The recent pact between ALROSA and the Indian manufacturing sector carries great significance for the diamond industry. Not least, it demonstrates a shift in dynamics between suppliers and buyers of rough diamonds away from the sole influence of De Beers.

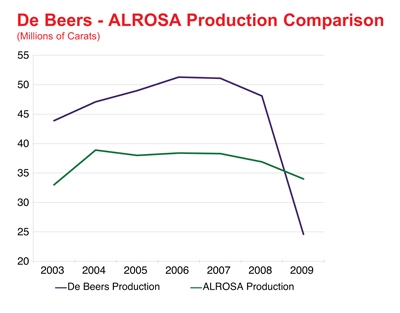

For its part, ALROSA has made a big deal of its position in the market after claiming to have outproduced De Beers in 2009 — the Russian miner reported production of 34 million carats during the year, compared to De Beers output of 24.6 million carats.

“We wish to foster closer ties between the world’s largest rough producer and the world’s largest diamond processing center,” Yury Okoyomov, ALROSA’s vice president in charge of marketing and sales, said during a recent visit to India. Okoyomov was in the country to lay the groundwork for the three-year, $490 million supply deal that ALROSA subsequently signed with three Indian companies — Rosy Blue, Diamond India Ltd. (DIL) and Ratilal Becharlal & Sons. Under the contract terms, ALROSA noted that prices will be reviewed and agreed upon by the parties on a quarterly basis.

The agreements pave the way for the company to sell to India goods it had been selling to De Beers for many years, until antitrust laws were invoked in 2008 and the European Commission (EC) barred all future sales to De Beers. The ruling forced ALROSA to search out new customers. These agreements build on the $550 million worth of rough sold to 47 Indian companies in the second half of 2009. It is presumed they also will form the basis for similar deals in the future as ALROSA implements its strategy to form long-term alliances with its customers. The company has said it hopes that 70 percent of its sales will be made via long-term contracts by the end of 2010.

Stockpiling Differences In the current economic environment, the benefit of these deals is clear for ALROSA as the company assures itself of a sustainable level of demand for its goods, regardless of market conditions. It also provides an outlet to eventually release its $1 billion–plus of stockpiled diamonds currently held by Gokhran, the state repository. Vladimir Rybkin, Gokhran’s chief executive officer (CEO), has said these goods will not appear on the market before 2012.

De Beers, for its part, does not appear too concerned at being displaced as the world’s top diamond producer. For one, it realizes that the headline makes for a good ALROSA story, and not much more. In reality, the 2009 production data was more a reflection of how the two rivals responded to the global economic downturn, rather than a comparative measure of their actual resources. Whereas De Beers curbed production to bring its supply on a level with the slump in demand, ALROSA continued production but sold all of it to Gokhran instead of the market. ALROSA’s decision during the midst of the crisis might have been very different had it not had its government to sell to. As one mining executive noted, “ALROSA stockpiled through Gokhran and De Beers stocked its diamonds in the ground.” (See comparison graph below). Second, given its sell-off of mines in the past three years, De Beers is perhaps quite happy to allow ALROSA the responsibility of being the market leader, freeing itself to “focus on profits rather than production.”

As De Beers begins renegotiating its long-term contracts with sightholders in anticipation of the new contract period that begins in April 2011, the company may well follow ALROSA’s lead in focusing on Indian manufacturers. The company already has indicated that it will reward those companies that fulfilled their intentions to offer (ITOs) during the difficult sights of 2009. It will surely take into account how manufacturers, or potential sightholders, fared during the recession. Like ALROSA, De Beers needs to be assured of a sustainable level of demand for its goods, regardless of market conditions.

Of all the manufacturing centers, none have managed the crisis as well as India, and none can assure De Beers and ALROSA of such sustainability.

Indian InfluenceThe strength of the Indian industry has emerged in the past six months as Indian buyers have aggressively bought rough stock, bringing Surat’s manufacturing sector back to full employment and spurring the strong recovery in the rough market (see rough prices graph below). In polished, too, buyers from the subcontinent have dominated the market, as evidenced at the Hong Kong International Jewellery Show in March.

