|

|

Niru Group, EZ Diamonds Join Forces

Dec 26, 2018 4:46 AM

By Avi Krawitz

|

|

|

RAPAPORT... Two of the largest suppliers of better-quality, small polished diamonds have combined their operations, signaling further consolidation in the diamond-manufacturing sector.

A joint venture between Niru Group and EZ Diamonds will bring EZ’s supply of round diamonds below 0.70 carats into Niru’s infrastructure, the companies announced this week. Niru will adopt EZ’s online portal, and part of EZ’s sales and operations team will move to Niru’s offices in New York, Ramat Gan and Hong Kong. The companies plan to expand their product offering to include fancy-cut diamonds in the future.

“We saw synergies in our businesses and realized we can consolidate our strengths to create a win-win for everyone, including our customers,” Rakesh Barmecha, president of Niru Group, told Rapaport News.

Following the agreement, EZ Diamonds will focus on its Swiss subsidiary, Voegeli & Wirz, which supplies high-end polished diamonds to the watch industry. “We’ll continue to work with the brands, while our independent [retail] customers will get the same value-added service through Niru,” explained Orit Samet, CEO of EZ Diamonds.

The deal won’t affect EZ’s manufacturing operations in Panyu, China, where it polishes diamonds for Voegeli & Wirz at a factory in which it has part ownership. Meanwhile, Niru expects its workforce at its facility in Sri Lanka to increase from 1,300 to 1,500 in the first quarter of 2019 as a result of the joint venture, Barmecha said. Both companies remain De Beers sightholders, while Niru also has a rough-supply contract with Alrosa.

Barmecha forecasts Niru’s turnover will rise by a double-digit percentage next year, after sales were in line with growth expectations in 2018. Niru ranked as Israel’s third-largest exporter of polished diamonds in 2017, with shipments valued at $116 million, according to the country’s Ministry of Economy and Industry.

The weakness reported in demand for small diamonds this year affected the lower end more than it did the better-quality goods that Niru supplies, Barmecha explained. Growth is being driven by strong macroeconomic fundamentals in the global economy, with a third of Niru’s sales generated in each of the US, Europe and the Far East.

He sees the rising acceptance of lab-grown diamonds as the biggest challenge facing the segment in the coming years, which will put additional pressure on the trade.

That, along with other factors, will lead to further consolidation among diamond manufacturers and wholesale suppliers, Barmecha and Samet both predicted. Earlier in 2018, Indian manufacturer Rosy Blue bought a minority stake in Israel-based Leo Schachter, while miner Alrosa is close to buying Russian diamond cutter Kristall, as reported by Rapaport News this week.

“Our industry is shrinking, and consolidation is inevitable,” Samet stressed.

Niru will try to take advantage of that trend by launching additional joint ventures in the future, Barmecha said.

“There’s no way to exist with the expenses we face and the way the market is trending. We have the infrastructure in place so the joint ventures don’t add to our costs,” Barmecha explained. “Our deal [with EZ Diamonds] is reflective of a mature market in which bigger and stronger players will be the ones who survive.”

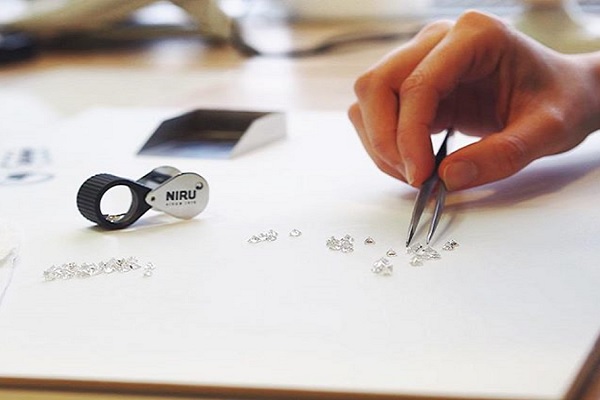

Image: A worker inspects diamonds at Niru. (Niru Group/Instagram)

|

|

|

|

|

|

|

|

|

|

Tags:

acquisitions, Alrosa, Avi Krawitz, De Beers, diamonds, ez diamonds, Israel, Jewelry, Joshua Freedman, mergers, mergers and acquisitions, Niru Group, Orit Samet, Rakesh Barmecha, Small diamonds

|

|

|

|

|

|

|

|

|

|

|

|

|