|

|

Trend Report: Covid-19 Driving Move to Digital

Jewelers are preparing their holiday marketing with an emphasis on e-commerce, part of a notable shift in the industry toward embracing online solutions

Sep 24, 2020 5:47 AM

By John Costello

|

|

|

Las Vegas, September 24, 2020

As the diamond industry begins its recovery from the initial impact of Covid-19, its once-lagging progress toward digital is being vastly accelerated.

While this will not be a rapid transition for a trade that has traditionally thrived on face-to-face networking and handshakes, a growing number of companies are putting increased resources into focusing on their online capabilities.

With COVID-19 unlikely to vanish any time soon and further outbreaks possible, businesses within the diamond and jewelry sector will face increasing pressure to develop and refine their digital strategies. Online marketing and sales will be a key element of these efforts and an important driver of growth, particularly during the upcoming holiday season.

The key trends Rapaport has observed in this area since the emergence of the pandemic have been:

Impressive Online Retail Sales

Digital Auctions Breaking Records

Trade Shows Forced to Reinvent Themselves

Rough Suppliers Seeking to Boost Efficiency

Growth of Online Trading Platforms

Impressive Online Retail Sales

While retail revenue plunged due to enforced closures during the pandemic, online sales became a silver lining for stores looking to generate alternative channels to compensate for the dramatic drop in business.

Tiffany & Co.’s e-commerce sales rose 123% during the three months that ended July 31. The segment accounted for 15% of the company’s total revenue in the first half of the year, compared to an average of about 6% annually in the past three years. Its overall group revenue, however, fell 29% to $747 million due to the lockdown of its retail stores.

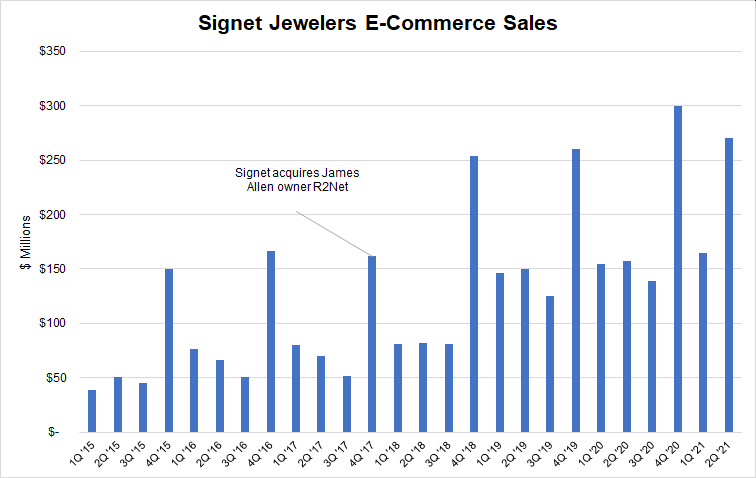

Signet Jewelers also saw overall in-store sales enter free fall, dropping 35% to $888 million for the quarter ending August 1. However, the retail giant’s online sales grew 72% to $270 million (see graph), accounting for 30% of the group’s total — up from an 11% share a year earlier.

Based on reports by Signet Jewelers.

E-commerce may have jumped by more than usual during the quarter as the Covid-19 shutdowns forced consumers to shop online. But while online sales are expected to account for a lower percentage once the market returns to normal (Signet’s figures for August, when stores were beginning to open again, showed the proportion of e-commerce sales at around 20%), companies are likely to continue investing in and marketing their online offerings to counteract any future Covid-19 outbreaks or enforced lockdowns as winter looms.

Digital Auctions Breaking Records

While some stores were able to offset at least some of their losses with improved online sales, auction houses appeared to fare better than retailers in pivoting to a digital-only presence.