Unlike their Belgian and Israeli counterparts, Indian manufacturers had strong government support in securing credit for their export sector. The result is that Indian manufacturers as a group yield tremendous leverage over the market, including ALROSA and De Beers. As much as the Indians need the rough to manufacture, the mining companies need the Indian assurance of their business.

How this all plays out in terms of pricing remains to be seen. While the Indians may hold the cards to negotiate better prices with the two mining giants, they also have the influence — and hunger for rough — to drive prices higher at tender.

Healthier Markets For now, the market has been assured of stable prices by De Beers, “barring any further major changes in market conditions,” the company said at its February sight. And ALROSA’s strategy of long-term alliances should also ensure some degree of price stability. Near-term stability in rough prices would filter through to polished and would be a welcome relief to the market, which is still finding it difficult to profit on manufacturing, even after polished prices rose around the Hong Kong show.

Reports from the Hong Kong show indicated strong traffic from Chinese and Indian buyers, with good demand for 1-carat to 3-carat, D to H, VS+ and H to K, VS to SI goods. Hot items at the show were 3-carat, D to F, VS+ diamonds, while commercial goods sold well. Demand for larger 4-carat-plus expensive stones was weak, with very strong buyer resistance to the high prices. Trade at BaselWorld was less enthusiastic, with mixed reports about the state of the big-stone market as prices of large stones held stable. There was strong demand for fine-quality 1-carat to 3-carat stones and large cape rounds, with improving demand for D to G, VS1-plus qualities. In some cases, severe shortages appear to have limited sales.

Manufacturers returned from the shows confident that the industry was in a healthy position, but they remain cautious for the near-term prospects. “Prices are higher and inventories are larger, but it remains to be seen how things develop in the coming months,” one Israel-based diamantaire said. (See polished graph below).

Betting on Vegas

Despite the growth in the Chinese and Indian consumer markets, manufacturers’ concerns remain focused on the weak U.S., particularly with JCK Las Vegas approaching. With Hong Kong and Basel out of the way, Vegas will be the next stop for the industry, and will provide a far more important test for the state of the recovery — especially given that the U.S., even with its growth stagnant, continues to account for 40 percent to 50 percent of the global jewelry market.

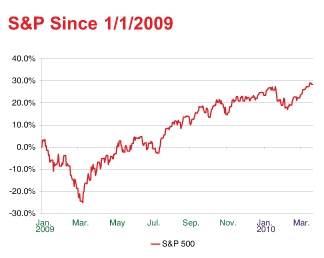

The U.S. economy continues to give off mixed signals. On the positive side, financial markets are now on a 13-month bull run. The S&P 500 index celebrated the one-year anniversary of the previous bear market on March 9 at a level 68 percent higher than that low point. (See S&P graph below). In addition, there appears to be sufficient stability in the retail market to indicate a level of sustainable economic activity.

However, the U.S. economy continues to be plagued by high unemployment, low consumer confidence and high government debt. These factors caused Moody’s Investors Services to warn the U.S. that it is considering downgrading U.S. Treasury bonds from their Aaa rating if the government fails to manage its federal debt.

“The recovery that has taken hold across the global economy remains fragile in several of the large, advanced economies, most of which have also implemented the most aggressive expansionary fiscal and monetary policies,” Moody’s wrote.

As economic trends strengthen with each passing month, it is expected that by the time JCK Vegas rolls around in June, a better sense of the diamond market will be apparent. As RDR predicted previously, following a relatively upbeat Christmas, the first quarter of 2010 should provide “the next milestone for the market on its road to recovery.” It appears that the diamond industry has passed that test, emerging in a healthier position than three, six and twelve months ago.

However, as the industry works toward the next milestone, it is becoming clear that the market is becoming increasingly reliant on the ALROSA-De Beers-India relationship. How their collective influence develops may prove as crucial to the industry’s future as the pace of economic recovery.

Article from the Rapaport Magazine - April 2010. To subscribe click here.