If the diamond trade was seeking a strong boost from the Hong Kong Jewellery & Gem Fair, it was left slightly disappointed. The show, viewed by many as an early indicator of fourth-quarter market conditions, brought mixed reactions from exhibitors. Despite the apparent decline in visitor traffic, a sustainable level of business was conducted and prices remained stable on average — with both buyers and sellers appearing determined not to cross the redline price levels they had set for themselves.

The show did not prove to be the game changer many had hoped for; guarded business activity continues to prevail.

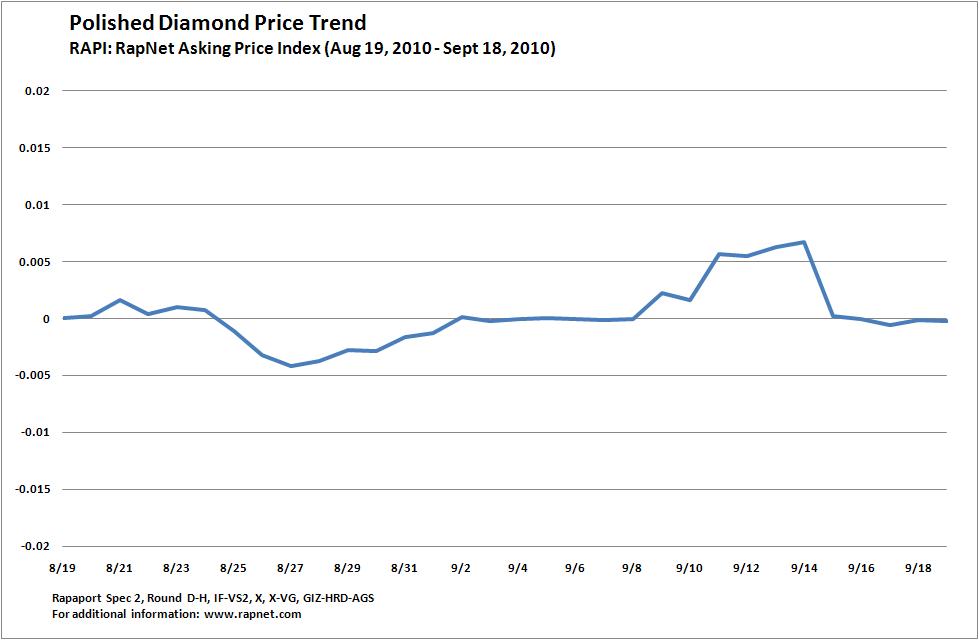

The average price of polished diamonds traded on RapNet held steady during the month, up to September 20, 2010 (see graph below), with most sizes and categories of diamonds showing little movement. Trading has been quiet, due to summer vacations in the trading centers and the Jewish holiday period, which fell earlier than usual this year.

The slow trade in polished is coupled with relative stability in the rough market, where supply is ramping up at a cautious rate and prices have remained steady, although high. The question is what these trends signal for the all-important fourth-quarter U.S. holiday season.

Seeking the Positive

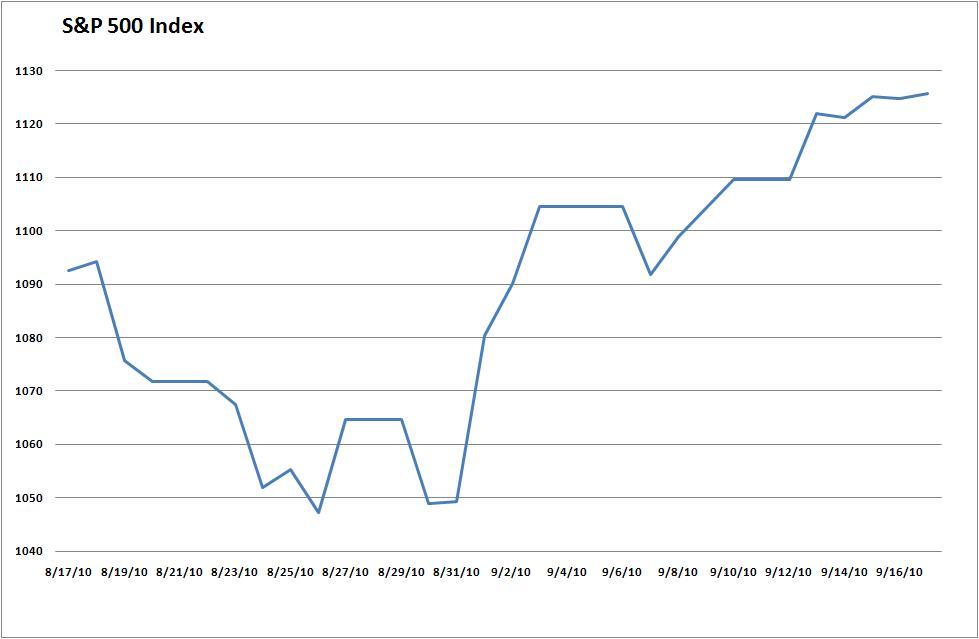

While diamond markets have fallen relatively flat over the past month, the same cannot be said for the financial markets, which proved quite bullish in September. The S&P 500 Index rose 7 percent between September 1 and 20, albeit with low trading volumes, as analysts noted that strong earnings overshadowed weak macroeconomic news. A closer look at the index, however, shows its recent inability to break out of the 1,040 to 1,130 range, indicating reluctance by investors to make significant bets on future movements (see graph below).

Like traders in the diamond industry, there appears to be a cloud of caution hanging over financial markets, as investors have been unable to shake the off chance of another downturn. Positive trends have been seen in the retail sector, where chain-store sales were expected to rise 3 percent year on year in September, according to the International Council of Shopping Centers (ICSC) and Goldman Sachs, even if that increase is set against weak 2009 data.

