Diamond cutters continued to struggle with diminishing margins as rough prices rose again in November. Price pressures were fueled by increases implemented by the Diamond Trading Company (DTC), even if the hike was no surprise to sightholders, given that premiums on DTC boxes were high prior to the November sight. The De Beers sales and distribution unit raised prices by an average of 2 percent to 3 percent, which brought premiums down from double digits to an estimated average of about 4 percent.

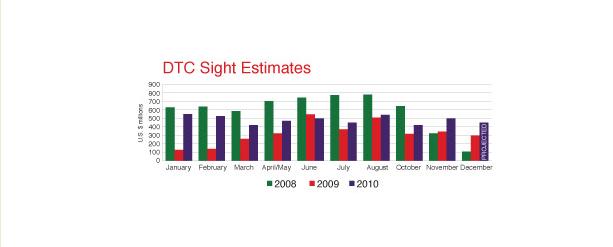

Despite the rising prices, there continued to be bullish demand for rough, as evidenced by the fact that the DTC sight closed at an estimated value of $500 million, with a large quantity of ex-plan supplied outside the regular allocation. DTC sales rose 49 percent year on year to approximately $4.38 billion in the 11 months through November 2010, but remain 25 percent below 2008 levels (see chart below), according to Rapaport estimates. In addition, Diamdel, the De Beers unit that distributes to the secondary market, reported strong demand at its October–November online auctions, in which sightholders participated for the first time. All 113 lots were sold, with winning bids split relatively proportionally between sightholders and nonsightholders.

* Rapaport estimates

“We continued to witness strong demand across all product categories throughout this cycle of events,” said Neil Ventura, chief executive officer (CEO) of Diamdel. Similarly, ALROSA reported that its sales continue to grow and it forecasted fourth-quarter sales of $680 million, which would represent its strongest final quarter in the past four years.

Seeking Rough

ALROSA added that it expects rough diamond prices will continue to grow in the near future, driven by the disparity between demand and supply, and the company called on other major diamond producers to focus on maintaining overall market stability “as the speculative factor poses a potential threat for the diamond business.”

Current shortages in the market resulting from the scaled-down production at De Beers and Rio Tinto, both during and following the global economic crisis, have eased the concern that the market might be destabilized by the future influx of rough from untapped resources, such as Zimbabwe’s controversial Marange fields and Russia’s Gokhran stockpile. On the contrary, diamantaires expressed their willingness to buy these goods.

Even while negotiations remained unresolved at the Kimberley Process (KP) on whether or not to allow Zimbabwe to export goods from Marange, the country managed to sell $160 million — 4 million carats — worth of rough in November, reportedly to four large Indian companies. The KP discussions remained stalled at press time. Once released, the sales will more than double the country’s diamond exports for 2010. Earlier, the Minerals Marketing Corporation of Zimbabwe (MMCZ) had reported that diamond exports grew 73 percent to $110 million during the first nine months of this year.

Meanwhile, following a visit to Moscow of Surat-based diamantaires, Russian manufacturers expressed concern that their Indian counterparts were aggressively pursuing the accumulated rough currently held by the Russian government.

Christmas Caution

The rise in prices and demand for rough remains unmatched by the polished market, which continues to display stability, despite the considerable growth in polished imports to the consumer markets.

Data collected from the U.S. Commerce Department shows that U.S. net polished imports, which represent imports less exports and indicate the amount of diamonds remaining in the country for the consumer market, rose 38 percent year on year to $904 million in the third quarter of 2010, although the imports remained 38 percent below prerecession 2008 levels (see chart below). During the same period, Japan’s polished imports increased 26 percent year on year to $175 million. Similarly, the Diamond Administration of China (DAC) reported that total import and export of diamonds rose to $1.95 billion in the first nine months of 2010, up from $1.52 billion traded during the whole of 2009.

* Data sourced from the U.S. Commerce Department

Regardless of these increases, polished prices have exhibited relative caution in the market as the average RapNet Asking Price Index (RAPI) rose a slight 0.2 percent through the month to November 21 (see chart below), and has increased 8.9 percent over the past 12 months.

Diane Irvine, CEO of Blue Nile, noted in a recent conference call that the rate of increase in polished prices softened in the third quarter and into October, from the first half of the year, reading that this may be a sign that “the industry is looking at the holiday season with caution.”

Retail Resistance

Furthermore, reports indicate that polished demand in November was driven more by interdealer trading in the manufacturing centers, as U.S. retailers continued to focus on filling existing orders, rather than making larger inventory purchases ahead of the Christmas season. It appears that demand for polished is very specific and highly dependent on price.

Some cutters expect a strong opportunity in the polished market as prices eventually increase and as shortages, resulting from a pullback in manufacturing over the past two years, bring added competition for the goods they already have in stock.

Retailers, however, have been reluctant to pay higher prices on their diamond purchases. For the most part, they fail to see the same demand at their end of the pipeline as that reported in the rough market, and, at the same time, they face other rising costs. They are concerned with accelerated growth in spot precious metals prices they have to absorb, with gold seemingly reaching perpetual new highs, up 23 percent from the beginning of the year, and platinum also showing strong increases, rising 13 percent since January (see graph below).

The Bulgari Group reported that it raised its jewelry retail prices in October to offset the increase in the price of gold. But few others are expected to do the same before the end of the year as they try to keep their price points affordable enough for discount-seeking consumers to boost holiday sales. Analysts have noted that a rise in retail jewelry prices is more likely to take effect in the spring, ahead of the engagement season, when the current cost of raw materials will be factored in. In the meantime, retailers continue to vigilantly resist attempts by diamond cutters to increase polished prices, and manufacturing profits continue to be squeezed.

Holiday Hopes

Still, diamond cutters are looking toward the holiday season with much hope that it will provide a positive boost, both in sales and sentiment, leading into the market for 2011. A strong season, they say, will force retailers to restock in 2011, while a weak Christmas would likely keep the trade in a sluggish recovery mode at best.

It is now expected that sales will increase by low percentage points in the fourth quarter, slightly below the 6 percent growth seen in the U.S retail sector during the first nine months of the year. Whether this will be enough to further restore confidence and stimulate a flurry of wholesale activity in the first quarter of the next year remains to be seen. What is clear — with further rough price hikes on the horizon and jewelers facing their own rising costs of doing business — is that polished sales will continue to be extremely price sensitive.

Article from the Rapaport Magazine - December 2010. To subscribe click here.