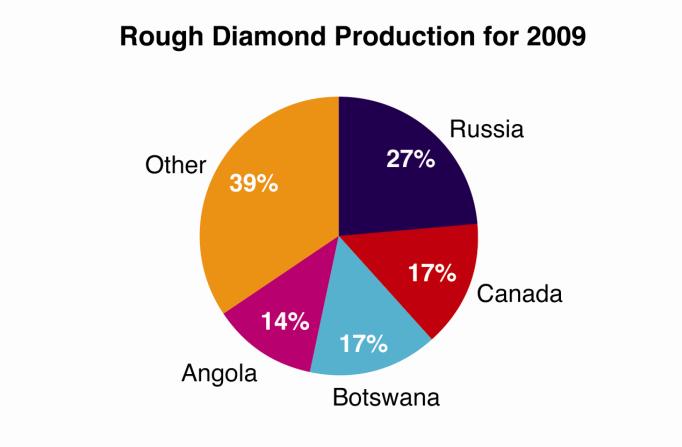

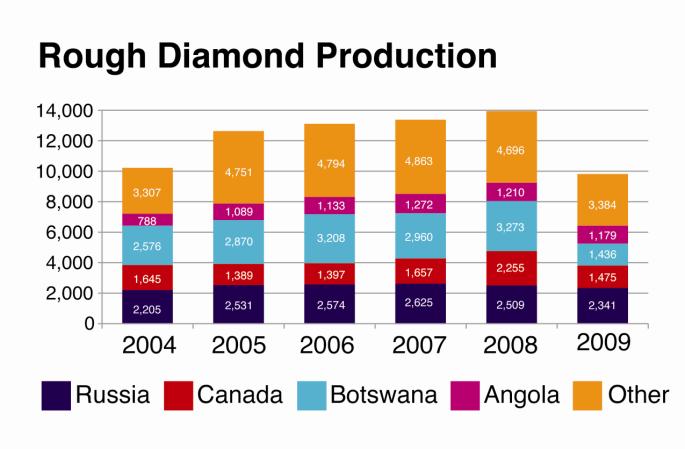

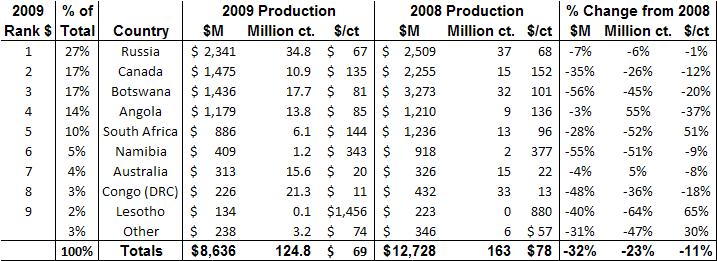

Russia was the world’s leading producer of diamonds by volume and value in 2009, as other producers sharply curtailed production during the financial crisis. The Russian government agreed to purchase and stockpile over $1 billion of rough diamonds since the cost of shutting down the Siberian mines was prohibitive. The Angolan government also played a role in stockpiling diamonds during 2009.

Botswana, which historically was the largest producer by value, is not expected to regain the top spot in 2010 as De Beers has adopted a cautious approach to ramping up production. While Russia’s production is expected to remain at 32 million to 34 million carats again this year, Botswana is forecast to increase production by about 35 percent to around 24 million carats, still well below 2008 levels. Although the African country holds an advantage in the per-carat value of its output, it is unlikely that value will be sufficient to offset its slump in production.

Still, the long-term outlook is positive and Botswana should reclaim its number one ranking in 2011, as it increases output to full capacity and as rough diamond prices are expected to rise further. While rough prices declined by as much as 50 percent during the worst part of the crisis, they recovered to an average 11 percent below 2008 levels, and have improved significantly in the first half of 2010, so that they are now approaching prerecession levels.

Still, the long-term outlook is positive and Botswana should reclaim its number one ranking in 2011, as it increases output to full capacity and as rough diamond prices are expected to rise further. While rough prices declined by as much as 50 percent during the worst part of the crisis, they recovered to an average 11 percent below 2008 levels, and have improved significantly in the first half of 2010, so that they are now approaching prerecession levels.