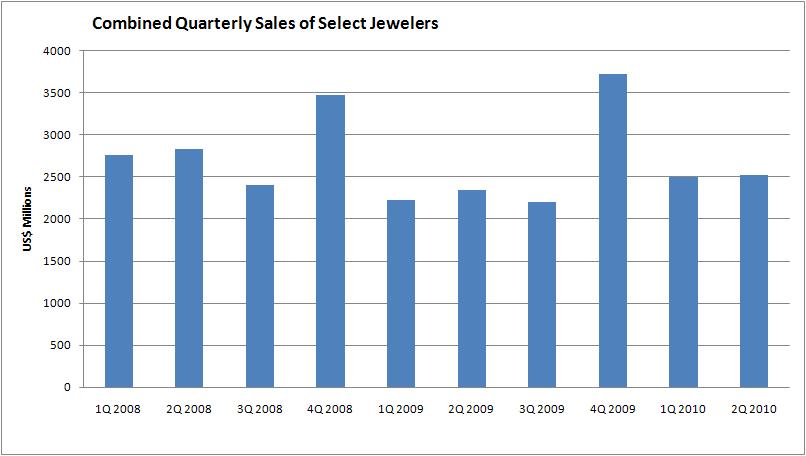

Rapaport research shows that sales collected from a sample of select jewelry retailers increased 6 percent year on year in the second quarter of 2010 (see chart below). Sales were basically flat against the first quarter, but the combined effect showed that sales in the first half of the year increased by 10 percent compared to 2009. They remain 10 percent below the same period in 2008.

Notes to Chart:

• Data collected from Bidz.com, Birks & Mayors, Blue Nile, Bulgari, Harry Winston, LJ International, LVMH, Michael Hill, Signet Jewelers, Tiffany & Co. and Zale Corporation.

• Non-U.S. company sales were converted from local currency to U.S. dollars at time of reporting.

• Table shown according to the calendar year. Companies may have different fiscal quarterly references.

• Quarters may vary between the end of May, June and July, depending on the company’s fiscal year.

• Data represents a small sample of the total jewelry sector and should be used as an indication of trends only.

• Zale Corporation has yet to report its earnings for the second quarter – its fiscal fourth quarter. Data presented are Rapaport estimates.

The data reinforces the overall stability along the diamond pipeline, which should continue through the third quarter, while extending the growth trend when compared to the stalled period of 2009.

Fourth-Quarter Forecasts

The big question, however, is whether the fourth quarter will bring the spurt in activity that signals a more complete recovery — particularly since the comparative year-on-year data traditionally becomes stronger in the year’s final quarter. While manufacturers have tried to downplay the importance of the Christmas period to their annual performance since the emergence of new markets in India and China, there’s little doubt the jewelry sector remains highly dependent on the fourth-quarter sales in the U.S. and Europe.

Many of the jewelry retailers, in particular the largest retailer, Signet Jewelers, as well as major diamond companies elsewhere in the pipeline, such as De Beers, have expressed caution for the remainder of the year. The main reasons for their concern are the lingering high unemployment figures and low consumer confidence in the U.S. According to the U.S. Labor Department, 14.9 million people were unemployed in the U.S. in August, as the jobless rate rose to 9.6 percent. At the same time, although consumer confidence rose from July to August, the Conference Board measure remained about 2 percent below a year earlier (see graph below).

The “fading W” was discussed in this column a year ago in terms of analyzing the effects of the Lehman Brothers collapse on its one-year anniversary. This year, a more somber reality seems to have set in. Lower consumer confidence appears to reflect a more pessimistic outlook for the job market and with it, the Christmas season.

Other Markets

Still, it appears that U.S. wholesalers are preparing for a rise in fourth-quarter activity, as polished diamond imports continue to show strong increases over 2009. Net polished imports — imports less exports, a measure of the amount of polished remaining in the country for local consumption — increased 34 percent in July, and were 71 percent higher through the first seven months of the year. Polished imports to the U.S. in August and September, which were not yet published at press time, will provide a stronger bearing on the market’s preparations for the holiday season.

Other markets appear to be signaling similar mixed prospects for their respective retail seasons, with trading activity lulled ahead of China’s Golden Week national holiday, which started on October 1, while high gold prices appear to have dented jewelry demand in India for the Diwali Festival on November 5.

Some analysts have suggested that high gold prices in advance of the festival — the yellow metal set new highs above $1,280 an ounce in September — may work in favor of the diamond industry, as consumers may prefer to spend more on the diamond content of their purchases as a trade-off for high gold.

However, the Indian diamond market remains aggressive and, in many ways, the positive trendsetter in the trade following the strong Mumbai show in August and the visible presence of Indian buyers at the Hong Kong show in September. The inherently bullish Indian manufacturing sector and domestic consumer market continue to set the pace for the industry, as they have for the past two years.

The Overall Effect

The result of all these factors is that, just as demand and prices are stable at the start of the fourth quarter, so is the general mood in the diamond industry. While business may not be booming, the trade is turning, and while caution continues, there is no sense of panic.

Should such stability — in both the polished and rough markets, as well as trader sentiment — persist through to the end of the year, the industry may well find itself willing to pursue a more aggressive approach in 2011. But can it afford such a luxury in light of concern about a double-dip recession?

While the recovery may not yet be entrenched, the diamond industry appears to be staying upbeat while suppressing its expectations. That is a healthy place to be. A final quarter of just-modest growth compared to 2009 may well cement better prospects for 2011.

Article from the Rapaport Magazine - October 2010. To subscribe click here.