|

RAPAPORT... Capgemini and RBC Wealth Management released its annual World Wealth Report for the year 2013 and found that the world’s high-net-worth-individuals (HNWIs), or those with $1 million or more in investable assets reached a new high of 12 million in 2012. HNWIs benefited from strong stock market returns and they expressed a high degree of confidence in being able to generate new forms of wealth this year and in the future.

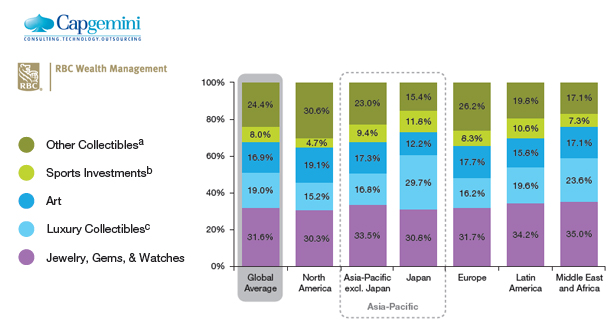

Already for the first quarter of 2013, jewelry, gems and watches remained the HNWIs' most preferred ''investment of passion'' for a second year, representing 31.6 percent of allocated funds. According to the report, collectibles, such as coins, wine and antiques, accounted for 24.4 percent of investment, while luxury automobiles, boats and jets accounted for 19 percent of allocated passion investments. HNWIs reserved 16.9 percent of allocated passion funds for artwork and 8 percent for sports-related investments. (Story continues after the chart.)

The report concluded that art remains one of the most dynamic passion markets, especially in the emerging economies and is increasingly becoming a meaningful element of HNWI portfolios. Given the demand, the art market is lively compared to other categories that are characterized more by inheritance and private sales. HNWI buyers who purchase art for the first time account for almost 20 percent of contemporary art sales, with many of these new buyers coming from the U.A.E., Mexico, China and Brazil.

Other data from the annual report found that HNWIs' aggregate investable wealth increased 10 percent year on year to $46.2 trillion in 2012, after declining slightly in 2011. There were also relatively stronger growth rates for higher wealth bands, or those with $5 million or more in assets, and this led the growth of overall investable wealth globally.

North America and the Asia-Pacific regions, the two largest for HNWIs, drove global growth, expanding 11.5 percent and 9.4 percent, respectively. North America reclaimed its position as the largest HNWI market with a market share of 3.73 million HNWIs to Asia-Pacific’s 3.68 million. Capgemini and RBC expect HNWI wealth to grow by 6.5 percent annually to $55.8 trillion by 2015, driven mainly by growth in Asia-Pacific.

Authors of the report concluded that U.S. stock markets performed ''admirably in 2012 amid signs of a U.S. recovery aided by repeated Federal Reserve interventions and rising home prices.'' Every measure of the market was upbeat and dividend-paying companies and multinational blue chips delivered.

In Asia-Pacific, equity markets responded well to aggressive monetary policy moves, while in India, reform measures and monetary easing helped equity markets gain 23.9 percent. Strong exports in South Korea partly contributed to a 20.2 percent gain and Chinese markets rallied during the second half to post gains of 19 percent. Japan also fared well with a 5.8 percent gain as the newly elected government pledged to turn around the ailing economy.

In Europe, stock market performance was mixed, with stronger markets outperforming and weaker ones contracting. The ECB’s intervention buoyed the more stable markets and attracted investors drawn to the cheaper valuations, according to the report. Benchmark indices grew 27.2 percent in Germany, 17.7 percent in France, and 8.6 percent in Italy. Even though the peripheral economies rallied with the central bank intervention, they still ended up with negative growth for the year as they continued to suffer from excessive debt and economic inactivity.

Latin America was the only exception to the equity growth as lower prices for commodities and slow economic growth in Brazil weighed heavily on performance. Only Mexico, which benefited from the resilience of the U.S. economy and posted a gain of 27.1 percent, according to the report.

|