RAPAPORT... September 15 marked the one-year anniversary of the collapse of Lehman Brothers and the start of the economic crisis that has enveloped world markets ever since. Many predicted — correctly — that the date would become, like September 11, a symbol of a day that changed the world as we knew it. As other financial giants in the U.S. and around the globe followed Lehman into crisis — including such prominent firms as AIG, Bear Stearns, Goldman Sachs, Merrill Lynch, Credit Suisse and Deutsche Bank, to name a few — requiring bailouts from governments or their peers to avoid bankruptcy, it soon became clear that this was not a short-term crisis. Many of the doomsday predictions proved true as bankruptcies, sluggish sales and panic continued into what has been a very tough year.

However, as one reflects on a year of crisis, it is important to learn from the trends that emerged and recognize that the global economy, and indeed the diamond industry, have come a long way in the past 12 months — in the form of progress that is most evident in mood, if not actual economic performance. While markets entered the fourth quarter of 2008 consumed with fear, they face the Christmas period of 2009 with a strong sense of optimism.

Indeed, investment guru Warren Buffett went from predicting an “economic Pearl Harbor” around the time of the Lehman collapse to recently stating that the worst is over. “I think the odds are very much against getting significantly worse,” he said in an interview with CNBC on September 16, 2009. “It’s sort of plateaued at the bottom right now...but we’re past the critical point.”

The Fading “W”

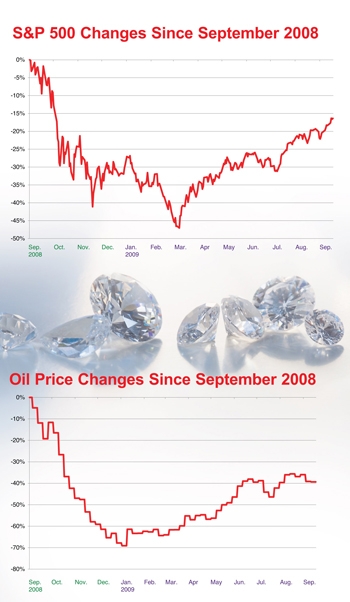

Much of the positive outlook is based on the sustained rallies seen in the financial and commodities markets over the past few months. With each day of gains, there is less talk of another downturn to bring about the much-anticipated “W” effect on trade graphs. The 12-month Standard & Poors (S&P) 500 data reveals that the market is working its way to an almost symmetrical “V” shape in the wake of the index falling nearly 50 percent from September 2008 to its low in March 2009. It has since regained approximately 57 percent of those losses (see Graph 1 below), finishing the 12-month cycle 16 percent lower than where it was at the beginning of the crisis.

Similarly, oil prices, which dropped approximately 70 percent from $111.83 a barrel in September 2008 to a low of $34.57 in January, have climbed back to settle at around $67 a barrel in September 2009 (see Graph 2 above). Optimism has been fueled by second-quarter gains in the banking sector, indicating that government stimuli have helped loosen credit. In contrast to one year ago, “credit crunch” is not a term that is heard as much today.

The Diamond Contrast

The diamond sector has displayed similar trends, particularly in the rough market. Rough prices spiraled down through January following the Lehman collapse and have increased consistently since then through August and September. Mining companies report improving demand for rough and have ramped up production after the dramatic cuts and mine shutdowns implemented at the beginning of 2009. In September, Harry Winston and Rio Tinto cancelled a planned December shutdown of their jointly owned Diavik mine in Canada due to the “sufficient improvement in the market outlook,” which has enabled them to continue normal production. Adding to their confidence, an estimated $1 billion in rough was reportedly sold to the market in August and another $1 billion was sold during the September-October sight season by the larger mining companies.

