RAPAPORT... In 2100,

the diamond industry will look vastly different from its current makeup, Martin

Rapaport assured diamantaires at the recent Antwerp Rough Diamond Days event. Most

notably, it will be less influenced by the mining companies as demand dynamics

increasingly impact the market, the chairman of the Rapaport Group noted.“Market

power is shifting from supply to demand,” Rapaport explained at the November 21

event, which coincided with the Antwerpsche Diamantkring bourse’s 90th

anniversary. “In the next 90 years, diamond-mining companies will not have

market power. They probably won’t even exist, as diamond mining will be very

limited.”

When

rough supplies are reduced, and eventually eliminated from the open market,

recycled diamonds, gems and jewelry will emerge as the primary source of

supply, with elderly consumers selling and young ones buying. That will result

in a more profitable diamond and jewelry trade, as “unconstrained free-market

supply becomes available from motivated sellers,” Rapaport continued.

Gift

of commitment

Meanwhile,

on the demand side, growth will be driven by demographics as the global

population is projected to rise by 40% to 10.9 billion people by 2100, and

middle-income earnings will rise by 24% to $7.08 trillion, according to United

Nations forecasts Rapaport cited.

With

those predictions in mind, the challenge for the diamond industry is to ensure

that diamonds remain a symbolic gift of commitment. “The gift of a diamond

engagement ring is a social contract and the idea of a social contract at a

time of commitment is a cultural requirement that transcends generations,” he

explained. “It will be as relevant in 2100 as it is today.”

Ensuring

the continuation of diamond demand into the next century requires maintaining

an honest and liquid diamond market that provides fair value to buyers and

sellers.

Riches

in the niches

The

long-term viability of the diamond trade, particularly for dealers, was an

issue he emphasized in a presentation at the New York Diamond Dealers Club the

previous week. Rapaport recognized the turmoil the diamond industry currently

faces, as profits and liquidity are disappearing.

Midstream

profit margins are being squeezed by the mining sector, which can only improve

its profit by raising rough prices, while manufacturers keep buying the rough

so they can keep getting credit, he noted.

At the

same time, consumer demand has narrowed, in part due to a shift toward branding

and a lack of generic marketing over the past decade or two. Instead of trying

to sell diamonds to everybody, companies have decided to sell diamonds in areas

where you can make the most money, which is by having a brand.

As

dealers are in the generic business, they need to create a niche that

differentiates them — whether in a certain cut of

diamonds, or goods with strong blue fluorescence, for example. “The riches are

in the niches,” he stressed.

Finding

a niche is not so easy considering the midstream is being further squeezed by

“disintermediation” — the phenomenon in which suppliers

cut out the middleman by selling directly to the consumer. It’s worse than that,

since everybody’s supplier’s supplier is trying to sell the customer’s customer,

Rapaport continued. “De Beers is opening up jewelry shops and Tiffany is

cutting diamonds,” he noted.

A critical

mass

Despite

this trend, Rapaport stressed that dealers still added value to the

distribution chain. “Brands are selective, but they still need goods,” he emphasized

in New York. “There’s no way a retailer can keep an inventory of all the items

that are necessary and so dealers become the retailer’s lifeblood.”

As such,

Rapaport outlined an opportunity for the New York trade to make money: Becoming

a very efficient source of memo goods for the US market. The key role of

diamond dealers is to move the entire range of diamond types and quality down

the pipeline: “That’s how dealers make money. They find the right diamond, for

the right person, at the right location, at the right time, and at the right

price,” he added.

Similarly,

diamond manufacturers need dealers as a source of liquidity, because if dealers

don’t buy their polished, cutters might lose their credit lines, and therefore

their ability — or contract — to buy rough.

“Don’t

underestimate the power of the dealers, or our power as a group of committed

people working together in an industry,” Rapaport concluded at his New York

presentation. “We have a critical mass. There is added value coming from the simple

fact that we’re all together.”

Maintaining

that vibrant trade will be crucial for the future of the diamond market over

the next 90 years, he added in Antwerp. “The ability of diamonds to retain

value is in the hands of the diamond trade,” Rapaport stressed. “It is the responsibility

of the diamond trade to ensure liquid, fair markets for natural diamonds.”

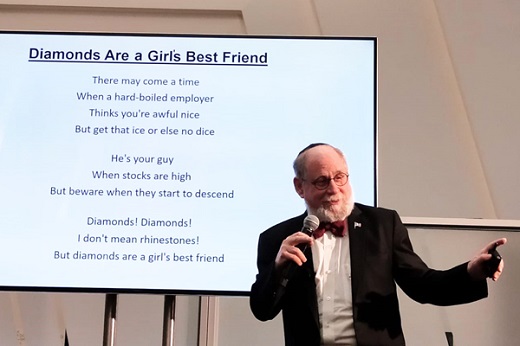

Image: Martin Rapaport, chairman of the Rapaport Group, delivers a presentation on the future of the diamond industry in Antwerp last week. (Rapaport News)

|