|

|

Petra Revenue Falls to Nine-Year Low

Jul 26, 2020 7:26 AM

By Rapaport News

|

|

|

RAPAPORT... Petra Diamonds’ full-year sales dropped to their lowest level in almost a decade as the coronavirus aggravated an already weak rough market.

Revenue fell 36% to $295.8 million in the fiscal year ending June 30, reflecting sluggish rough prices between July 2019 and February 2020 and a significant downturn during this year’s Covid-19 pandemic, the company explained. Sales volume declined 23% to 2.9 million carats, it reported last week.

Petra, which recently put itself up for sale, hasn’t seen revenues this low since fiscal 2011, before its Finsch mine in South Africa came onstream. While annual sales increased steadily following its acquisition of the mine from De Beers that year, the company’s performance has stumbled in the past two years amid uncertain diamond demand.

The global slowdown has almost frozen Petra’s sales, which totaled just $10.5 million in the fourth fiscal quarter, with the company canceling its May and June tenders because of weak demand and travel restrictions. Its rough-diamond inventories soared 61% to 1.4 million carats as of June 30, compared with 842,144 carats three months earlier.

“The unprecedented impact of Covid-19 has significantly reduced activity throughout the diamond-market pipeline, from production, rough sales, trading, cutting and polishing, right through to consumer sales,” the company noted.

In that context, Petra is seeking a buyer for all or parts of its business, while also negotiating with lenders to restructure its heavy debt. It missed a bond repayment in May, and saw its net debt rise to $658 million as of June 30, from $601 million on March 31.

Production fell 7% to 3.6 million carats for the year, reflecting Covid-19 disruptions at its Cullinan, Finsch and Koffiefontein mines in South Africa, as well as the temporary shutdown of the Williamson mine in Tanzania in April.

Since the end of the fiscal year, Petra has sold 574,000 carats for $36.4 million, mainly through agreements with long-standing customers, it said. The company plans to hold its next tender in September, subject to market conditions and social-distancing rules.

One worker at Cullinan has died in relation to the virus, while 39 employees have tested positive across its South African operations, the company also announced. Most are experiencing mild symptoms.

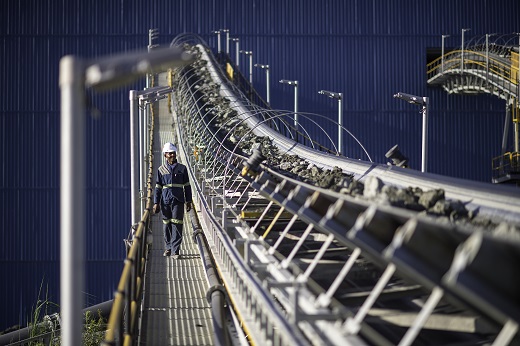

Image: The processing plant at the Cullinan mine in South Africa. (Petra Diamonds)

|

|

|

|

|

|

|

|

|

|

Tags:

Coronavirus, COVID-19, Cullinan, Finsch, Koffiefontein, mining, petra, Petra Diamonds, Rapaport News, Rough Diamonds, rough market, rough sales, South Africa, tanzania, Williamson

|

|

|

|

|

|

|

|

|

|

|

|

|