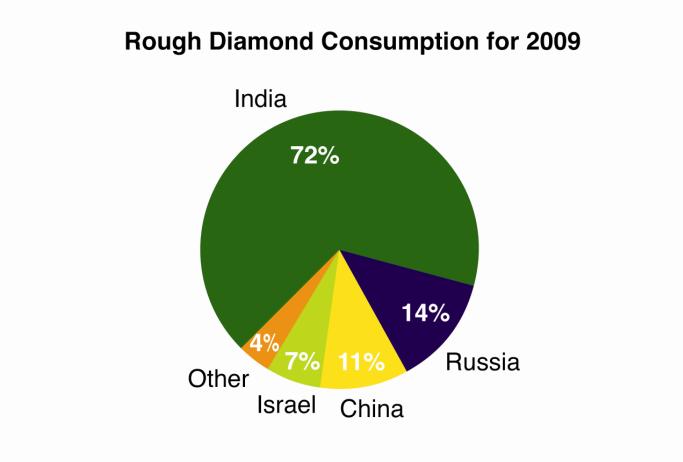

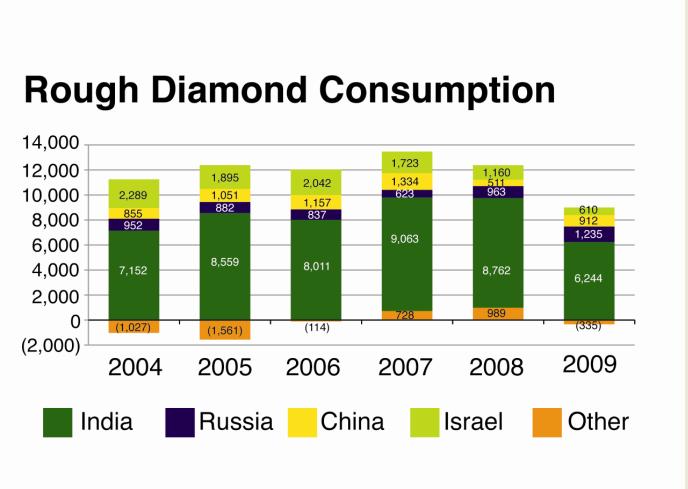

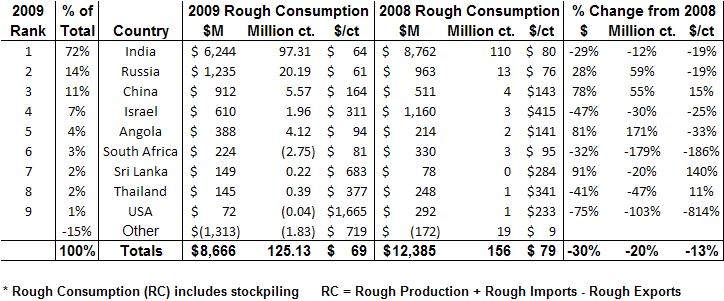

Rough Diamond Consumption

India is by far the largest cutting center and largest customer of rough diamonds, responsible for 72 percent of worldwide consumption in 2009.  China and Israel were distant seconds, with only 11 percent and 7 percent of global rough consumption, respectively.

China and Israel were distant seconds, with only 11 percent and 7 percent of global rough consumption, respectively.

Although Russia appears in the number two position and Angola in the number five position, this is not based on their strength as cutting centers, but rather due to the fact that their governments withheld exports by stockpiling diamonds that could not be sold due to exceptionally weak market conditions.

In some instances,  significantly in South Africa, consumption was negative, as countries exported more diamonds than they produced and/or imported.

significantly in South Africa, consumption was negative, as countries exported more diamonds than they produced and/or imported.

Rough consumption is calculated as a function of rough production and rough imports less rough exports, indicating the value or volume of rough available for cutting and polishing. Opening and closing inventory are not accounted for.

Article from the Rapaport Magazine - September 2010. To subscribe click here.