|

|

US Trade Confident as Polished Imports Surge

Apr 3, 2019 8:33 AM

By Joshua Freedman

|

|

|

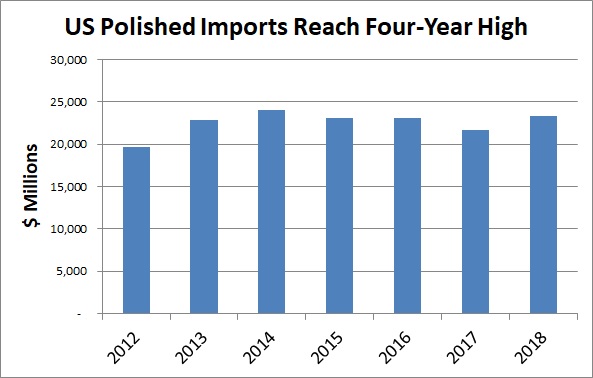

RAPAPORT... Dealers expressed optimism for the US diamond market

after polished imports rose last year to their highest level since 2014.

Shipments to the country jumped 8% to $23.3 billion in

2018, according to the US Census Bureau, despite more modest growth in consumer

sales. That indicates the industry may be sending large quantities of goods to

the US in anticipation of future demand, traders noted.

“The US is still the [most important] marketplace for

luxury items, and namely diamonds,” said Bruno Scarselli, a partner at

Scarselli Diamonds, a New York-based supplier of high-end colored diamonds. “There

are less restrictions doing business in the US than there are elsewhere in the

world.”

Markets such as Hong Kong and India can present

difficulties when it comes to bureaucracy and speed of payment, so traders prefer

to sell to the US, where they can receive cash faster, he added.

Retail potential

The growth in US polished imports in 2018 also reflects

the strength of the jewelry retail market, which continues to show “vibrant

potential,” Scarselli stressed.

The US retail market grew in 2018, with sales of diamond jewelry in North America climbing 4% for the full year, according to research by diamond miner Alrosa. However, demand faltered in the second

half due to political uncertainty and stock-exchange volatility, De Beers noted in February.

“Based on the last several months’ business performance,

we are anticipating continued growth in 2019,” said Stanley Zale, vice

president of diamond and gemstone procurement at Stuller, a Louisiana-based

diamond and jewelry wholesaler. “I’d be cautiously optimistic. There are so

many unanswered questions in the US political environment, and that could have

an impact on business.”

Best possible market

Still, dealers observed a shift in the diamond trade

toward the US as they continue to express uncertainty about the Far East.

The US is taking in a large quantity of the diamonds that

previously flowed to China when demand in that country was stronger, noted

Hertz Hasenfeld, president of New York-based polished manufacturer Hasenfeld-Stein.

Indian companies are increasingly targeting America with sales initiatives, and

many are opening offices that they could very well be stocking with goods, he added.

India remained America’s largest source of polished goods

last year, with its exports to the US increasing 11% to $9.09 billion, according to the Census Bureau. Supply

from Israel grew 6% to $7.56 billion, while Belgium’s shipments slipped 3% to

$2.93 billion.

“There’s no doubt that the market right now is the US,”

Hasenfeld stressed.

“The world is preparing to assault the best possible

retail marketplace that exists,” Scarselli added.

US Diamond Trade Data for 2018

| Millions unless stated otherwise |

2018 Full Year |

Change |

| Polished imports |

$23,296 |

8% |

| Polished exports |

$19,471 |

8% |

| Net polished imports |

$3,825 |

6% |

| Rough imports |

$609 |

-43% |

| Rough exports |

$478 |

-49% |

| Net rough imports |

$131 |

7% |

| Net diamond account |

$3,956 |

6% |

| |

|

|

| Polished imports: volume |

9.9 million carats |

1% |

| Average price of polished imports |

$2,355/carat |

7% |

Source: US Census Bureau; Rapaport archives

About the data: The US, the world’s largest diamond retail market, is a

net importer of polished. As such, net polished imports — representing polished

imports minus polished exports — will usually be a positive number. Net rough

imports — calculated as rough imports minus rough exports

— will also generally be in surplus. The nation has no operational diamond

mines but has a manufacturing sector, so normally ships more rough in than out.

The net

diamond account is total rough and polished imports minus

total exports. It is the US’s diamond trade balance, and shows the added value

the nation creates by importing — and ultimately consuming — diamonds.

Main image: A jewelry store in New York’s diamond district. (Shutterstock)

|

|

|

|

|

|

|

|

|

|

Tags:

america, Average Price, Belgium, Bruno Scarselli, data, diamonds, Far East, Hasenfeld-Stein, Hertz Hasenfeld, India, Israel, Joshua Freedman, Louisiana, net diamond account, net polished imports, Net rough imports, new york, polished exports, polished imports, rough exports, rough imports, Scarselli Diamonds , shipments, Stanley Zale, stuller, trade data, US, US trade, wholesale

|

|

|

|

|

|

|

|

|

|

|

|

|