Riding the wave of a strong first half of 2010, De Beers announced changes to its Supplier of Choice (SoC) program that will see closer cooperation between Diamdel and the Diamond Trading Company (DTC) by providing wider market access to Diamdel’s diamond auction site and expanding opportunities to become DTC sightholders.

With the changes, DTC sightholders will be allowed to bid for diamonds on Diamdel’s online auctions beginning in October, while Diamdel clients — De Beers customers who are not sightholders — will be given the opportunity to become sightholders during the next 2012 to 2015 SoC contract period. That prospect will be limited to Diamdel auction customers who demonstrate consistently strong demand for certain categories of rough. In its announcement, the company emphasized that it remains committed to the SoC system as the primary distribution method for its rough diamonds.

The changes will enable De Beers to distribute goods to more clients when its production of rough is waning, even if the supply is being spread thinner. Already, De Beers Chief Executive Officer (CEO) Gareth Penny, who steps down from his position at the end of 2010, has said that output will likely settle in the long term at about 40 million carats — below the annual peaks of around 50 million carats between 2006 and 2008.

It is quite clear that, in terms of total volume, De Beers is not what it used to be. However, in terms of sales and profitability, the reduction in volume may not be a bad thing.

Achieving its Goals

During Penny’s tenure, De Beers adopted a strategy to focus on profitability, rather than market share. The company’s performance in the first half of the year signals the fruits of that strategy. In addition, the company set out a five-step program at the start of 2009 to help navigate the global economic crisis, which included lowering production levels in line with customer demand, reducing costs, increasing efficiencies, managing debt and stimulating consumer demand. Eighteen months later, through its first-half 2010 results, De Beers can report significant success in each area.

Focus on Profits

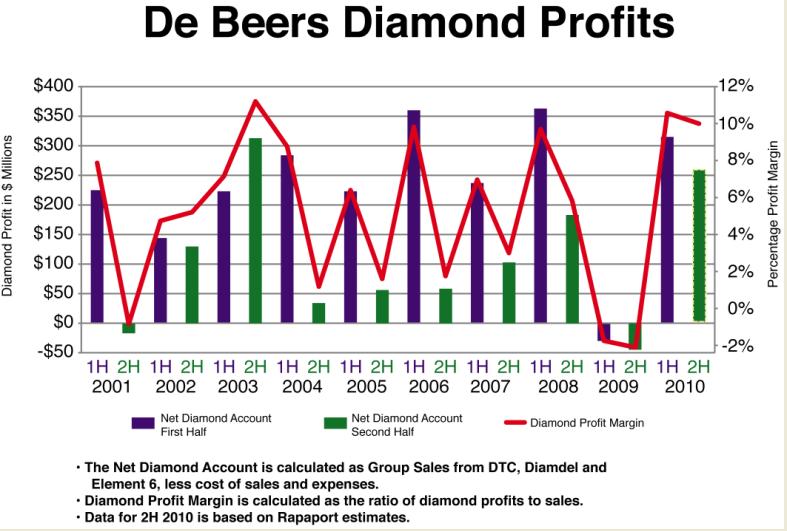

The half-year results indicated growth in all key parameters of sales, production, net profit and the net diamond account — representing profits from its diamond operations before tax, interest and investments — compared to the previous three half-year periods since the recession began (see chart 1 below).

Chart 1

While sales and production remain below prerecession levels, De Beers profitability resembles the heady days of 2006 through 2008 (see chart 1 above).

The De Beers net diamond account (see left axis of chart 1 above) represents total sales — including those at the DTC, Diamdel and Element 6 — less cost of sales and expenses. That number reached $315 million during the first six months of 2010, after being in deficit through the previous year. The account, after first-half 2010, stands 13 percent below its level in the first half of 2008, which was the highest it has been since the first half of 2000.

Perhaps more telling, the company’s profit margins — its ratio of diamond profits to sales — are at 11 percent, levels last seen in the second half of 2003 (see right axis - line graph - of chart 1 above). These results were achieved by severe cost-cutting and an increase in sales. Group sales increased 74 percent year on year to $2.98 billion, with DTC sales rising 84 percent to $2.63 billion. Both group sales and those of DTC were 20 percent below the first half of 2008.

High Expectations

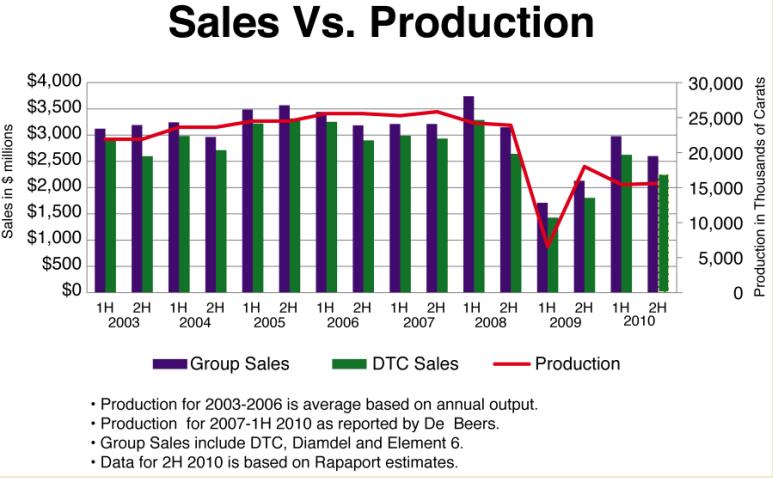

Production rose 134 percent year on year to 15.432 million carats in the first half of 2010, remaining 36 percent below the same period in 2008. De Beers said it expects production to reach around 31 million carats for the year and to level off at approximately 40 million carats annually from 2011 forward.

