graph or data presentation format only. The following credit notice must appear alongside, underneath, or in close proximity to any use of the copyrighted data: “Used with permission of Rapaport USA, Inc. Copyright © Martin Rapaport. All rights reserved.”

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, DTC, Rapaport, RAPI, RapNet, RapNet Diamond Index

|

|

|

|

|

|

|

|

|

|

|

|

|