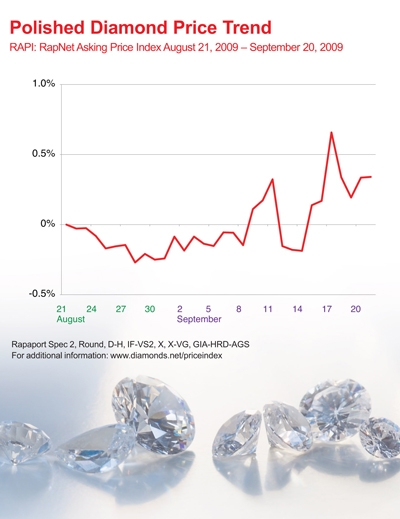

The same, though, cannot be said for the polished market, where prices have held relatively steady since the sharp declines of September 2008 through March 2009. The significant change in polished markets has impacted the industry's psyche and mood because manufacturers and dealers have come off a prolonged period of losses, job cuts and closures to operate aggressively again. During the September show season, there were positive reports from London through Shenzhen, Vicenza and Hong Kong, signaling that Christmas may not be as bad as expected and that consumer markets in China and India continue to grow. However, while polished prices were again stable in September (see the graph below), there remain significant price gaps between buyers and sellers.

Still in the Woods

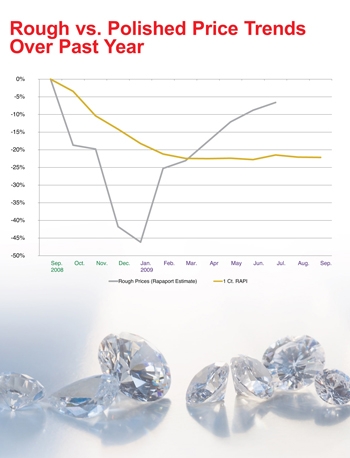

The tensions that have developed between bid and asking prices indicate that there are still some jitters in the market regarding the pending fourth quarter, causing dealers and manufacturers to question whether the crisis is, in fact, over, particularly when price movements in rough and polished are viewed together in context (see the graph below). Though the rough graph has spiraled down and up again from September 2008 to September 2009, polished remains approximately 20 percent below its September 2008 levels and has resisted following the path of the so-called rough recovery.

While these trends have led many to believe that a downward correction in rough prices or an increase in polished prices is looming, they may also reflect strong caution by polished dealers about the short-term prospects for the market. Their skepticism is reinforced by continued weakness in U.S. retail sales and consumer confidence, along with rising unemployment, which signal that consumers are not quite ready to buy diamonds with the same enthusiasm as they did prior to September 15, 2008.

With their expectations of continued high demand giving mining companies a different market outlook, the biggest questions remaining for everyone else are how the rough market will play out in the final three months of 2009, whether the demand for rough can sustain the continued ramping up of production and if current rough prices are a realistic reflection of market conditions.

Lessons Learned?

With the recent good-news factor in play, it may be easier than expected to forget where the industry was both before and immediately after the crisis hit. Through 2008, the financial markets were riding the wave of ever-increasing returns. Investors, such as Lehman Brothers, sought higher yields by reinvesting their clients’ money based on the notion that the higher the risk, the better the return — all the while ignoring the risk. By disregarding certain influential economic factors, this strategy created a bubble, which, in hindsight, we know now was destined to burst. Similarly, in the rough market, dealers bought at ever-higher prices, confident they could sell even higher, until this practice could no longer be sustained.

With stock markets now in a six-month rally and rough prices seemingly in a perpetual upward trend, there is every indication that the market may be creating another bubble. Have we forgotten the recent lessons and how fearful the market was just 12 months ago? While this recession has been a painful one, if we are, in fact, climbing out, it may not have been painful enough to be a true game-changer if it does not prevent us from repeating the mistakes of the past.

Still, while it is important to be cautious of these trends, it is certainly worthwhile to recognize the significant strides we have made. As U.S. Treasury Secretary Timothy Geithner summed up recently, “The emerging confidence and stability of September 2009 is a far cry from the crippling fear and panic of September 2008.” Based at least on mood and attitude, things are certainly looking up.

LH

Article from the Rapaport Magazine - October 2009. To subscribe click here.