Christie’s led the way on June 30, when it established a new record for a jewel sold in an online-only auction. The emerald-cut, 28.86-carat, D-color, VVS1-clarity, type IIa diamond ring garnered $2.1 million, beating its $2 million high estimate at the Jewels Online sale. After the auction, Christie’s said the $4 million in total sales demonstrated greater client confidence in its digital ability and online sales platform.

| The emerald-cut, 28.86-carat diamond ring that garnered $2.1 million at Christie’s, marking a new record for the most expensive jewel sold in an online-only auction. (Image: Christie’s) |

Sotheby’s also made a successful transition to online auctions with its Magnificent Jewels series. “The past eight months have been transformative for our luxury division, and in particular for our online jewelry sales, which have grown exponentially,” said Josh Pullan, Sotheby’s managing director for the global luxury division.

To capitalize on the “unprecedented results” of its digital offerings, Sotheby’s recently announced it was launching a new series of weekly online sales.

Trade Shows Forced to Reinvent Themselves

The pandemic has also forced trade fairs to embrace a digital presence. The Virtual JCK Show — which ran in early August to replace the canceled Las Vegas event — had its faults, but the event organizer said it planned to develop a hybrid model for future trade shows, incorporating both online and physical elements.

Baselworld, in an attempt to revive its flagging fortunes, launched a rebranded trade show, which it has named Houruniverse. It will run virtually throughout the year and feature an annual live event.

The Jewellery & Gem World Hong Kong fair was initially rescheduled from September to November because of the pandemic, but the physical event has since been canceled. It will instead run as an online show, J&G Digital World, from October 27 to 29.

Rough Suppliers Seeking to Boost Efficiency

De Beers, which is no stranger to changing strategy, is looking to emerge from the Covid-19 crisis a sleeker, more flexible and more tech-savvy organization. The overarching approach is to utilize data and technology to increase the efficiency of its diamond supply chain, explained Stephen Lussier, executive vice president for consumer and brands at De Beers.

Other miners have turned to digital means to stimulate rough sales. Alrosa introduced an online auction for its large rough diamonds in an effort to minimize disruption during coronavirus-related travel restrictions. The Russian miner has been working with Sarine Technologies to let buyers view the rough remotely before making a bid.

Growth of Online Trading Platforms

The initial impact of Covid-19 brought the diamond industry and dealer activity to a standstill. The cancellation of trade shows and international travel caused the traditional face-to-face sales and handshakes that are the lifeblood of the industry to evaporate overnight. Limitations on shipping goods further curbed trading.

Those factors spurred a significant shift toward promoting online trading platforms as the one effective outlet for doing business, both during the pandemic and beyond. The World Federation of Diamond Bourses (WFDB) adopted the Get Diamonds platform in an attempt to offer an alternative to the industry-leading RapNet, while other platforms such as Uni, Idex and VDB ramped up their marketing efforts.

| RapNet has seen a significant rise in the number of searches, which now

exceed pre-pandemic levels. |

By mid-year, RapNet had recaptured a large amount of the activity it had lost in the initial coronavirus market slump, with listings of over 1.2 million diamonds valued at approximately $6.3 billion as of press time on September 24. The number of searches conducted on RapNet currently exceeds pre-pandemic levels (see graph). Due to the business closures the pandemic has enforced, the return to strong activity on RapNet signals an increased reliance on online trading.

Many Challenges Ahead

While there is hope of a Covid-19 vaccine becoming available over the next few months, it will take a significant amount of time before enough people are inoculated that populations can reach herd immunity. It is therefore likely that this coronavirus will be with us during 2021, and maybe beyond.

As such, there is immense pressure on businesses to withstand not only lockdowns, but also a lack of enthusiasm on the part of consumers, who are reluctant to go back to stores while the virus is still at large.

While the industry knows that digital sales and interacting with customers online will become an increasingly critical part of its business, the investment and planning involved will not be an easy transition for many.

One thing is for sure: Once Covid-19 is truly tamed, the landscape of our industry will have completely changed.

|

|

|

|

|

|

|

|

|

|

Tags:

Alrosa, Christie's, COVID-19, De Beers, diamonds, Jewelry, John Costello, Rapaport News, RapNet, Signet Jewelers, Sotheby's, Tiffany & CO.

|

|

|

|

|

|

|

|

|

|

|

|

|