Based on De Beers production forecasts, and given that the company has cautioned the industry that it expects slower growth in the diamond market in the second half, DTC sales are expected to reach around $4.8 billion for the full year 2010, and will likely rise above $5 billion in 2011 (see chart 2 below).

Chart 2

Despite the projected second-half slowdown, if it can keep its profit margin at around 10 percent, De Beers can continue to hold its diamond profits above $250 million in the second half of the year (see chart 1 above).

Healthier Company

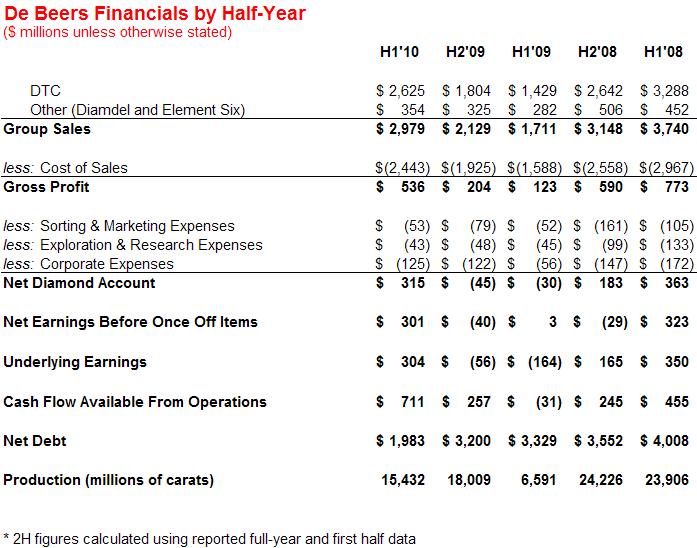

In addition to its improved profits and rising sales trend, De Beers reflected a far stronger net debt position than at the start of 2010. Net debt was cut by 38 percent to stand at $1.98 billion, due mainly to the $1 billion new equity investment made by shareholders in March 2010. This enabled the company to extend its bank loan facilities to August 2013.

Similarly, De Beers cash position vastly improved after it generated $711 million in cash from operations, rather than consuming $31 million worth, as it did in the same period a year earlier (see chart 3 below). Free cash flow was reported at $620 million as of June 30, 2010, compared with a deficit of $70 million six months earlier.

Chart 3

In short, De Beers has emerged from the downturn a more streamlined, profitable and healthier company, albeit one with depleted production and sales, and therefore a lower market share.

Should this strategy prove sustainable, Penny can indeed be satisfied that he has left the company in a strong position, regardless of whether it will be called upon by future market forces to manage another crisis, or to build for growth.

Cautious Market

DTC CEO Varda Shine stressed in a recent interview with Rapaport Diamond Report that while the company does not expect a double dip in the global economy, it remains cautious about the market.

In particular, there has been rising skepticism about the U.S. economy as unemployment at 9.6 percent shows no signs of improving and financial markets remain volatile. Both the S&P 500 and the Dow Jones Industrial Average (DJIA) fell about 6 percent by August 25, from the beginning of the month.

The diamond market also was unsure of its position in August, largely due to low trading during the summer vacation period. Rough prices hinted at softening but remained at high levels, while polished prices were largely stable during the month (see graph 1 below).

Graph 1

While uncertainty prevails in the U.S. and Europe, the markets in India and China continue to provide a balance with good domestic demand for diamonds. The India International Jewellery Show (IIJS) in Mumbai in August signaled strong buying activity in the local market, even if there was slight resistance from buyers to higher prices. The mood among diamond manufacturers at the show was very positive and they were confident that Indian consumer demand would carry them through the second half of the year.

For the international market, much will depend on the Hong Kong Jewellery and Gem Fair in September, which will provide a better gauge of global conditions for the industry, and, the state of the Far East market.

A Strategic Glimpse

De Beers appears to be betting on strong growth in India and China to balance the slump in the U.S. and Europe, when planning for the year ahead and beyond.

With the likelihood of global diamond production reaching its new capacities around the start of 2012, and the hope that Western consumer demand will have recovered by then, the company provided a glimpse into its long-term strategy with the SoC changes it is planning.

The company may well be softening the blow for the time when, in all likelihood, it will have to downsize the number of DTC sightholders it can supply with rough in the SoC contract of 2012 – 2015. “The number of sightholders will be dictated by availability and it is true we don’t expect to ramp up production to the prerecession levels,” Shine said.

In deciding to mesh some of the opportunities available to DTC sightholders and Diamdel clients, while placing a stronger emphasis on its online auctions, De Beers undoubtedly asked how it can extract the greatest profit from its diamonds. One thing is certain. De Beers focus has made a clear shift from production to profits.

Article from the Rapaport Magazine - September 2010. To subscribe click here.