|

|

Diamond Market Uncertain During Summer Slowdown

1ct. RAPI -2.6% in July

Aug 2, 2022 5:18 AM

By Rapaport

|

|

|

RAPAPORT PRESS RELEASE, August 2, 2022, Las Vegas… Diamond trading slowed in July as US dealers closed for the two-week summer break. Economic and geopolitical uncertainty fueled caution, leading to a decline in polished prices.

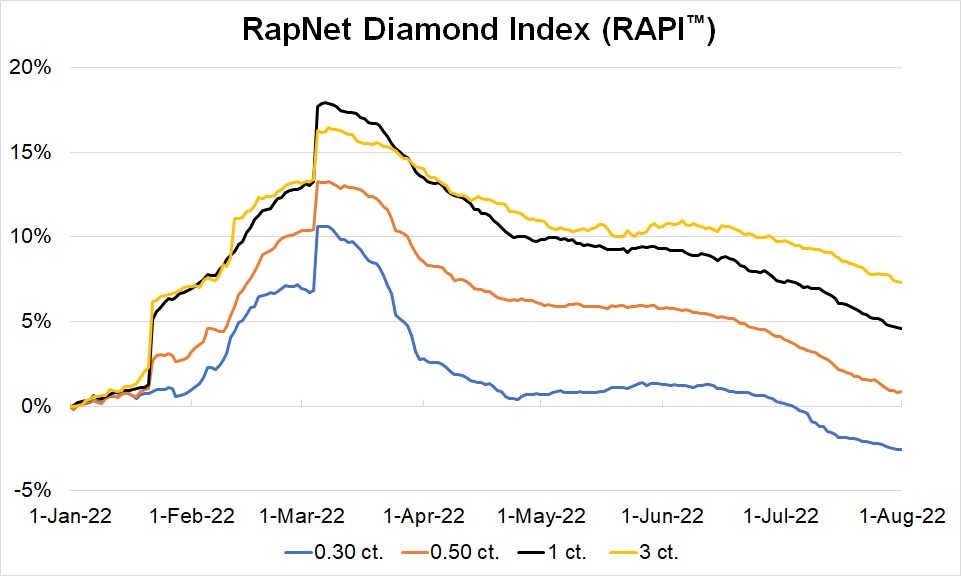

The RapNet Diamond Index (RAPI™) for 1-carat goods fell 2.6% during July but remained 4.6% higher than at the beginning of the year.

| RapNet Diamond Index (RAPI™) |

|

July |

Year to date

Jan. 1 to Aug. 1 |

Year on year

Aug. 1, 2021, to Aug. 1, 2022 |

| RAPI 0.30 ct. |

-2.8% |

-2.6% |

-5.0% |

| RAPI 0.50 ct. |

-3.1% |

0.8% |

0.1% |

| RAPI 1 ct. |

-2.6% |

4.6% |

10.4% |

| RAPI 3 ct. |

-2.2% |

7.3% |

19.5% |

© Copyright 2022, Rapaport USA Inc.

Manufacturing centers were quieter due to high rough prices and reduced polished demand. US dealers stayed resilient despite economic concerns, receiving steady short-term memo orders from jewelers.

US disposable income was under pressure. Consumer confidence dropped as inflation rose to 9.1% and the Federal Reserve hiked up interest rates by 0.75 percentage points in July. Yet jewelry retail continued to improve compared to 2021. June jewelry sales were up 16% year on year, according to Mastercard. European luxury brands reported stellar first-half results. Chinese jewelry performance decreased due to ongoing Covid-19 disruptions and economic weakness.

Concerns also mounted over rough supply. Global rough sales were down since March following US and European sanctions on Alrosa and restrictions on Russian banks. Alrosa’s absence has spurred demand for non-Russian production; De Beers and Rio Tinto saw significant growth and higher prices in the first half. De Beers’ rough price index ended that period 28% above 2021’s first-half levels.

Polished inventory remains high. The number of stones listed on RapNet as of August 1 was 24% greater than a year earlier. The record volume indicates that the lack of Alrosa goods has yet to impact the polished market. Strong rough buying in the first quarter made for enough polished to satisfy demand in the subsequent months.

The polished sector may start feeling the absence of Russian supply later in the third quarter, as Alrosa’s post-sanctions production will not be available. Short-term expectations have declined due to economic caution and the drop in polished demand. Sentiment is weak and the trade anticipates a slow third quarter, but there is optimism for the holidays.

Rapaport Media Contacts: media@diamonds.net

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.diamonds.net.

About the Rapaport Group: The Rapaport Group is an international network of companies providing added-value services that support the development of ethical, transparent, competitive and efficient diamond and jewelry markets. Established in 1976, the group has more than 20,000 clients in over 121 countries. Group activities include Rapaport Information Services, providing the Rapaport benchmark Price List for diamonds, as well as research, analysis and news; RapNet, the world’s largest diamond trading network; Rapaport Trading and Auction Services, the world’s largest recycler of diamonds, selling over 400,000 carats of diamonds a year; and Rapaport Laboratory Services, providing Rapaport gemological services in India and Israel. Additional information is available at www.diamonds.net.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, De Beers, diamonds, Jewelry, Rapaport

|

|

|

|

|

|

|

|

|

|

|

|

|