|

|

Not Enough Rough

Jul 29, 2021 9:01 AM

By Avi Krawitz

|

|

|

RAPAPORT... Alrosa is not used to buying diamonds. As the largest producer of rough by volume, the Russian miner accounts for about one-quarter of global supply and is therefore second only to De Beers in setting the tone for the market. RAPAPORT... Alrosa is not used to buying diamonds. As the largest producer of rough by volume, the Russian miner accounts for about one-quarter of global supply and is therefore second only to De Beers in setting the tone for the market.

It was therefore somewhat unusual that Alrosa bought the majority of rough at an auction held by Russia’s state gem repository Gokhran in July. The company is usually a seller to Gokhran when it has excess inventory to offload. This time, Alrosa needed to fill inventory gaps ahead of its July sale. In other words, it didn’t have enough rough to meet demand.

This strange scenario was another indication of how strong the rough market has been in 2021. Furthermore, Alrosa raised prices an estimated 7% at its subsequent sale, according to customer reports to Rapaport News. That adds to the 16% hikes it implemented in the first half of the year. Similarly, De Beers’ price index rose an average 14% in the six-month period, parent Anglo American noted in its interim earnings report on Thursday, and raised them another estimated 5% in July, according to sightholders.

The miners point to the retail recovery in the US, where pent-up demand, high savings and government stimulus have consumers spending on gift items again. Manufacturers, meanwhile, are wondering how sustainable the rough-market dynamic is. But, needing to fill polished orders, they continue to buy.

All that makes sense as demand has staged a remarkable comeback from the coronavirus crisis of 2020. However, there is also a supply issue at play. Could it be that production is too low?

It appears that diamond production has peaked, and a new lower bar has been set for the number of carats coming out of the ground. “The lack of new diamond projects means supply is likely to be flat or declining for the foreseeable future,” Anglo American said.

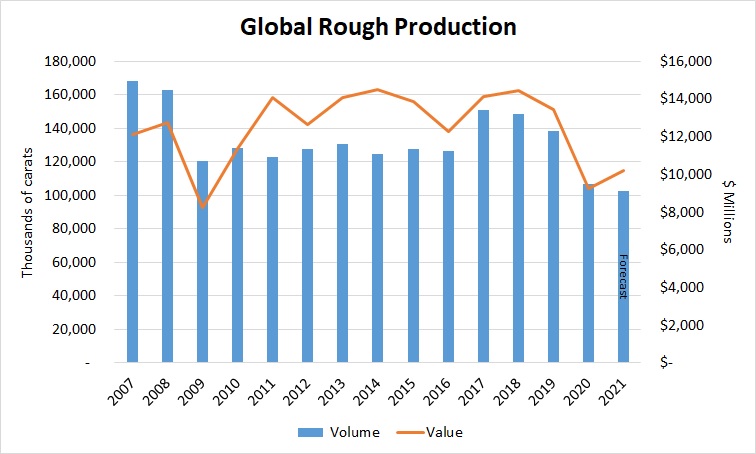

Global rough output fell 23% by volume to 107.1 million carats in 2020 and by 31% in value terms to $9.24 billion, according to Kimberley Process (KP) data published in early July. And while value is anticipated to increase by more than 10% in 2021 — boosted by higher prices — volume is projected to decline about 4%, according to Rapaport estimates (see graph).

Based on data from Kimberley Process and Rapaport estimates for 2021.

For now, Covid-19 continues to affect the mining sector, with sporadic outbreaks of the virus disrupting operations. That occurred at the Ekati mine in June, while some mines, such as Gahcho Kué, remained shut for longer than expected at the beginning of the year. Production at Alrosa’s Zarya and Zarnitsa pipes was suspended for 14 months through June 2021, although both operations have since resumed.

De Beers also experienced operational challenges from heavy rainfall and electricity issues in the first quarter, which brought about lower production than it initially planned. And arguably most significantly, the Argyle mine in Australia closed last November, taking annual production of between 10 million and 20 million carats off the market.

Perhaps that sheds some light on the buoyancy of rough this year. While retail sales and polished demand have returned to pre-pandemic levels, rough production is at a historic low.

The scenario that for years has been marketed to investors about the long-term value of diamonds is now playing out — rising demand and stagnant supply should boost rough prices and sales for mining companies. And that should further support polished values.

While many are questioning whether the recent polished price increases are sustainable, manufacturers say they cannot reduce prices due to their high rough costs. And if rough production is limited compared to demand, the miners may yet be able to uphold current rough-price levels.

De Beers explained that in the first half of 2021, robust demand, combined with supply constraints arising from production challenges, created a favorable dynamic that also supported higher rough-diamond prices. Perhaps that will continue in the second half, too, when demand typically rises for the holiday season.

With no major deposits set to come on stream, it may also represent a new normal for the long term. It’s little wonder the mining companies are suddenly preaching efficiency to the market. The supply chain is indeed going to get tighter. And that’s a scenario that bodes well for anyone who can get their hands on rough — even if it means dipping into state treasures.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Anglo American, Avi Krawitz, De Beers, diamonds, Jewelry, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|