Having passed the Christmas test, the diamond and jewelry industry is working its way through the next milestone on its road to recovery. The market breathed a collective sigh of relief as the Christmas retail numbers were published and encouraging trends revealed, albeit compared to the weak recessionary period a year earlier. While, at the beginning of December, market developments were difficult to project, today, there appears to be a tilt toward the positive.

Indeed, the question has shifted from how Christmas will pan out, to how the market will react in the new year. While the balance — or rather imbalance — of rough and polished prices continues to be the main concern, the industry also is watching consumers for their willingness to spend, retailers for their interest in replenishing inventory and manufacturers for their insistence on buying rough.

The opposing trends in 2009’s rough and polished markets have distressed manufacturers — and with good reason. As long as rough prices continue to rise, and polished remains relatively stable, manufacturing profit margins will be squeezed. Furthermore, some have noted that perpetual increases in rough are reminiscent of precrisis days, when a bubble developed in the same manner, and subsequently burst. Many are asking in wonderment if the lessons of the recession have truly been learned.

While the first quarter of the year traditionally is a quieter period for the industry, this year, it will be closely watched for clues to the market’s performance in subsequent quarters.

The Early Signs

Reports from the January BHP Billiton tender, Diamond Trading Company (DTC) sight and Rio Tinto sale are that the rough market continues to be unstable, with prices climbing still higher in the face of strong demand and scarce supply. ALROSA’s sales amounted to more than $300 million and the DTC sight had an estimated value of $550 million. Both De Beers and ALROSA are expected to increase their combined sales to about $2.5 billion in the first quarter of 2010, approximately $1 billion more than their supply in the fourth quarter of 2009.

The imminent influx of goods to the market could stabilize prices by bringing supplies more in line with demand. As supplies to the market increase, it is hoped that any shortages of goods currently being experienced in certain diamond categories would be eliminated, easing the competition among manufacturers to buy rough at any price.

As was evident during the second half of 2009, however, additional factors beyond the supply-demand balance can have a bold influence on the market. One is dealer speculation. Another is the motivation of manufacturers to buy goods to curry favor with mining companies. This is even more plausible in light of the fact that Rio Tinto slashed its client list in November and De Beers currently is accepting applications to be included on its coveted sightholder list for the new contract period, which begins in April 2011.

How Much is Too Much?

Achieving supply-demand equilibrium is a complicated process. The diamond sector is fundamentally supply driven. Demand for diamonds is a function of supply, whereby the scarcer the supply, the greater the demand will be. Given the scarcity of the product, the long-term outlook for the market remains in favor of producers.

It is assumed that rough prices are high because the market, perceiving shortages, is willing to pay whatever it costs to obtain rough. But what if the perceived shortages are not real? Indeed, the skeptics wonder if the industry can absorb the volumes of rough that De Beers, ALROSA and others intend to supply in the short term. Is the demand really there? And, how would the market react if it isn’t?

An injection of too much rough to the industry would have an immediate downward impact on prices and, by extension, a disastrous effect on the market. For the mining companies, achieving the supply-demand equilibrium is complicated by the fact that they are cash strapped and carrying huge amounts of debt. The temptation to raise large amounts of immediate capital by dumping rough on the market would serve their interests, but not necessarily the interests of the diamond industry at large.

Changing Market Leaders

Aside from the issue of balancing rough and polished, the industry is playing to a market that is currently being driven by two primary forces: China and India. While neither of these markets is a newly revealed secret to the diamond industry, their importance and their influence has escalated during the past year of recession. This was not so much because they compensated for the lack of growth in the U.S. and Europe — because they didn’t — but because of their impact on the way diamantaires conduct business.

In a year of global recession and choked credit lines, many single out Indian manufacturers as having been “able to buy rough at any price.” After Surat was so badly hit by the recession this time last year, the Indian banks provided financial aid to the industry, unlike their Belgian and Israeli counterparts, which gave Indian cutters stronger financial backing to purchase rough. In addition, they had a vibrant domestic market in which their polished could be sold.

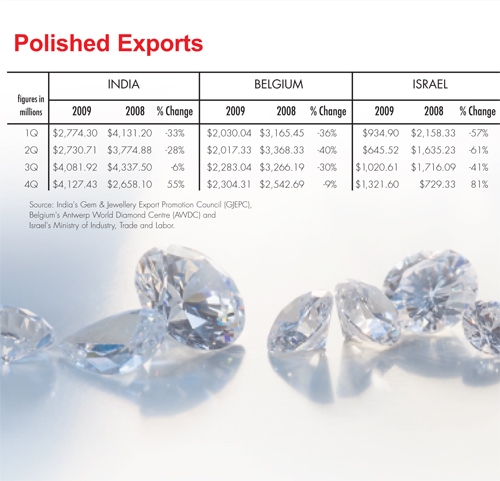

As a result, among the major diamond cutting centers, India was able to stabilize its rough imports and polished exports far more quickly than Israel and Belgium. (See tables above and below.) In fact, India’s ability and willingness to continue buying up rough may have contributed to the out-of-sync demand for rough.

China’s Polished

In a different way, wholesalers in the Far East appear to be influencing the relative stability in polished. While the U.S. market for buying polished — long the mainstay of the industry — was characterized by memo purchases, easy credit, flexible terms and large inventory purchases, the Far East traditionally has taken a more conservative approach. Buyers in China and Hong Kong have a culture of paying in cash rather than credit, and they appear to be less flexible regarding price, so they tend to buy only when they can acquire the goods on their terms.

While the movement to cash may suit the cutting centers, many manufacturers, particularly in Israel and Belgium, have reported strong gaps in price with their potential Chinese and Hong Kong–based customers. Similarly, reports indicate that these buyers consider prices at the manufacturing centers high, and this differential could well explain the static polished market (see graph below). If the manufacturers don’t meet their terms, these customers simply don’t buy.

Some Good U.S. News

Despite the growth of the Far East markets, and its faster rate of growth, the U.S. remains the largest diamond market. This Christmas season gave testimony that the U.S. market should not be written off, even when the numbers are viewed in the perspective of the recession. Tiffany & Co. posted U.S. same-store sales growth of 12 percent through November and December, and Signet Jewelers’ U.S. same-store sales rose 7.6 percent. Still, it would take a brave economist to headline a full recovery just yet.

Nevertheless, the results indicate that the worst seems to have passed and that there is now a sustainable base from which the industry can grow. Equally encouraging was a report by MasterCard Advisors SpendingPulse noting that jewelry sales, as measured primarily by MasterCard transactions, rose 5.6 percent during the two months, outperforming most other retail categories in the U.S. This opens up the possibility that retail inventory, which was stockpiled during 2009, may have finally been depleted. That raises hope that U.S. retailers will start buying again, and as a result, manufacturers may buy up rough in anticipation.

If anything, Christmas sparked an air of optimism through the diamond pipeline, but one that most qualify with strong caution. As market trends inevitably evolve to fuel both the positive outlook and the concern, the first quarter provides the next test to see which way the balance leans.

Article from the Rapaport Magazine - February 2010. To subscribe click here.